Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

21.07.2025 12:00 2 min. read Kosta Gushterov

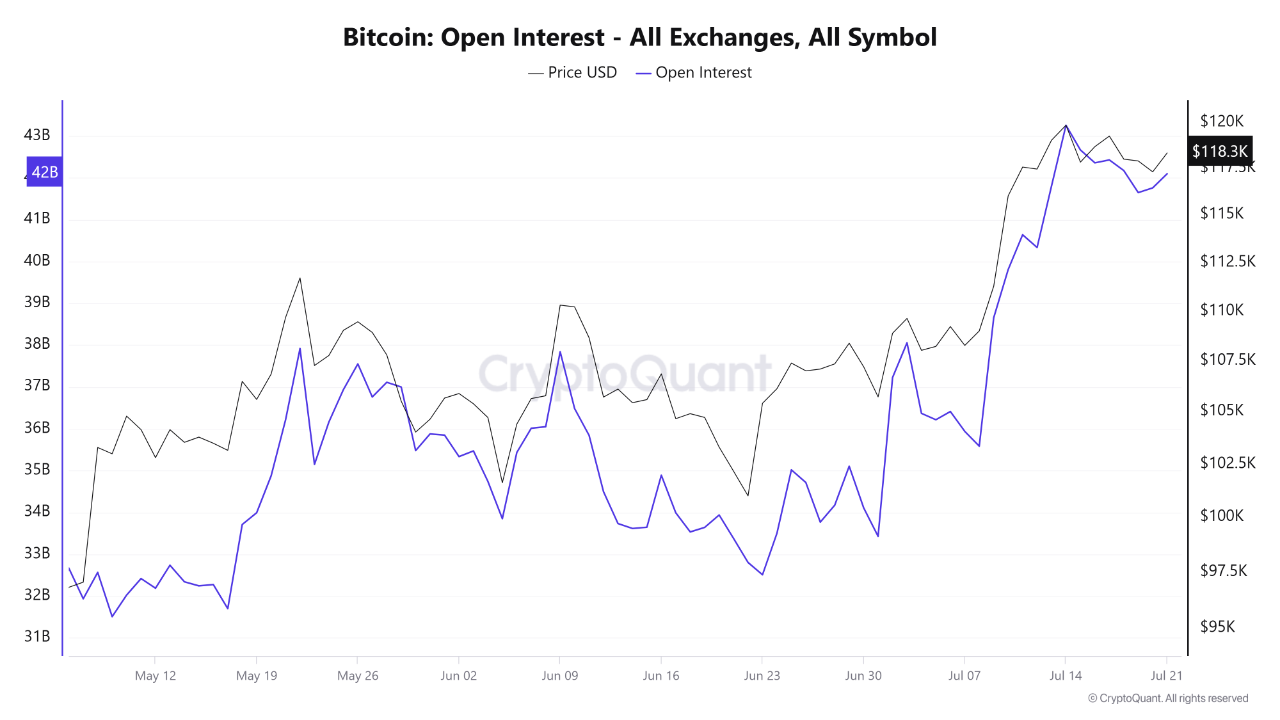

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

According to data shared by CryptoQuant, the market is experiencing a significant uptick in leveraged activity, suggesting both strong bullish sentiment and rising risk of liquidations.

High open interest signals market momentum

Open interest in Bitcoin futures reached a recent peak of $43 billion and now sits just slightly lower at $42 billion—still well within historically elevated territory. This reflects a large volume of outstanding contracts, indicating strong participation in the derivatives market. As BTC trades near $118,300, the growing open interest suggests traders are positioning aggressively ahead of a potential move beyond the $120K resistance.

Historically, spikes in open interest coincide with increased price volatility. A build-up of leveraged positions—especially in tight market conditions—can lead to rapid liquidations when prices swing sharply.

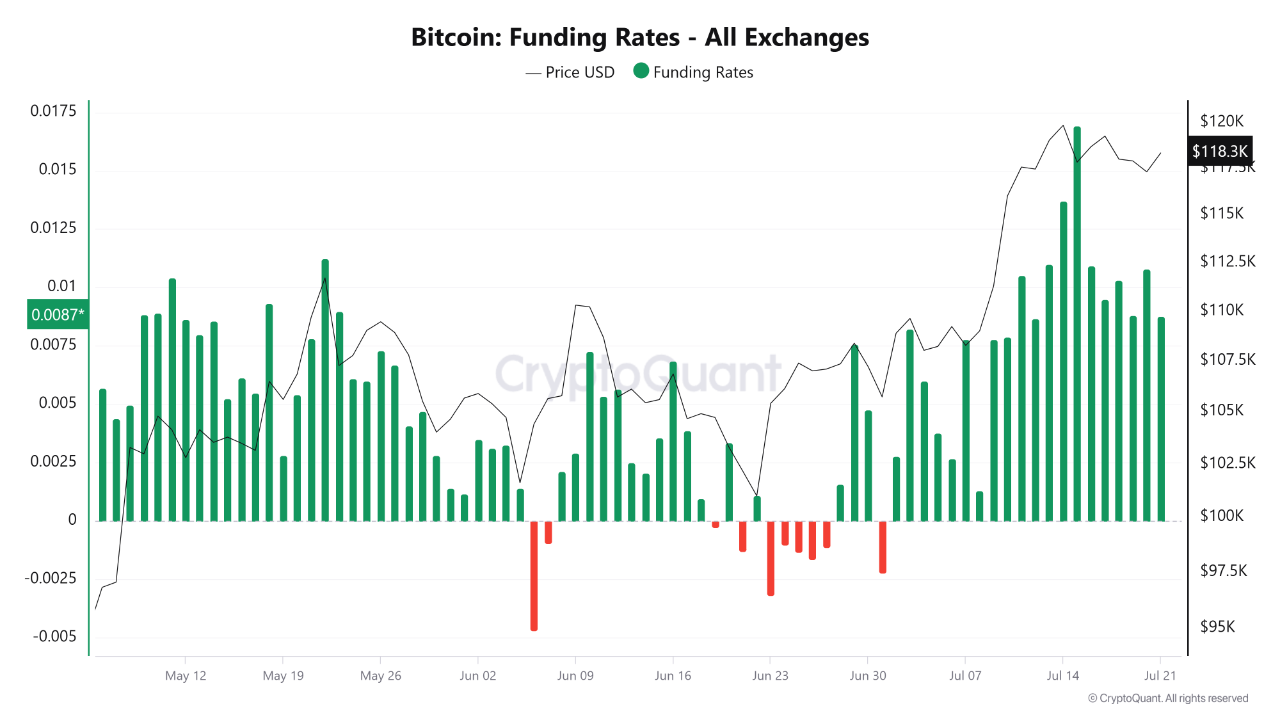

Rising funding rates reflect bullish bias

Funding rates across exchanges are trending higher, confirming that long positions are currently dominating. The more traders are willing to pay to maintain bullish bets, the more upward pressure there is on funding levels. CryptoQuant notes that elevated funding, when combined with high open interest, often reflects excessive optimism.

This dynamic signals a market in “greed mode,” where traders chase momentum. However, it also raises caution flags, as crowded long positions are vulnerable to sudden corrections or liquidation cascades if the price unexpectedly dips.

Leverage risk builds as traders chase the rally

The current setup—high open interest and elevated funding—suggests traders are aggressively deploying leverage to ride the rally. While this can amplify short-term gains, it also increases downside risk. A sudden move against the dominant trend could trigger widespread forced selling and rapid position unwinds.

CryptoQuant analysts warn that exchanges may need to intervene by adjusting margin requirements or temporarily restricting activity if volatility surges. For now, Bitcoin remains near $118K, but derivatives data hints that the next big move—up or down—may come swiftly.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read