Bitcoin Long-Term Holders Gain Market Dominance Amidst Market Fluctuations

28.08.2024 20:30 2 min. read Alexander Stefanov

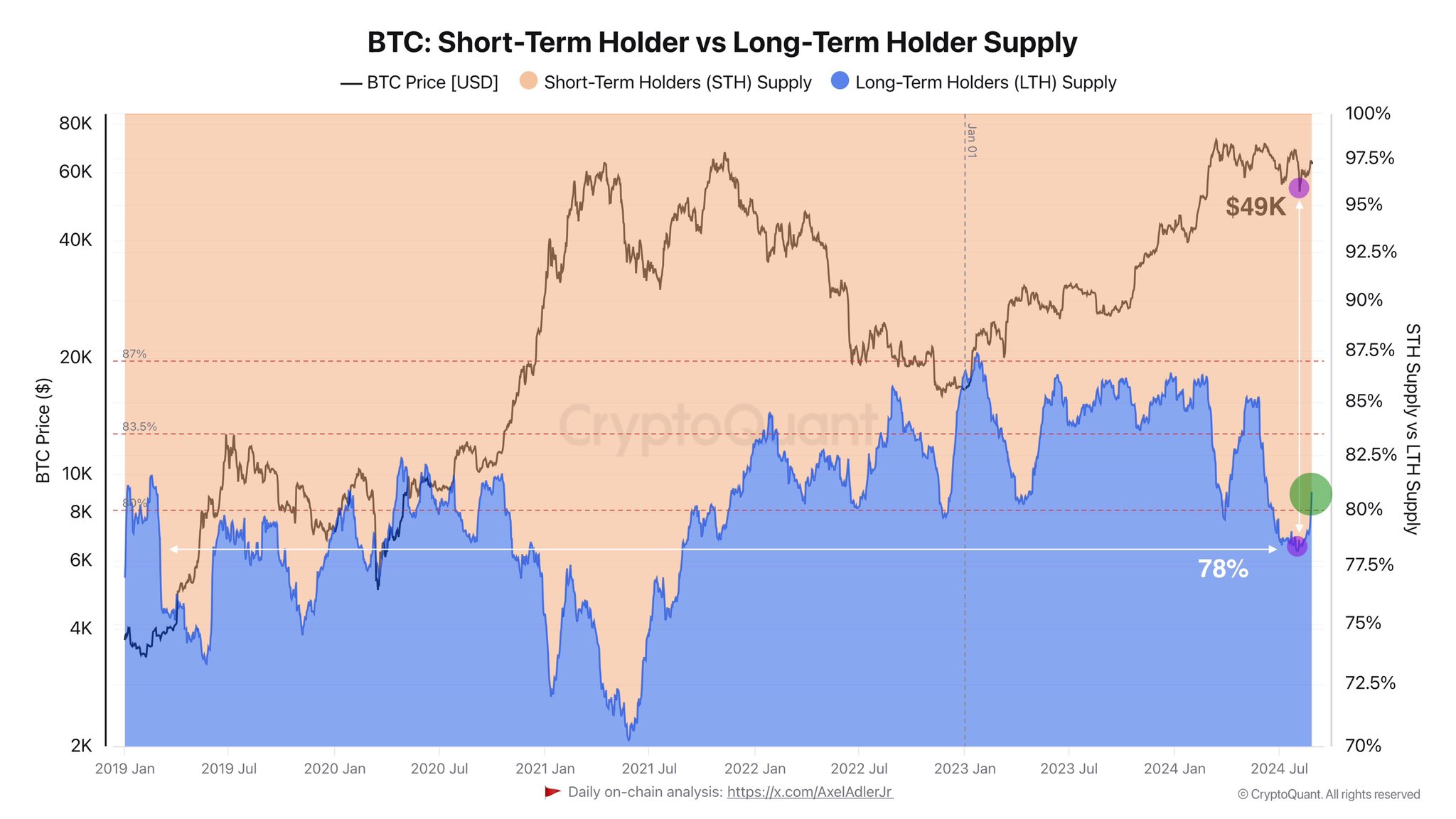

Recent data from the chain shows that long-term Bitcoin holders (LTH) have increased their dominance, suggesting a growing conviction to hold onto their assets.

LTH, defined as those who hold Bitcoin for more than 155 days, are known for their resilience, typically not selling even during significant market events, unlike short-term holders (STH) who are more reactive to market changes.

The chart reveals that earlier this year, LTH’s share of supply dropped to around 78%, coinciding with the market crash. Recently, however, LTH supply has rebounded sharply, exceeding 80%. This shift suggests that many investors who acquired BTC months ago are now moving into the LTH category, demonstrating a serious intent to hold their assets for the long term.

It is important to note that this increase does not necessarily mean new buying activity. Instead, it reflects the aging of the coins held by STH as they pass the 155-day threshold, thus becoming part of the LTH group. It is generally seen as a bullish signal for Bitcoin, as it suggests a higher level of confidence among investors who are willing to move to long-term holdings through market fluctuations.

Interestingly, LTH has shown a willingness to sell under certain conditions, such as during Bitcoin’s rally to an all-time high (ATH) earlier this year. This behavior indicates that even these steadfast holders are tempted to sell when the market reaches particularly favorable levels. However, the recent increase in dominant LTHs suggests that many now prefer to hold, which could support Bitcoin’s price stability or even spur future growth.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read