Bitcoin Holders Retain Assets as Exchange Activity Drops

17.09.2024 10:00 1 min. read Alexander Stefanov

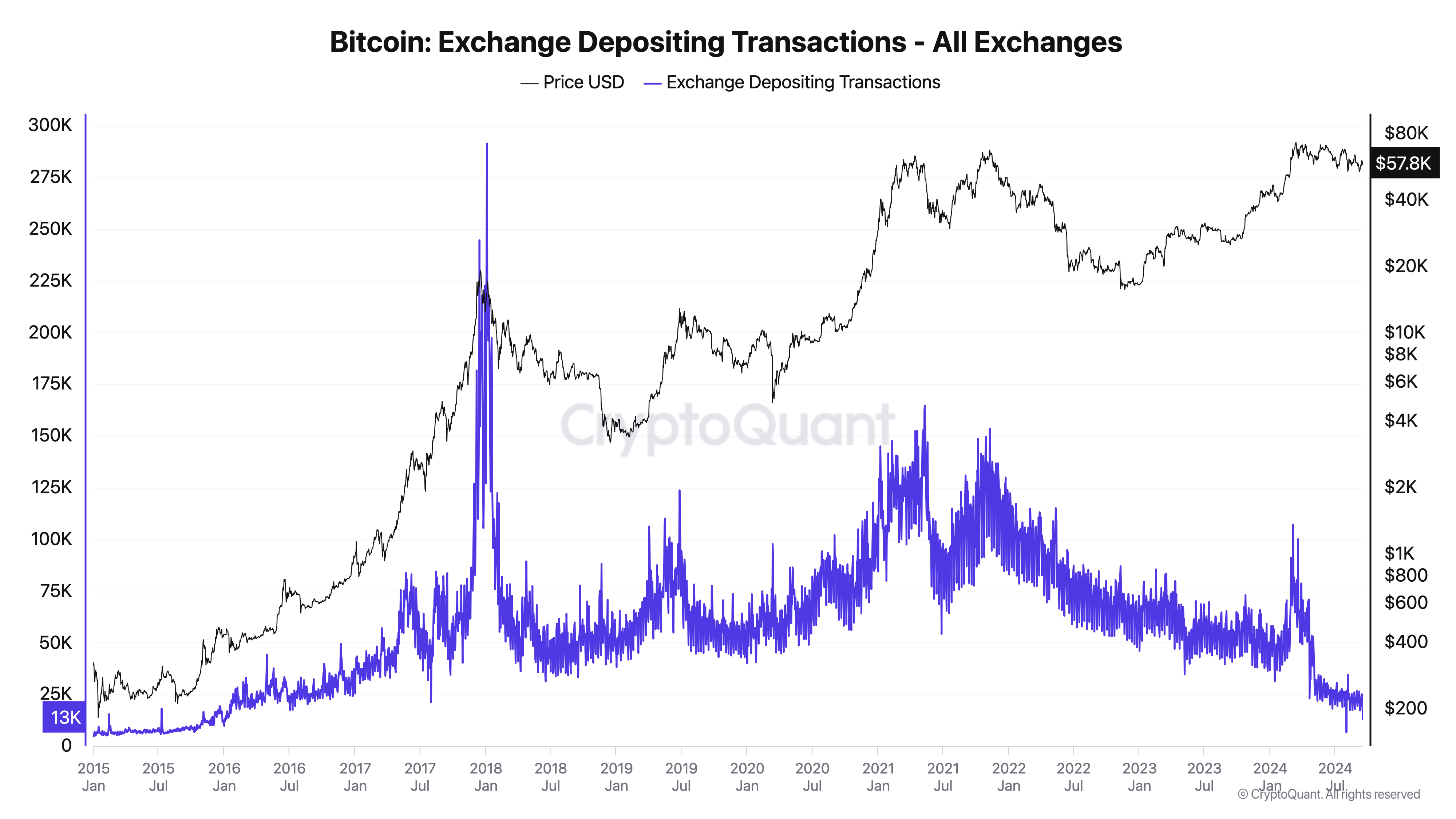

Bitcoin (BTC) continues to struggle with breaking the $60,000 threshold, but this has not led to a sell-off among holders.

In fact, many are retaining their assets, as evidenced by a drop in exchange activity.

The daily number of Bitcoin addresses sending funds to exchanges has recently reached a multi-year low. This decline aligns with market expectations surrounding the Federal Reserve’s decision on September 18.

On-chain data reveals a decrease in Exchange Depositing Addresses, a metric tracking Bitcoin inflows to exchanges. This figure peaked for the year on March 5 and has been declining since.

In the past week alone, deposits to exchanges have fallen by 19%. A drop in this metric typically indicates that investors are holding their Bitcoin rather than selling.

This reduced exchange activity comes amid speculation about a potential 50% chance of a 0.5% rate cut by the Federal Reserve. The easing of Bitcoin’s selling pressure suggests investors might be anticipating a more favorable market. This sentiment is also reflected in Bitcoin’s funding rate, which turned positive recently after a week of negative values.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read