Bitcoin Funding Rates Remain Positive, But Risks of Market Shift Loom

10.02.2025 11:00 1 min. read Alexander Zdravkov

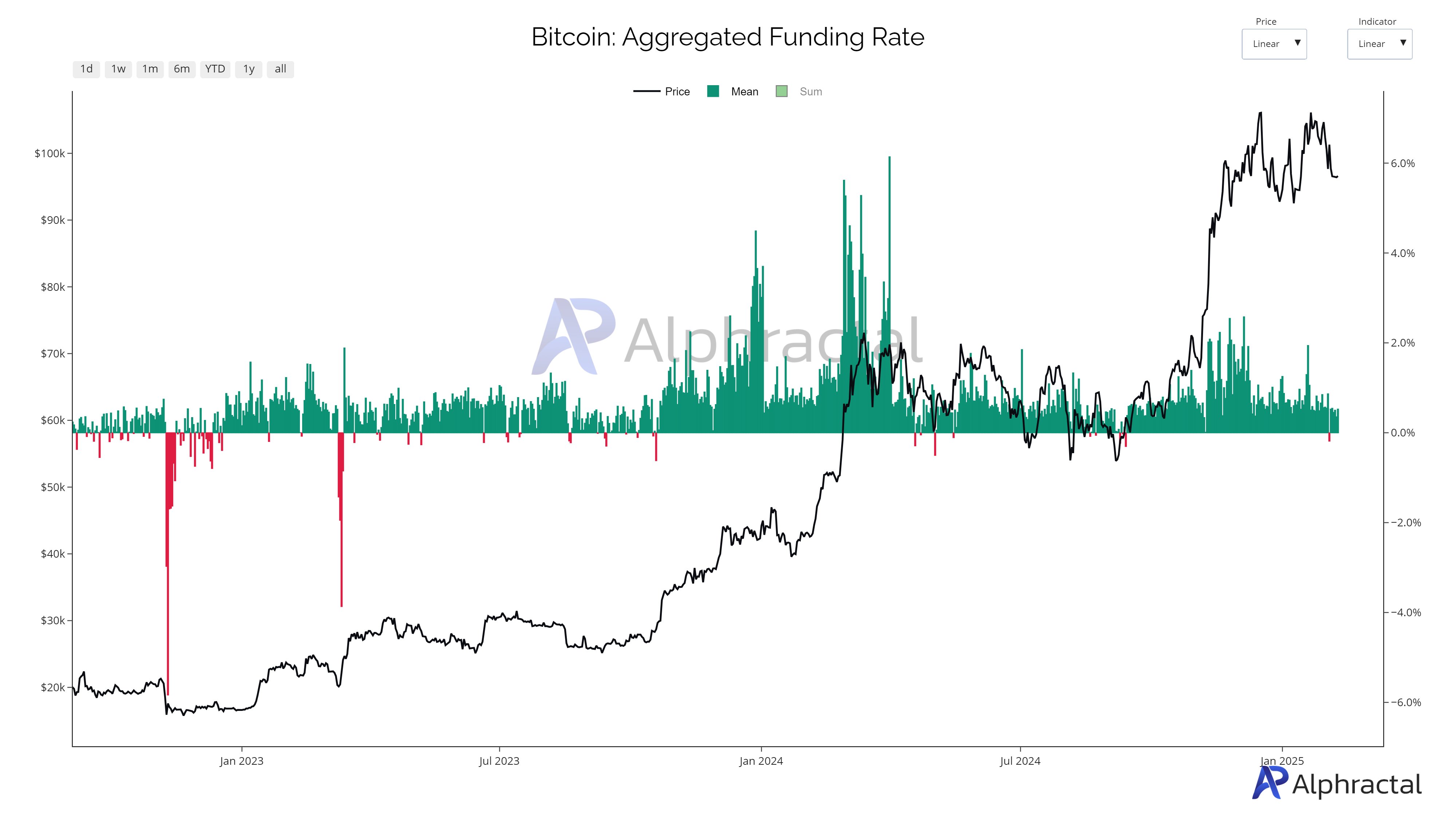

Alphractal, a cryptocurrency analytics firm, has released a new analysis of Bitcoin, highlighting that despite recent price drops, the overall funding rate across major exchanges remains positive.

This indicates that more traders are betting on Bitcoin’s price to rise, with long positions paying fees every eight hours, while short positions receive compensation.

Currently, the funding rates are mostly positive, except for BitMEX and OKX, which are seeing negative rates. Bitfinex stands out with the highest positive rate.

Alphractal has outlined two possible scenarios based on these funding trends: one suggests that sustained positive rates could reflect over-optimism, potentially leading to a risk of liquidation if Bitcoin’s price falls further.

On the other hand, if funding rates turn negative across all platforms, it could mark the start of a bearish phase dominated by short traders.

While Bitcoin has seen some downward movement, the overall positive funding rate suggests that market sentiment hasn’t completely turned bearish yet. However, Alphractal advises caution, as sudden shifts in funding rates could indicate a significant change in market dynamics.

-

1

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

4

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

5

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read

Weekly Crypto Roundup: Bitcoin Hits ATH, Ethereum Surges, Trump Advances Crypto Reforms

Analyzing the latest updates shared by Wu Blockchain, this past week underscored a pivotal shift in the crypto landscape. Bitcoin surged to a new all-time high of $123,226, pushing the overall crypto market cap beyond $4 trillion—a milestone reflecting renewed investor confidence and accelerating institutional flows.

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

-

1

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

4

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

5

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read