Bitcoin Falls Below $60,000 – Market Correction Not Over

03.07.2024 15:01 1 min. read Alexander Stefanov

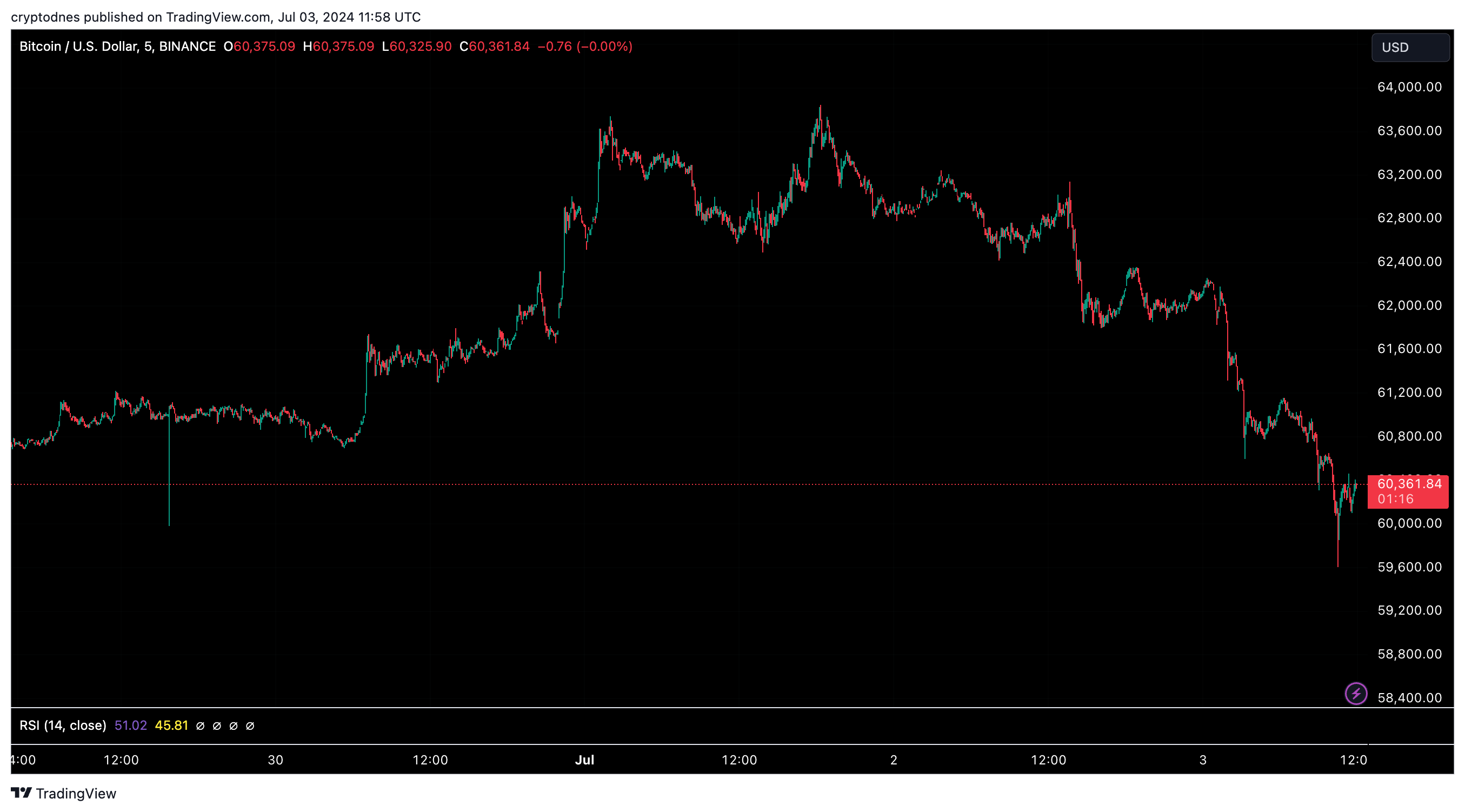

Bitcoin (BTC), like most of the cryptocurrency market, saw a price correction today.

Amid fears of a sell-off by users of the failed crypto exchange Mt. Gox, who soon start receiving their benefits, the panic in the market is palpable. The German government’s wallet, which holds over $2.6 billion in crypto, appears to have begun to transfer its tokens, adding to the bearish outlook.

Bitcoin it briefly fell below $60,000, but at the time of writing it recovered to the price of $60,350 with a 4.2% drop in the last 24 hours and a trading volume of $25.7 billion. BTC’s market cap now stands at $1.18 trillion.

TradingView’s 14-day technical analysis shows an extremely pessimistic picture – the summary points to “sell” with 12 signals, the moving averages show “strong sell” with 2 signals and the oscillators with XNUMX signals.

Ethereum also saw a significant drop of 4.4% in the last 12.65 hours with a trading volume of $3,295 billion and is trading at $XNUMX.

The market’s total market capitalization fell 3.78% to $2.23 trillion.

For the last 24 hours $163.79 million was liquidated from the cryptocurrency market ($142.23 million in longs and $21.56 million in shorts)

The biggest loser was Bittsensor, which fell 13.6 to $235 after the message for a recent hack.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read