Bitcoin Faces Selling Pressure as U.S. Institutions Unload Holdings

09.10.2024 13:00 1 min. read Alexander Zdravkov

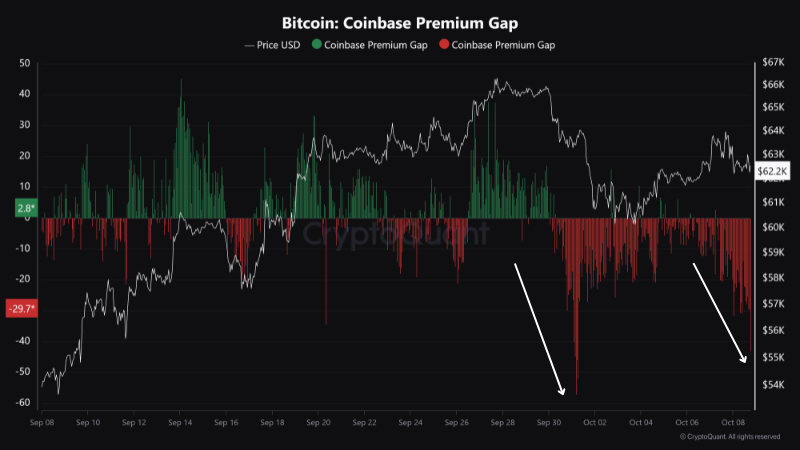

Bitcoin is facing selling pressure in the U.S., with its price hovering around $62,000.

Data from October shows institutional investors are offloading the cryptocurrency, weakening its momentum.

The Coinbase Premium Index, which compares Bitcoin prices on Coinbase and Binance, has stayed in the negative, signaling that U.S. investors are selling at lower prices than their global counterparts.

Analyst Maartunn pointed out that this index dropped to -$41, reflecting heightened selling activity.

In addition to this, U.S. Bitcoin ETFs have seen outflows, with over $408 million leaving these funds in early October, while inflows lag behind at $260 million. Even portfolios tied to BlackRock experienced significant outflows during this period.

Glassnode highlighted $62,600 as a key support level for Bitcoin. A fall below this could lead to a drop toward $52,000, while breaking through $64,000 could see a surge beyond $72,000. At the time of writing BTC is priced at $62,100.

The market remains on edge, with the potential for sharp reactions depending on Bitcoin’s next move.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

3

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

3

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read