Bitcoin Faces Risk of Further Price Crash – What to Expect

05.08.2024 8:00 2 min. read Alexander Stefanov

Bitcoin has experienced a 10% decline in value over the past week, dropping from a peak of $69,801 on July 29 to around $57,000.

This price drop suggests a potential buying opportunity, yet trader activity indicates reluctance to invest during this dip.

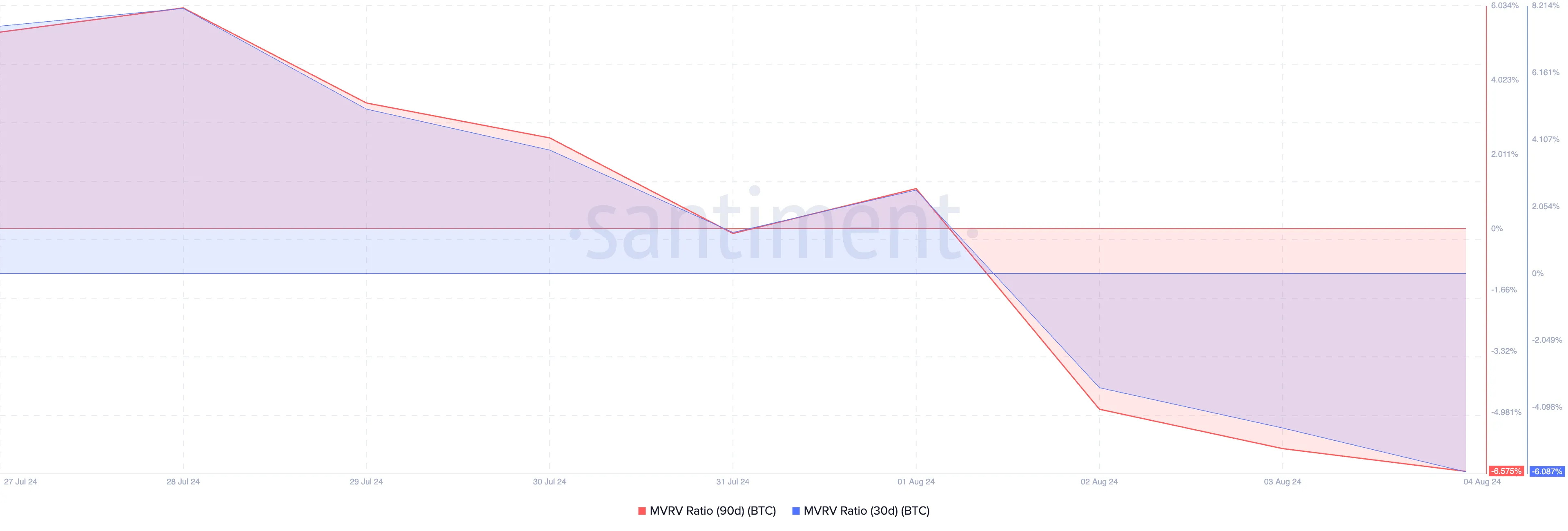

An important indicator, Bitcoin’s market value to realized value (MVRV) ratio, suggests the cryptocurrency might be undervalued. Santiment reports negative MVRV ratios for 30-day and 90-day periods, both below zero, signaling that Bitcoin’s market price is lower than the average purchase price of its tokens.

Typically, a negative MVRV ratio points to a good buying opportunity, but traders are currently cautious, fearing further declines.

The BTC Fear and Greed Index stands at 34, reflecting a fearful market sentiment. On-chain data provider Santiment notes that unlike a similar dip in early July, current market participants are not eager to buy the dip.

🤷 With this dip being roughly on par to the one we saw in early July, the same crowd enthusiasm for dip buying isn’t present… at least not yet. Look for $60K BTC or $2.9K ETH to be key psychological levels that may be enough for traders to open their wallets. pic.twitter.com/rRSVFMY4AW

— Santiment (@santimentfeed) August 3, 2024

Analysts warn that negative sentiment in the crypto market and adverse macroeconomic factors could push Bitcoin’s price to $50,000 or lower. CryptoQuant analyst Abramchart highlights that Bitcoin has failed to maintain the short-term support level of $64,580.

If it continues to fall, it might target the $53,000 to $54,000 range. Additionally, 10x Research points out that weakening economic indicators and potential stock market declines further increase this risk. They also suggest that a possible emergency rate cut by the Federal Reserve, in response to a declining stock market, could worsen Bitcoin’s decline by signaling economic distress rather than recovery.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read