Bitcoin Exchange Inflows Increase as Traders Adjust Holdings

19.07.2024 10:00 1 min. read Kosta Gushterov

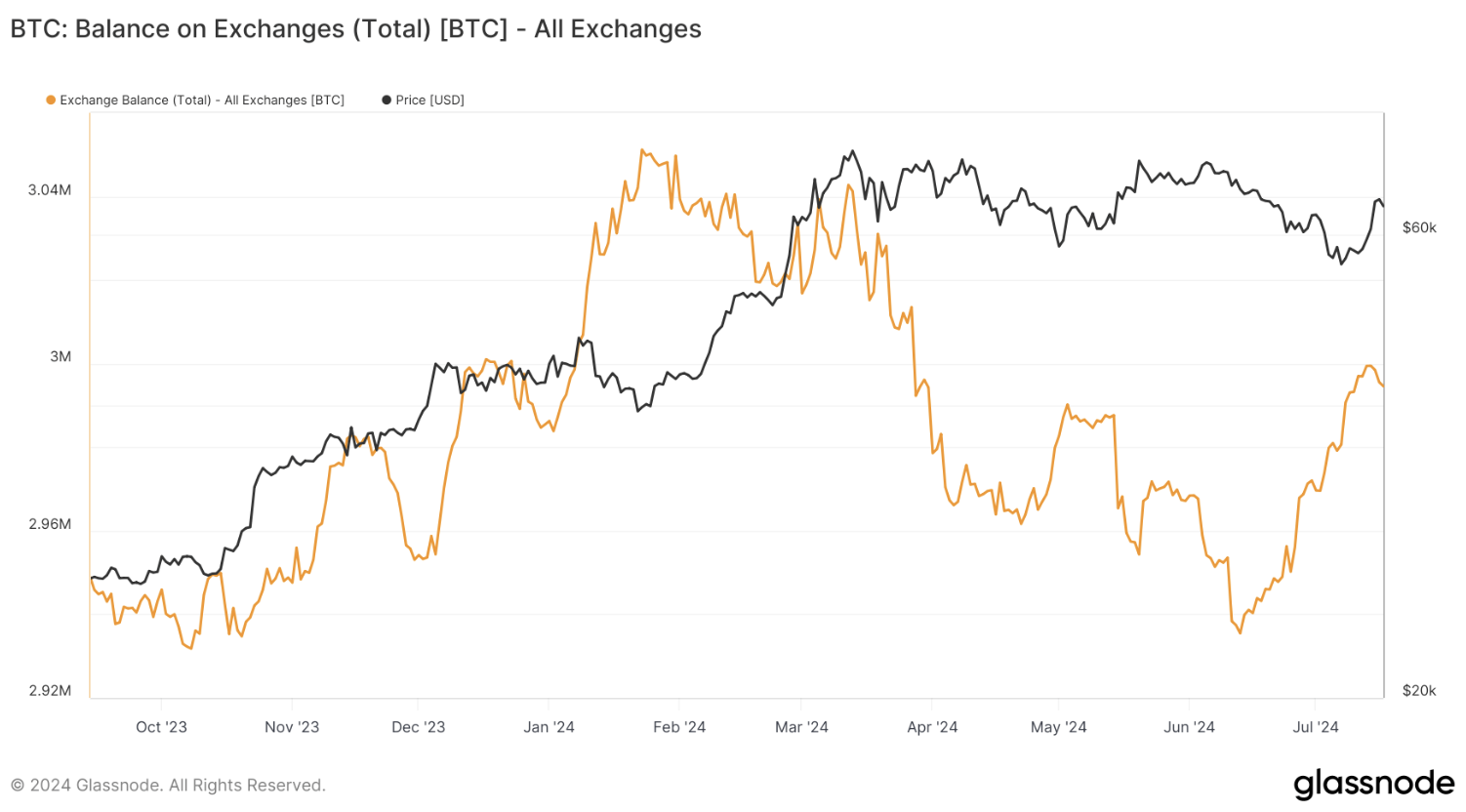

Bitcoin has seen a notable increase in exchange balances recently, with around 64,000 BTC, equivalent to about $4.1 billion, moving onto exchanges in the past month, based on Glassnode data.

This follows a trend of declining exchange-held Bitcoin that began in early 2024, which was influenced by the introduction of spot Bitcoin ETFs in the US and was further intensified after the halving event in April.

At the end of 2023, Bitcoin exchange balances rose sharply, peaking in late January 2024. This increase coincided with a local price dip, which came after the initial hype around Bitcoin ETFs subsided. Traders likely moved Bitcoin to exchanges to benefit from a price rally that started in October.

However, as Bitcoin’s price surged again around March and May 2024, a significant amount of Bitcoin flowed out of exchanges, indicating a preference among investors to store their assets in personal wallets for the long term.

Recently, the trend has reversed with a noticeable influx of Bitcoin back onto exchanges. This suggests that traders might be selling into the market dip or adjusting their positions based on current price movements. Such inflows often signal an uptick in trading activity, potentially for profit-taking or preparing for upcoming market changes.

Since July 14, there has been a small reversal, with approximately 1,000 BTC moving off exchanges.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Top 10 Biggest Crypto Developments This Week

12.07.2025 22:00 3 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Sberbank Moves to Dominate Russia’s Crypto Custody Sector

Sberbank, Russia’s largest state-owned bank, is preparing to launch custody services for digital assets, marking a significant expansion into the country’s evolving crypto landscape.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Top 10 Biggest Crypto Developments This Week

12.07.2025 22:00 3 min. read