Bitcoin ETFs Surge with Over $235M Inflows, Fueling Market Optimism

08.10.2024 12:00 1 min. read Alexander Stefanov

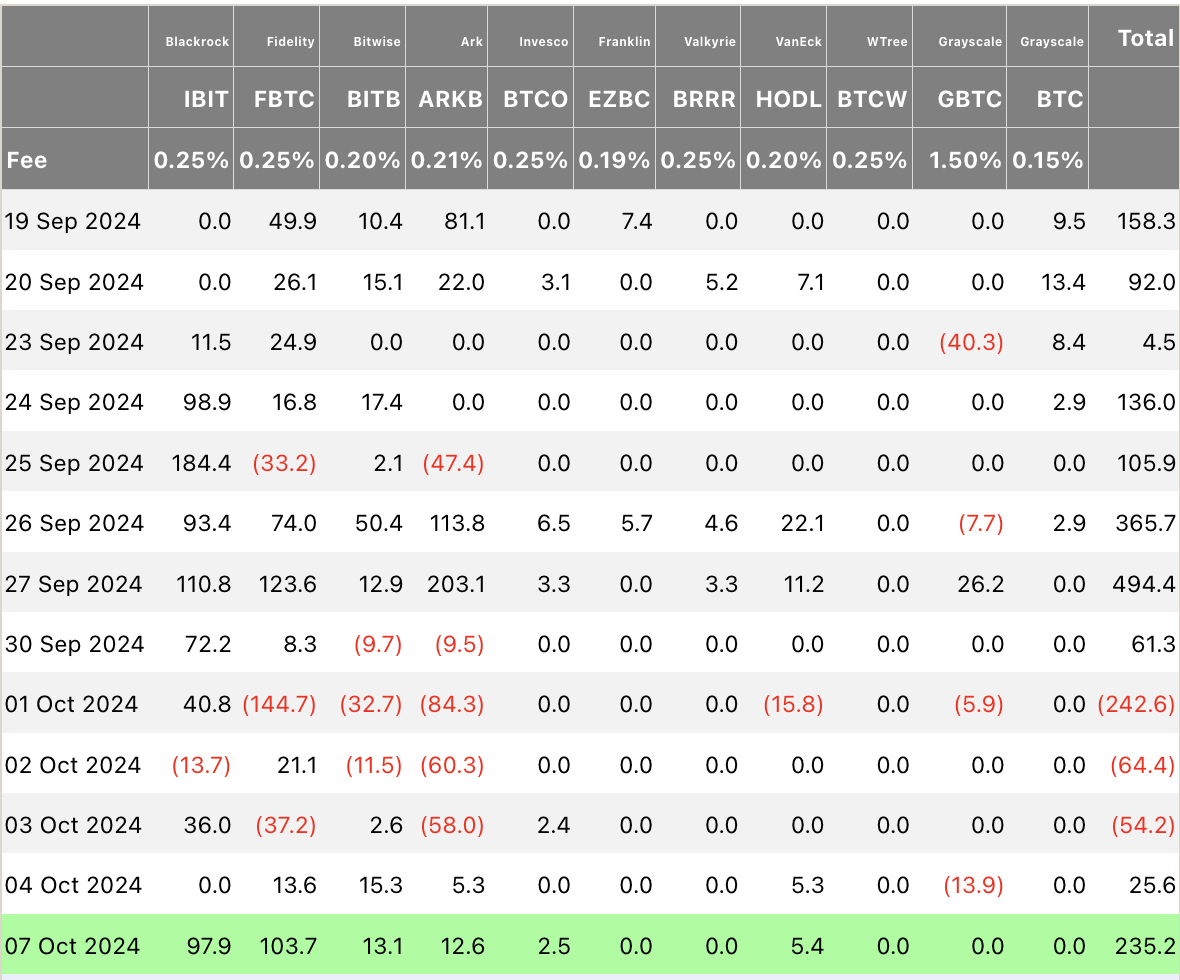

Bitcoin ETFs kicked off the week with a surge, drawing in over $235 million on a single day in October.

Fidelity’s FBTC led the charge with $104 million in inflows, closely followed by BlackRock’s IBIT, which attracted $98 million, according to data from Farside.

Bitcoin, which had reclaimed the $64,000 mark on Monday, has since pulled back slightly.

Bitcoin ETFs have been a key driver of optimism in the market this year, with investors closely monitoring their progress.

Despite a sluggish start to the month, including $242 million in outflows on Oct. 1 and three consecutive days of negative flows, analytics firm CryptoQuant has suggested that renewed interest in these products could send Bitcoin’s price significantly higher.

Robbie Mitchnick, BlackRock’s head of digital assets, recently remarked that he considers Bitcoin a risk-off asset, countering the widespread belief that it moves in sync with the stock market.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read