Bitcoin ETFs Record $403M Inflows as BlackRock Leads Nine-Day Streak

16.07.2025 15:00 2 min. read Kosta Gushterov

U.S.-listed spot Bitcoin ETFs continue to post strong inflows, recording their ninth consecutive day of net positive investment activity on Tuesday.

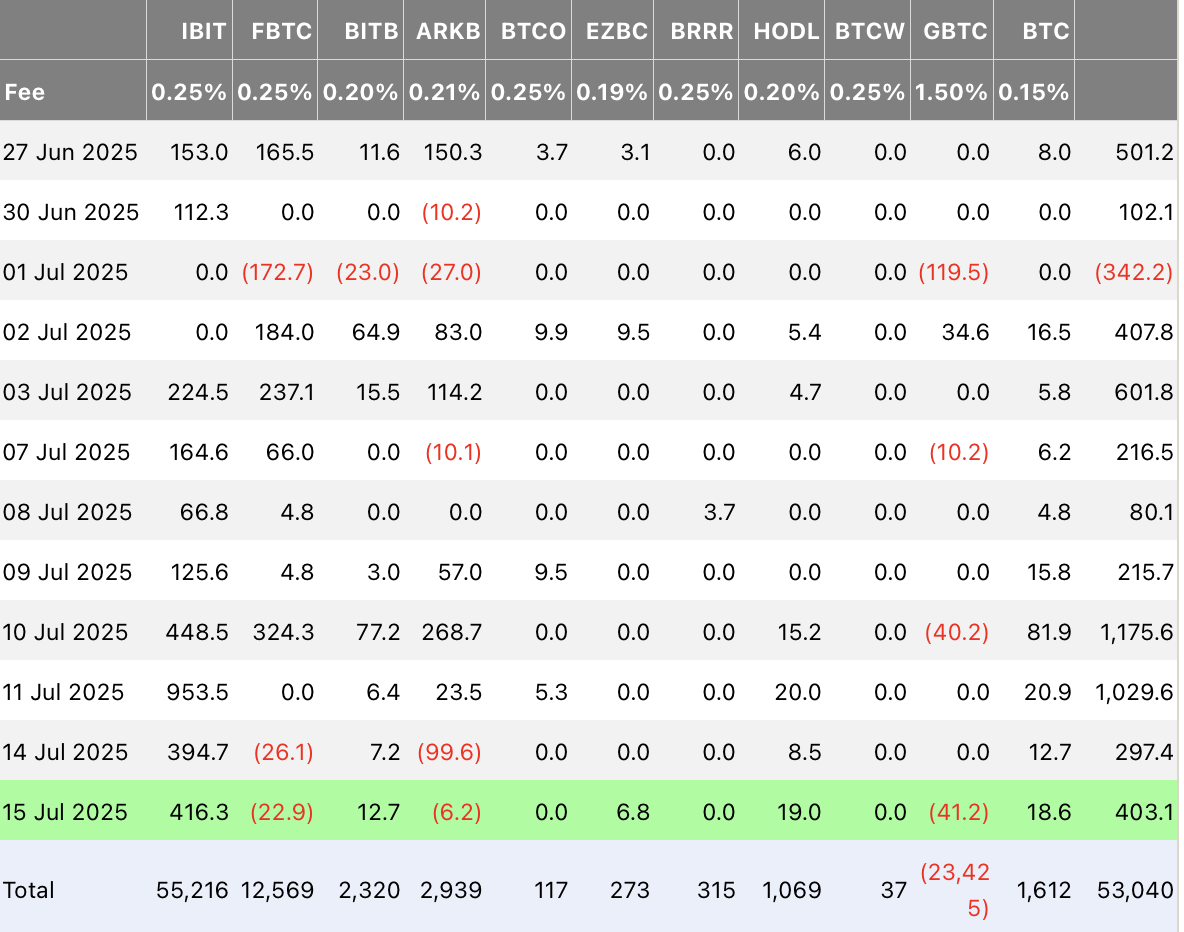

According to data from Farside Investors, the sector attracted $403 million in total net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) dominating the day.

IBIT led the surge with $416.3 million in net inflows, reaffirming BlackRock’s position as a dominant force in institutional Bitcoin investment. VanEck’s HODL ETF followed with a respectable $19 million in positive flows, while Bitwise’s BITB and Grayscale’s Mini Bitcoin Trust also saw moderate inflows.

However, the momentum was not evenly distributed across all products. Three ETFs experienced net outflows on the day—Grayscale’s GBTC lost $41.2 million, Fidelity’s FBTC saw $22.9 million pulled out, and Ark & 21Shares’ ARKB reported $6.2 million in outflows. Despite these losses, the overall trend for spot Bitcoin ETFs remains decisively bullish.

Cumulatively, spot Bitcoin ETFs have attracted $53 billion in net inflows since launching earlier this year. In just the last nine trading days, $4.4 billion has poured into these funds. Since April, the sector has seen nearly $17 billion in capital inflows, signaling growing institutional confidence in Bitcoin as a long-term asset.

READ MORE:

How Can You Tell When it’s Altcoin Season?

This sustained demand comes as Bitcoin trades near all-time highs, bolstered by a mix of macroeconomic uncertainty, rising institutional participation, and optimism around regulatory clarity. Analysts suggest the ETF momentum could persist if Bitcoin continues to hold above key psychological levels, potentially setting the stage for another leg higher in 2025.

-

1

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

2

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

05.07.2025 12:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Here’s How Bitcoin Reacted to the June PPI Report

Bitcoin showed a brief bullish reaction to the June U.S. Producer Price Index (PPI) release at 12:30 UTC, but the move quickly lost steam as traders digested the broader implications of the data.

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

Chaitanya Jain, Bitcoin strategy manager at Strategy, has pushed back against online speculation that the company’s fate is tightly bound to the price of Bitcoin.

Cantor Fitzgerald-backed SPAC Targets $4 Billion Bitcoin Purchase

Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick, is reportedly finalizing a multibillion-dollar Bitcoin acquisition deal through a special purpose acquisition company (SPAC) backed by Cantor Fitzgerald.

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

Despite Bitcoin soaring past $120,000 and testing new all-time highs, several high-frequency market indicators suggest that the current bull run may still be gathering momentum.

-

1

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

2

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

05.07.2025 12:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read