Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read Kosta Gushterov

According to on-chain analyst Darkfost, Bitcoin is entering a new stage of on-chain behavior marked by two key developments: a rare third peak in the SOPR Trend Signal during a single bull cycle and a sustained outflow dominance in exchange flows.

Together, these trends suggest a strengthening conviction among holders and a maturing phase of accumulation, despite short-term volatility.

SOPR trend hits rare third peak

The SOPR (Spent Output Profit Ratio) Trend Signal, a metric that tracks the average profit margin of coins moved on-chain, has now risen for the third time within the same bull cycle — an unprecedented occurrence. This indicates that within just 12 months, Bitcoin holders have seen multiple profitable exit points yet continue to show strong holding behavior.

This metric becomes especially relevant when identifying market shifts. If the SOPR signal’s blue line crosses below its long-term orange trend line, it often flags a transition toward bearish sentiment. As of now, however, the signal remains bullish, indicating that profit-taking has not yet overwhelmed market demand.

Exchange outflows reaffirm long-term confidence

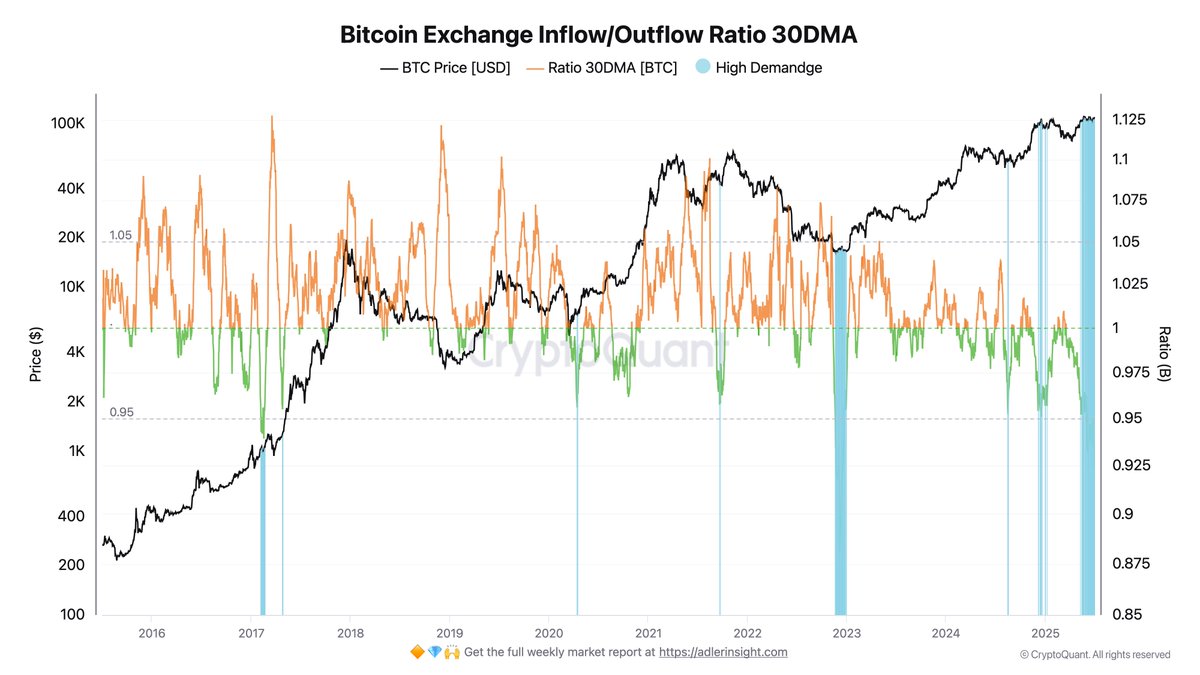

Supporting this trend is the current inflow/outflow ratio for BTC on exchanges, which has dropped to around 0.9 — a level last seen during the 2023 bear market. A ratio below 1 suggests that more Bitcoin is leaving exchanges than entering, a classic signal of accumulation.

Historically, when this ratio rises above 1.05, it has marked the start of distribution phases or broader corrections. But with long-term holders continuing to absorb supply and outflows dominating, Darkfost suggests the market remains in a favorable spot-driven demand cycle.

Both indicators — the triple SOPR peak and sustained outflows — point to a market where conviction is growing, not waning. While risks remain, these trends suggest that Bitcoin’s next major move may once again defy conventional expectations.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read