Bitcoin Drops to $64,000 – the Whole Crypto Market is in the Red

25.07.2024 9:07 2 min. read Alexander Stefanov

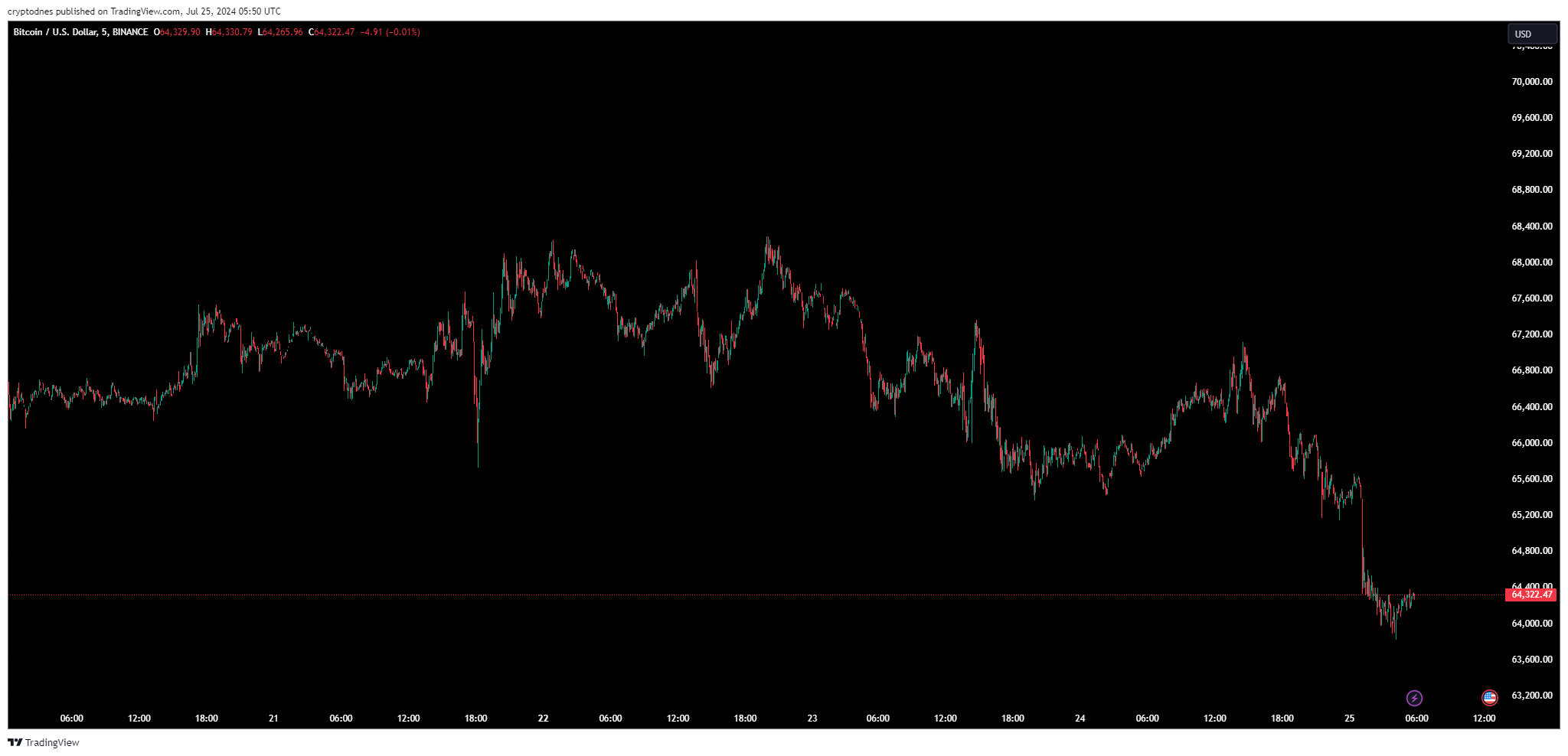

The whole cryptocurrency market seems to be experiencing a downturn after the weekend's slight recovery when BTC managed to break above $68,000.

At the time of writing, Bitcoin (BTC) is trading at $64,320 after a 2.3% drop during the past day and has a trading volume of $33.77 billion. Bitcoin’s market cap is currently $1.267 trillion.

During the past 24 hours $291.65 million were liquidated from the crpyptocurrency market ($258.32 million in longs and $33.35 million in shorts). Bitcoin liquidations accounted for 28.5% of the total liquidations

The 1-day technical analysis from TradingView remains rather bullish with the summary showing “buy” at 11, the moving averages poitn to “buy” at 10, while oscillators remain “neutral” at 9.

The biggest losser in the past 24 hours is Mogcoin, dropping by 13.54%. Ethereum (ETH) and LidoDAO (LDO) also registered significant declines.

Fear has tighly gripped the Bitcin community amidst the Mt. Gox repayment plan. Billions of dollars in BTC are being distributed to the bankrupt crypto exchange’s creditors.

Reportedly, the average purchase price for new large investors is about $64,000. As long as prices remain above this level, market sentiment remains optimistic and major holders are likely to hold their positions.

Looking at the daily chart, Bitcoin should avoid a drop below $64,000 and gain momentum to try to get back above the $66,300 and $68,300 crosses. These levels are significant as they have been points of significant trading activity in the past.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read