Bitcoin Crashes Below $63,000 – The Whole Crypto Market is Bleeding

01.08.2024 18:47 1 min. read Alexander Stefanov

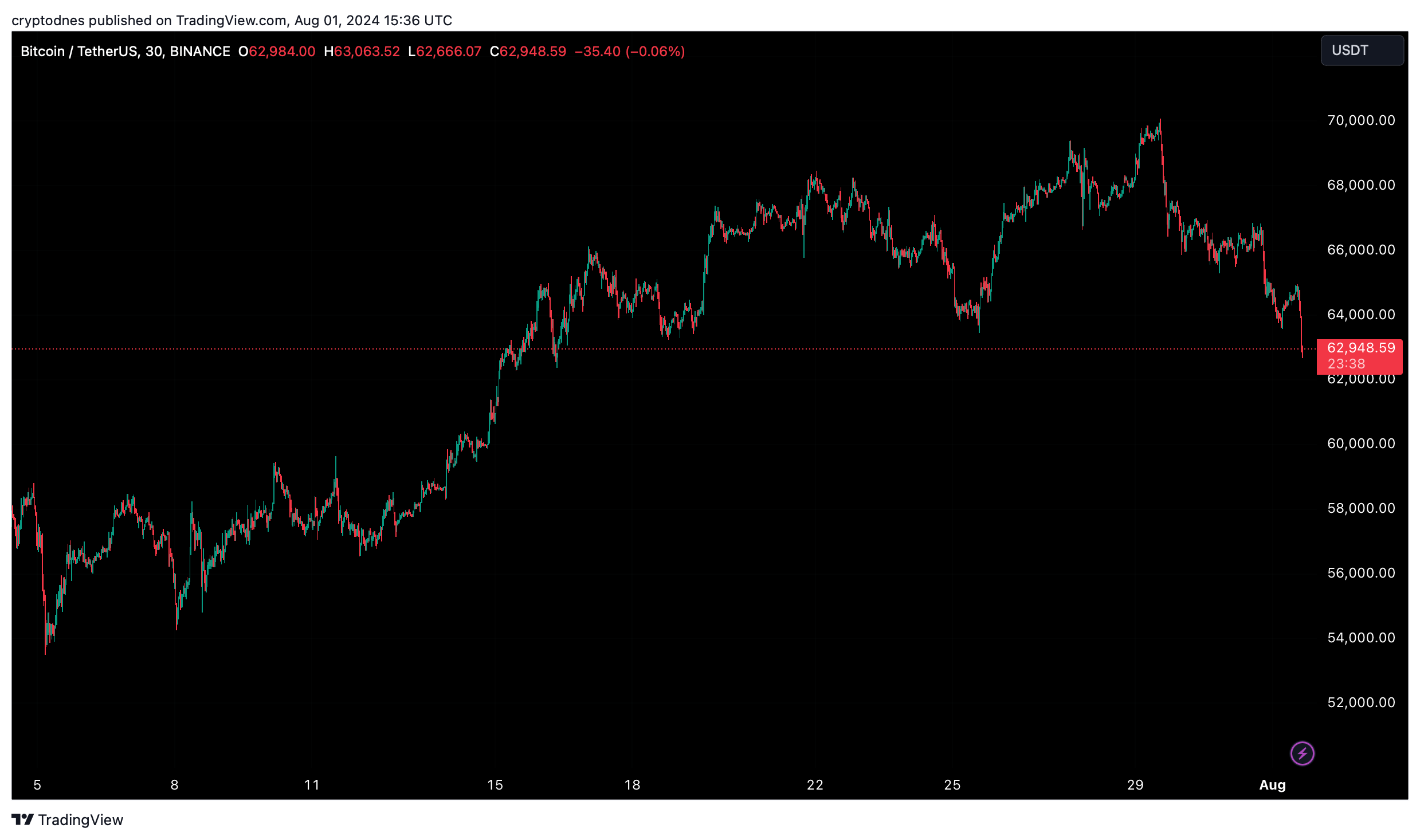

On Thursday (August 1), the price of Bitcoin dropped below $63,000 at the time of writing after managing to stay above $64,000 all day.

Over the past 24 hours, the value of Bitcoin has dropped 5.1%, trading around $62,950 at the time of writing, after fallen to a low of $63,700 early this morning on Binance.

The decline in BTC’s price dragged down other cryptocurrencies as well.

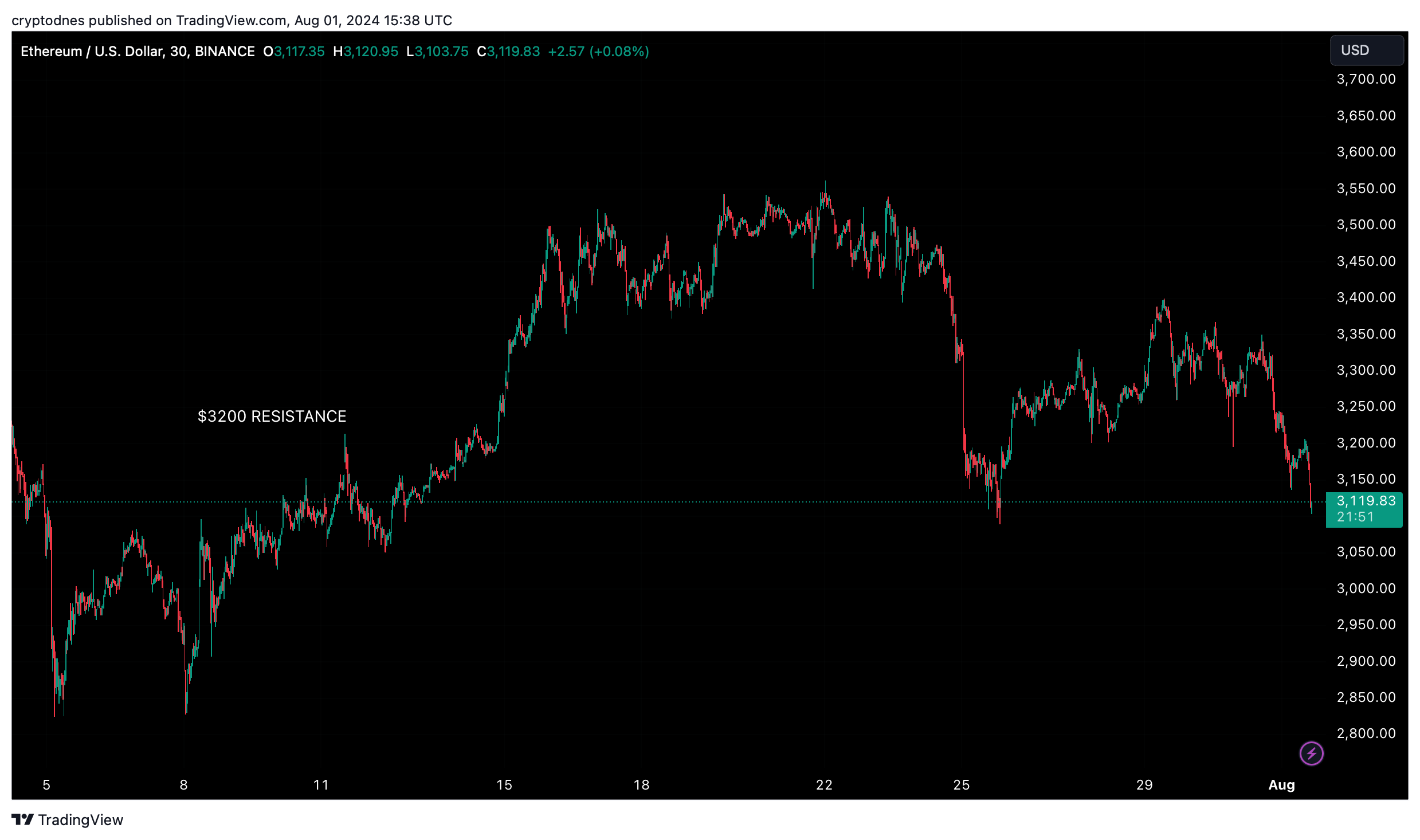

Ethereum, for example, also lost just over 5.3% over the past day, trading at $3,130 as of 15:38 p.m. (UTC), as the excitement surrounding the approval of the ETH spot exchange-traded fund partially subsided.

Other of the larger cryptocurrencies such as SOL, ADA and XRP fell 9%, 6% and 9.5% respectively. In the realm of meme coins, SHIB and DOGE each lost between 6% and 8%.

The total crypto market cap dropped by 5.28% to $2.26 trillion.

In the past 24 hours $289.14 million were liquidated from the crypto market ($265.54 million in long positions and $23.59 million in shorts).

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read