Bitcoin Cash: Undervalued Yet Traders Remain Skeptical

24.07.2024 14:15 1 min. read Alexander Stefanov

Bitcoin Cash (BCH) has seen a steady decrease in value recently, currently trading at $373 - a 2.4% drop in the past 24 hours.

Despite this downturn, recent data suggests BCH might be undervalued at its current price, potentially offering a buying opportunity for traders.

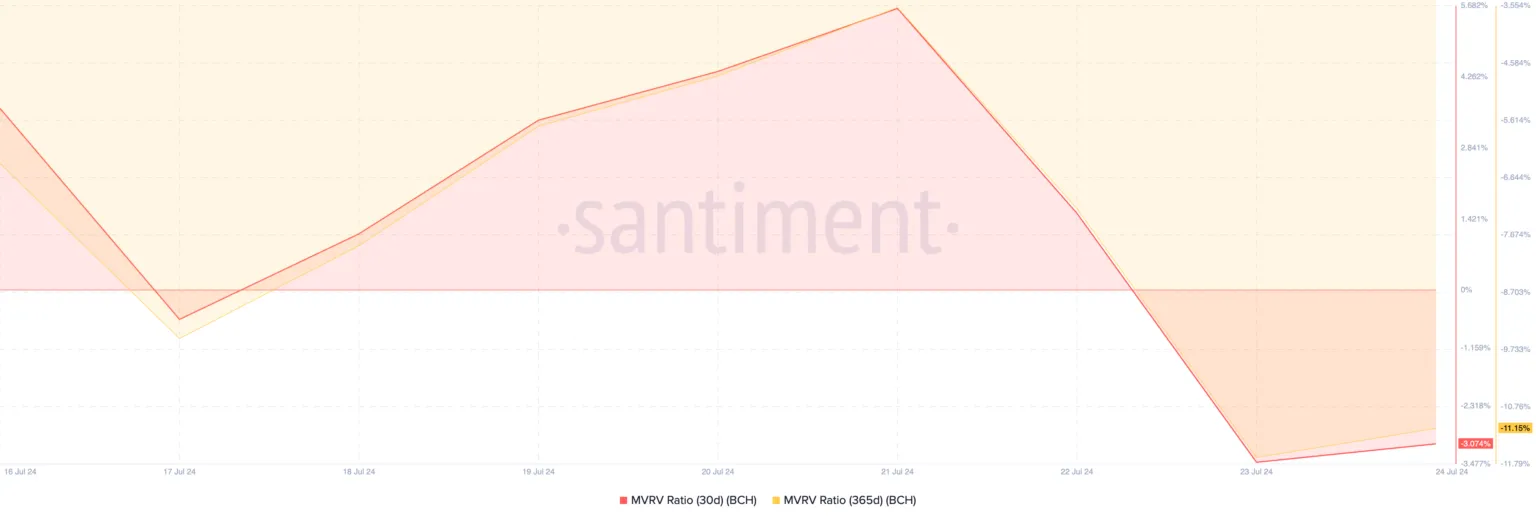

The coin’s Market Value to Realized Value (MVRV) ratio indicates BCH is priced below its historical cost basis. Specifically, BCH’s MVRV ratios for the 30-day and 365-day averages are -3.07% and -11.15%, respectively.

A negative MVRV ratio signals that BCH’s market value is less than the average price paid by investors, suggesting it could be a good buy.

However, BCH futures traders remain cautious. The negative funding rate of -0.02% since early July reflects a stronger preference for short positions, indicating bearish sentiment among traders who anticipate further price declines.

BCH’s recent fall below its 20-day exponential moving average (EMA) suggests a potential continued drop. This trend could push BCH’s price down to a six-month low of $286 if selling pressure persists.

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

3

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read

Ethereum Trading Volume Overtakes Bitcoin

A major shift is underway in crypto markets as Ethereum begins to outpace Bitcoin in both price performance and trading activity.

DOGE Drops 8.75% After 27% Rally, Key Support Under Pressure

Dogecoin is seeing a sharp correction just days after triggering a bullish MACD crossover that many analysts saw as the setup for a major upside move.

Crypto Market Slips on Senate Bill and Altcoin Leverage Risk

The crypto market dropped 1.82% over the last 24 hours, ending a multi-day streak of gains.

Ethereum Price Prediction: New ETH Whale Accumulates $400M Worth of Ether – Is $5K in Sight?

Ethereum (ETH) has gone up by 62% in the past month as the passing of the Genius and Clarity Acts in the United States may have kicked off altcoin season. Combined with the tailwind provided by the Pectra upgrade, market conditions favor a bullish Ethereum price prediction and we could see this crypto rising to […]

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

3

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read