Bitcoin Bull Market Could Have More to Offer, Glassnode Suggests

02.02.2025 12:00 1 min. read Alexander Zdravkov

Glassnode, a leading on-chain analytics company, suggests that Bitcoin (BTC) still has potential for growth, according to its analysis of a key indicator.

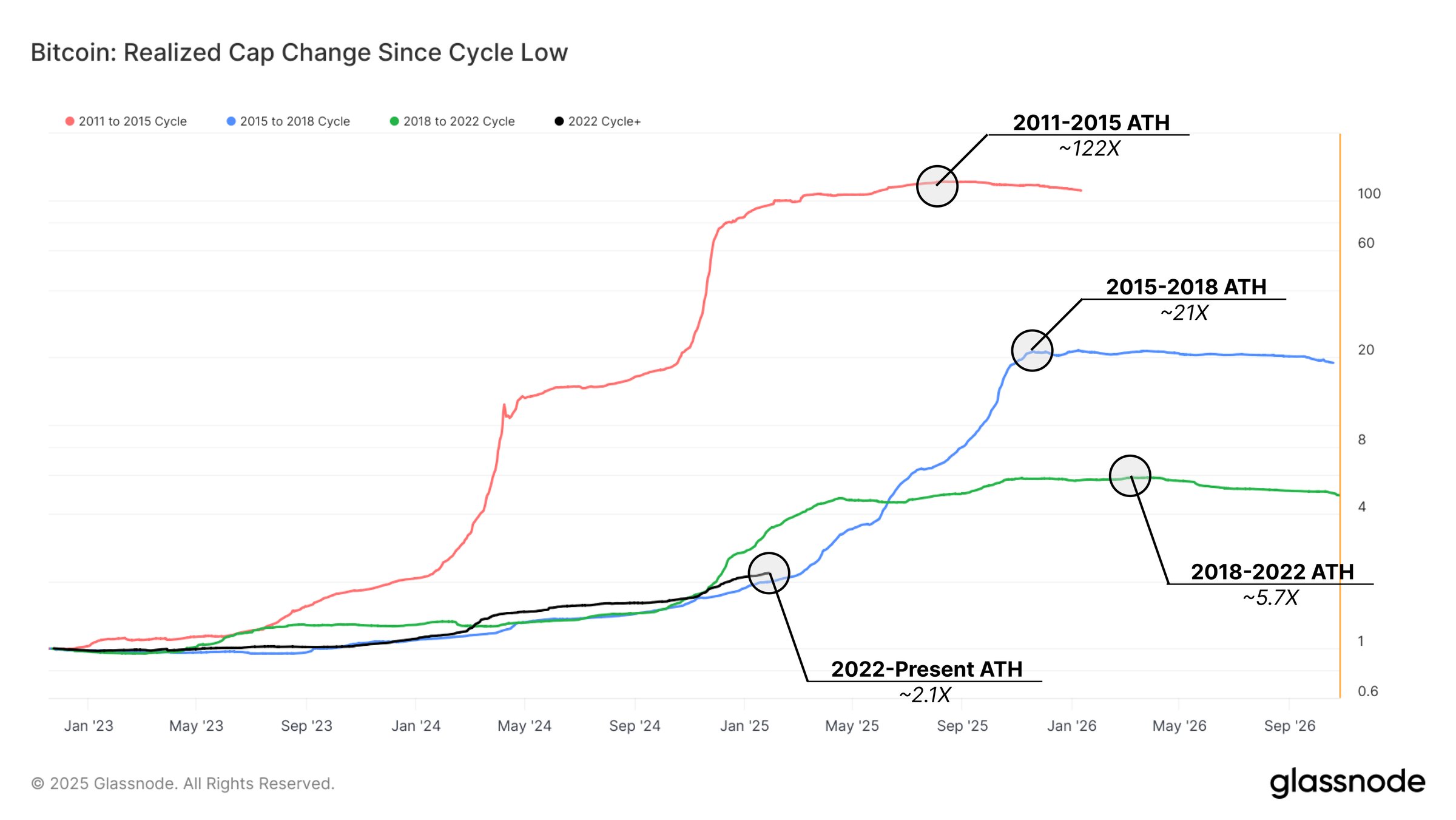

The company highlights Bitcoin’s Realized Cap, which measures the price at which each coin last moved. This indicator helps determine whether holders are in profit or loss and is seen as a reflection of net capital inflows into Bitcoin.

Glassnode notes that the Realized Cap has increased by 2.1 times from its 2022 lows, but is still far from the 5.7 times peak seen in the last bull cycle. The firm suggests that Bitcoin is still in the earlier stages of growth, as the usual surge seen during a market’s euphoric phase hasn’t fully emerged.

Furthermore, Glassnode observes that the current Bitcoin cycle appears similar to the 2015-2018 bull run, which was largely driven by spot market investors.

Despite the market’s significantly larger size now, Bitcoin has remained resilient, with price pullbacks rarely exceeding 25%. This stability is attributed to strong demand, ongoing ETF inflows, and Bitcoin’s growing role as a macro asset.

Glassnode concludes that while it may not be realistic to expect a massive 100x rally like the one seen in 2015, the potential for further expansion remains if demand continues to rise.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read -

5

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

07.06.2025 12:00 1 min. read

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

Institutional interest in Bitcoin is heating up again, with major asset managers making massive moves.

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

Tokyo-listed Metaplanet has kicked off its aggressive Bitcoin acquisition plan by securing 74.9 billion yen ($515 million) through new share issuance — the first step in its bid to own 1% of Bitcoin’s total supply.

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

Trump Media & Technology Group (TMTG), the company behind Truth Social, is ramping up its entry into the crypto investment world.

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

Investor enthusiasm for U.S.-listed spot Bitcoin ETFs has reached a fresh high, with over $2.2 billion pouring in over the past 11 trading days.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read -

5

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

07.06.2025 12:00 1 min. read