Bitcoin and Michael Saylor’s Strategy Outperform Tesla, Apple, and Gold

25.05.2025 21:00 2 min. read Alexander Stefanov

Michael Saylor, chairman of MicroStrategy and one of Bitcoin’s most outspoken corporate champions, has once again underscored his belief in the cryptocurrency’s long-term potential—this time with data to back it up.

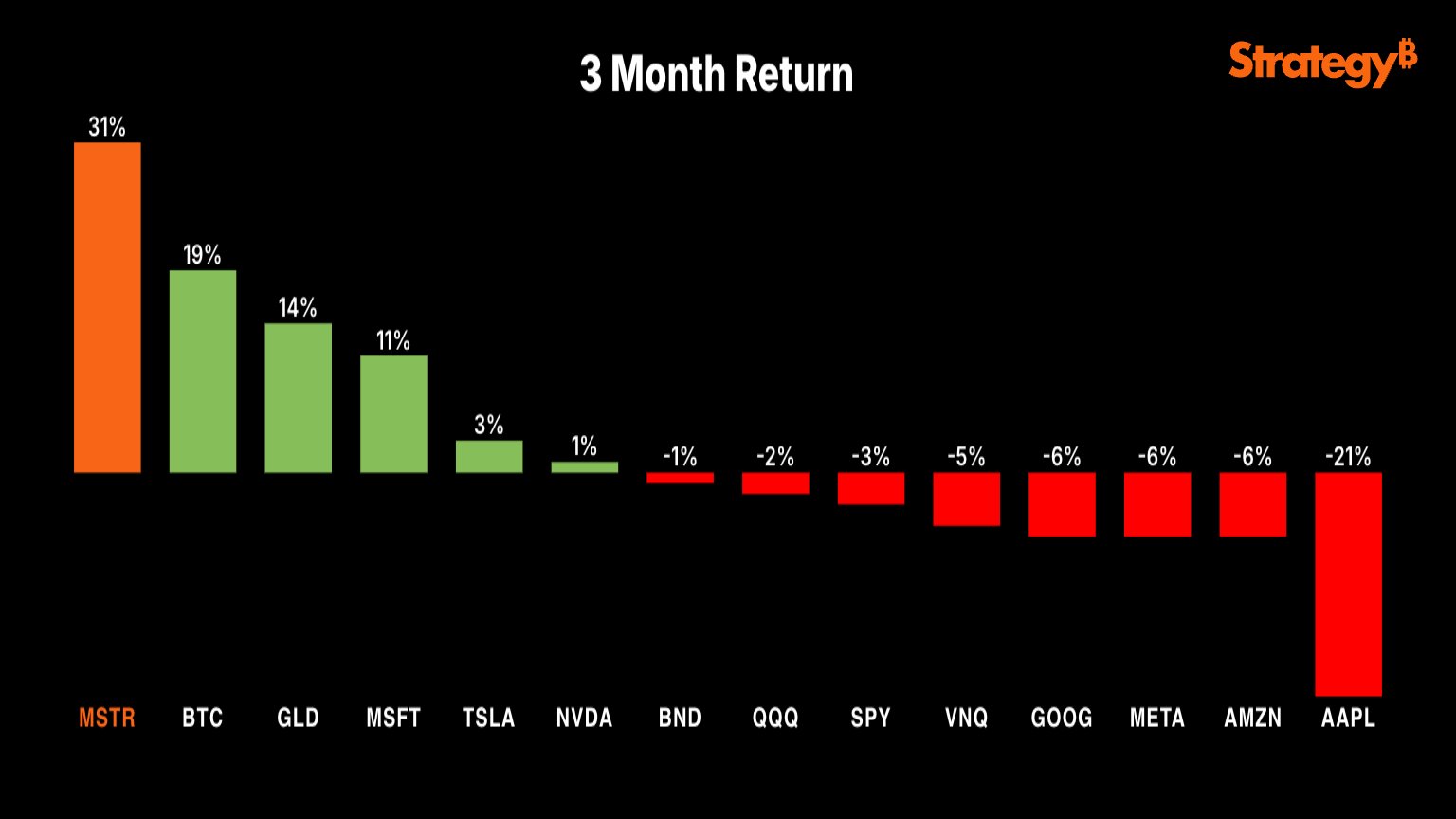

In a post shared on May 24 via X, Saylor revealed updated performance metrics comparing top assets over the past three months and one year. The standout? His own company. MicroStrategy’s stock surged 31% in three months and 139% over the past year, outpacing even Bitcoin’s 58% annual gain. Other assets like Tesla, gold, and Meta followed, while giants like Apple and Google lagged behind or posted losses.

The outperformance is no coincidence. With over 576,000 BTC on its books, MicroStrategy functions as a high-leverage Bitcoin proxy. The company’s aggressive buying—often funded through debt—has tied its market valuation to Bitcoin’s movements, making MSTR a go-to choice for investors seeking amplified BTC exposure.

READ MORE:

How Bitcoin Hyper’s Four Technical Pillars Make BTC Practical for Everyday Use And Raised $200,000

But Saylor’s message went beyond numbers. In recent interviews and social posts, he argued that buying Bitcoin—even at all-time highs—remains a smart long-term move. He pointed to historical four-year holding data showing consistent profitability, regardless of market timing. For Saylor, Bitcoin’s strength lies in its resilience against inflation and fiat currency decay.

He also warned of a coming shift: once banks and large institutions formally embrace Bitcoin, the window for everyday investors could close. As regulatory green lights emerge, Saylor predicts demand will surge—possibly outpacing supply and making BTC far less accessible to the public.

“Time in the market beats timing the market,” Saylor wrote, signaling that the best time to buy Bitcoin may always be now.

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read