Binance’s Latest Tokens Tank: What’s Behind the Massive Losses?

08.08.2024 9:00 1 min. read Alexander Stefanov

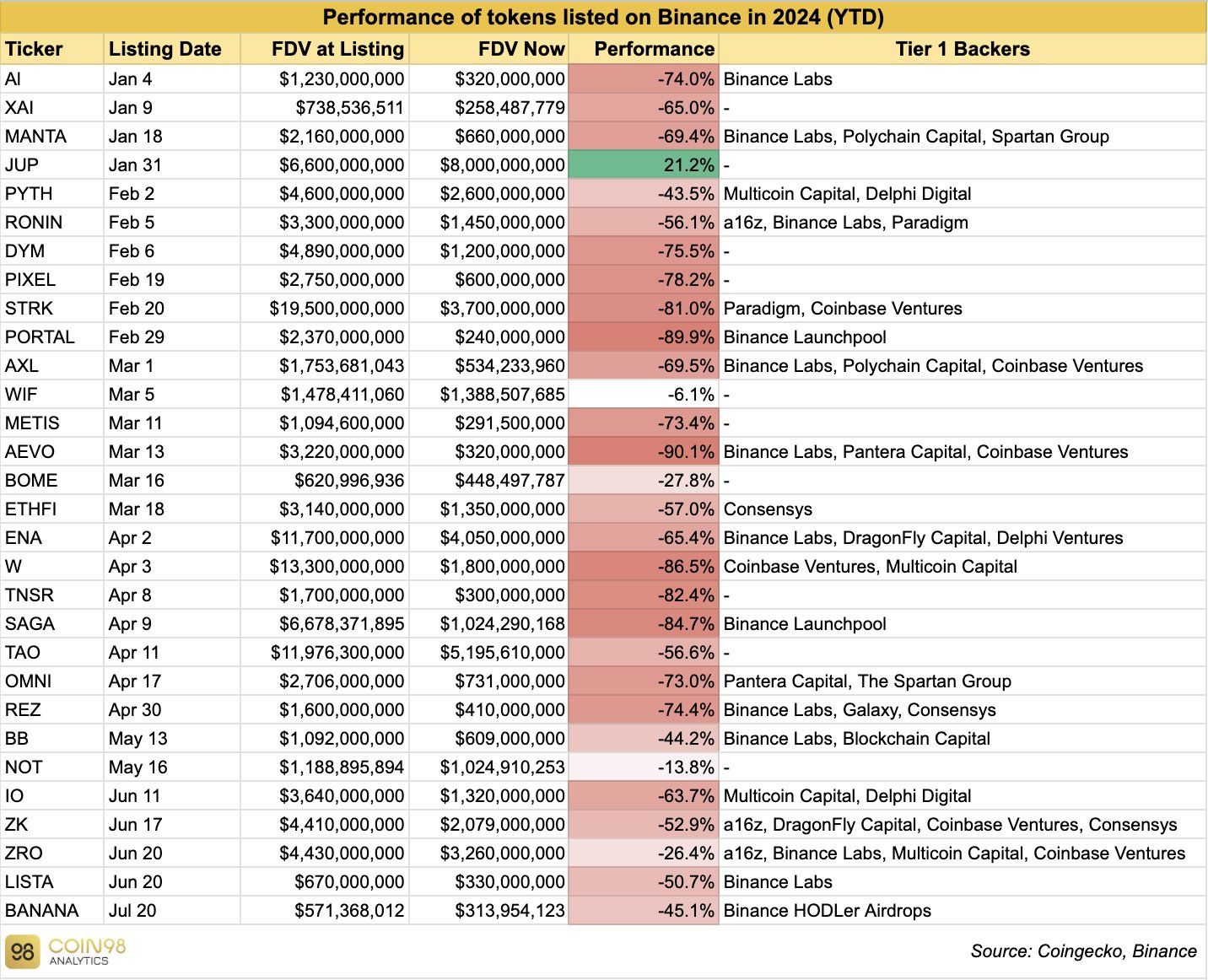

In 2024, Binance has added 30 new tokens to its platform, but the results have been largely underwhelming.

Data from Coin98 Analytics indicates that only Jupiter (JUP) has seen positive gains among these new listings. Most tokens have suffered significant declines, especially those supported by major venture capital firms like Binance Labs. For instance, tokens associated with Binance Labs have experienced drops ranging from 44% to 90%.

Vinay, a Web3 developer, points out that despite the overall market slump, some of Binance’s new projects have managed to stay stable.

He suggests that the broader market conditions rather than the projects themselves might be influencing these outcomes.

A recent study by Flow revealed that investing equally in all new Binance tokens would have resulted in an 18% loss over the past six months. Additionally, research by Haseeb Qureshi from Dragonfly points to the dominance of venture capitalists in these projects as a possible reason for the recent downturn, suggesting that retail investors have exited upon realizing the heavy VC ownership.

Overall, while Binance remains a prominent venue for launching new tokens, the mixed performance of these listings highlights the volatility and challenges within the cryptocurrency market.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

Why Most Americans Still Avoid Crypto Despite Growing Adoption

Cryptocurrency ownership in the U.S. has grown steadily over the past few years, but it remains far from widespread.

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read