Binance Denies Blocking Palestinian Accounts Amid Middle East Conflict

29.08.2024 17:00 1 min. read Alexander Stefanov

This week’s escalation in the Israel-Palestinian conflict has brought scrutiny to Binance, with claims suggesting the exchange blocked all Palestinian accounts at the request of the Israeli Defense Forces (IDF).

Binance has refuted these claims, stating that only a few accounts linked to illegal activities were affected.

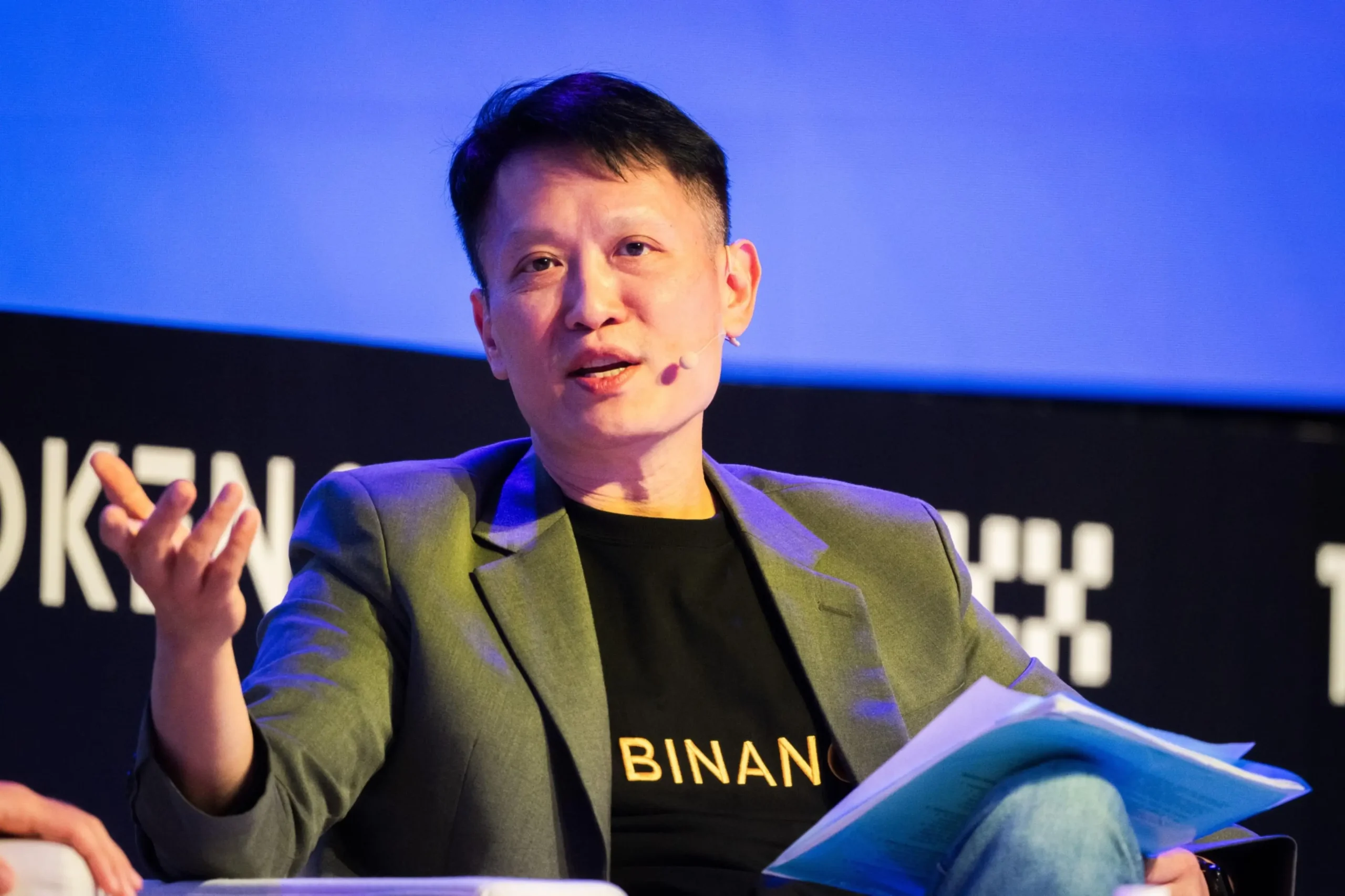

Binance CEO Richard Teng has denied the reports of a comprehensive ban, explaining that the restrictions were applied solely to accounts involved in illicit transactions, in accordance with international anti-money laundering laws.

The controversy began when Ray Youssef, CEO of NoOnes, accused Binance of freezing Palestinian users’ funds under IDF pressure and refusing to return them due to alleged links with a Gaza-based terrorist group. These accusations have raised concerns about potential bias and government influence on the exchange.

Binance’s spot trading volume has dropped by 23% over the past month, a significant decrease from its previous market dominance. Co-Founder Yi He assured that Palestinians can still use Binance without restrictions, specifying that only a limited number of accounts were impacted.

Investor Simon Dixon criticized Binance’s increased regulatory scrutiny, comparing its current operations to those of a bank, and suggested that geopolitical influences might be at play. Meanwhile, the situation in the West Bank has worsened, with recent Israeli military actions in Jenin and other areas resulting in at least nine deaths.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

Binance CEO Reveals What’s Fueling the Next Global Crypto Boom

Binance CEO Richard Teng shared an optimistic outlook on the future of cryptocurrencies during an appearance on Mornings with Maria, highlighting growing global acceptance, regulatory progress, and strategic reserve integration.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read