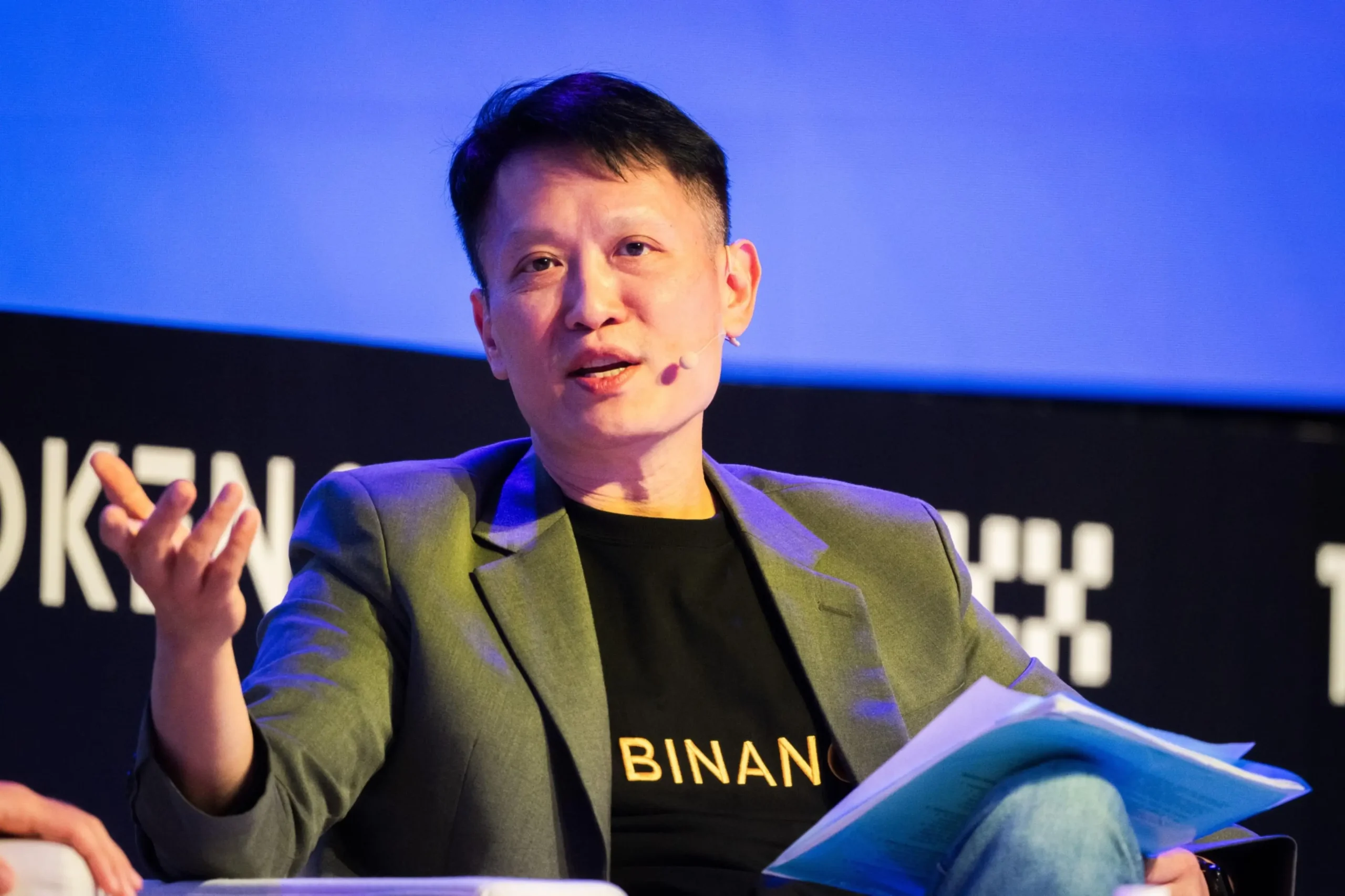

Binance CEO Richard Teng Urges Caution Amid Rising Crypto Scams

29.01.2025 19:30 1 min. read Alexander Zdravkov

With market optimism fueling increased activity, Binance CEO Richard Teng is warning investors to stay alert against Ponzi schemes and fraudulent crypto projects.

Taking over leadership from Changpeng Zhao (CZ), Teng emphasized the importance of due diligence and skepticism toward unsolicited offers, urging traders to verify before trusting any investment opportunities.

Scammers thrive during market upswings, preying on emotions and hype. Teng advised the Binance community to remain cautious, highlighting how fraudulent schemes often appear more frequently during bullish cycles. His core message: question everything and research thoroughly before committing funds.

In a separate discussion, Teng shifted focus to Bitcoin’s limited supply, reinforcing its long-term value. With only 21 million BTC ever to exist and less than 2 million left to be mined, he emphasized the asset’s growing scarcity as global adoption increases.

Meanwhile, Binance is under legal investigation in France over allegations of money laundering and tax violations. Authorities claim the exchange may have operated without full regulatory approval, leading to an expanded probe into its activities across multiple EU countries.

Despite legal pressures, Binance remains a dominant player, with Teng working to strengthen investor awareness and security in the evolving crypto landscape.

-

1

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

08.07.2025 10:00 2 min. read -

2

Ex-NCA Officer Jailed for Stealing 50 BTC From Dark Web Criminal

17.07.2025 20:00 3 min. read -

3

SEC Charges Georgia-based First Liberty and Owner in $140 Million Ponzi Scheme

12.07.2025 17:00 2 min. read -

4

Crypto Users Targeted as Cointelegraph and CoinMarketCap Fall to Front-End Hacks

23.06.2025 14:00 2 min. read -

5

Russia Struggles to Bring Underground Crypto Miners Into the Light Despite New Laws

20.06.2025 18:00 1 min. read

Ex-NCA Officer Jailed for Stealing 50 BTC From Dark Web Criminal

A former National Crime Agency (NCA) officer has been sentenced to five years and six months in prison after stealing 50 BTC—now worth over £4.4 million—from a criminal investigation he was helping to lead.

SEC Charges Georgia-based First Liberty and Owner in $140 Million Ponzi Scheme

The U.S. Securities and Exchange Commission (SEC) has filed emergency enforcement actions against First Liberty Building & Loan, LLC and its founder, Edwin Brant Frost IV, alleging they operated a $140 million Ponzi scheme that spanned more than a decade and defrauded around 300 investors.

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

A legal clash between Coin Center and the U.S. Treasury Department over sanctions imposed on Tornado Cash has officially come to an end, following a joint decision to dismiss the case.

Hackers Steal $140 Million from Brazilian Central Bank, Launder Funds Through Crypto

A sophisticated cyberattack targeting Brazil’s central bank reserve accounts has resulted in the theft of over $140 million (R$800 million), much of which was swiftly funneled through cryptocurrency channels.

-

1

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

08.07.2025 10:00 2 min. read -

2

Ex-NCA Officer Jailed for Stealing 50 BTC From Dark Web Criminal

17.07.2025 20:00 3 min. read -

3

SEC Charges Georgia-based First Liberty and Owner in $140 Million Ponzi Scheme

12.07.2025 17:00 2 min. read -

4

Crypto Users Targeted as Cointelegraph and CoinMarketCap Fall to Front-End Hacks

23.06.2025 14:00 2 min. read -

5

Russia Struggles to Bring Underground Crypto Miners Into the Light Despite New Laws

20.06.2025 18:00 1 min. read