Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now? Whales Buy The Dip On This New Coin As Prices Crash

11.03.2025 14:29 4 min. read Kosta GushterovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Whales and smart money investors do not believe that the crypto bull market is over.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

On-chain activity suggests that whales are buying the dip as small-scale retail investors panic-sell their holdings.

Whales’ optimism isn’t without merit. The soaring global liquidity, rapidly easing financial conditions and cycle top indicators all suggest that the crypto bull market isn’t over.

Whales Buy The Dip As Crypto Prices Crash

Crypto prices extended their losses on Monday, with the Bitcoin price temporarily falling below $78,000.

Coinglass data reveals that over $800 million worth of positions have been liquidated in the past 24 hours, with over $620 million in longs.

The continued decline in US stocks is adding to the selling pressure on crypto. The tech-heavy NASDAQ-100 is down by nearly 4% on Monday, while the S&P 500 posted its worst day since 2022.

And yet, whales are buying the dip. Take, for instance, the increase in long positions on Bitfinex. While the Bitcoin price is down by 15% since February 22nd, the long positions have surged by more than 21%.

Coinglass data reveals that the long-short ratio for top trader accounts on Binance has surged to 3.25, indicating that smart money investors are expecting a bullish reversal.

Altcoins are also in high demand. For instance, whales have scooped up 330k ETH in the last 3 days, which pans out to $660,000,000 at its current price.

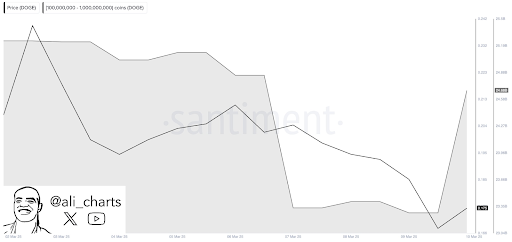

Meanwhile, prominent analyst Ali Martinez reveals that 600,000 ETH coins have been withdrawn from exchanges over the past week.

Martinez also reports significant whale buying activity in Dogecoin. Nearly $217 million was invested in DOGE in the past 24 hours alone.

Cardano is another asset that has received considerable interest from whales, perhaps due to its inclusion in Trump’s list of US crypto strategic reserve assets.

The whales’ optimism isn’t without merit. GMI’s Head of Macro Research Julien Bittel reveals that global liquidity is soaring while the financial conditions ease rapidly, creating the perfect backdrop for a crypto market rally.

Best Crypto To Buy Now

Whale buying activity reveals the most attractive investments.

It isn’t surprising they believe that Bitcoin, Ethereum, Dogecoin and Cardano are among the best cryptos to buy now, considering that the popular assets are in the highest demand by retail investors.

However, smart money investors are also stacking low-cap cryptos with high upside potential. For instance, Solaxy (SOLX) is seeing regular six-figure investments and has raised nearly $26 million in its ICO behind heavy whale and retail interest.

Just last week, a whale purchased nearly $200k worth of SOLX, despite the broader market uncertainty.

The first-ever prominent Solana layer-2 scaling has already impressed experts with its scaling solution, which features ZK-proofs, a deterministic rollup, a robut state change function, data availability tools like Celestia and a multi-chain bridge powered by Hyperlane.

The project promises zero network congestion for Solana, even during periods of heavy traffic and an exponential increase in scalability, resulting in low-latency transactions on both chains.

The strong demand for SOLX isn’t surprising. Whales realize that prominent Bitcoin and Ethereum L2s like Stacks, Optimism and Arbitrum have multibillion dollar valuations, making Solaxy highly undervalued during its presale.

It is, therefore no surprise that several early buyers are viewing SOLX as the next 10x crypto.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

2

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

3

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

4

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

5

Best Crypto to Buy Now as Ethereum ETFs Hit Record Inflows

19.07.2025 16:34 7 min. read

Vine Coin Explodes 250% After Elon Musk Tweet: Could TOKEN6900 Be Next?

Vine Coin (VINE), a viral meme coin inspired by the iconic short-form video app, has just skyrocketed nearly 250% in the past two weeks and over 500% in the past month. The rally followed Elon Musk’s tweet that Vine could return in a new, AI-powered form, triggering a surge of investor interest. As traders debate […]

XRP Price Prediction: Is XRP the Best Altcoin to Buy or Will ALGO and HYPER Pump Higher?

The cryptocurrency market cap has bounced back to a valuation of $4.02 trillion, marking a 15.85% month-over-month uptick. During this period, XRP has emerged as one of the top-performing altcoins, soaring by more than 50%. As the popular altcoin reached a new local high (ATH) of $3.65 – just under its 2018 ATH of $3.84 […]

Best Crypto to Buy Now as New Trump Tariffs Pause Turns Market Bullish

A new round of US-China trade talks kicked off in Stockholm, and already the impact on crypto has been immediate. With a fresh 90-day extension on the table, the threat of new tariffs has been pushed back, giving global markets room to recalibrate. This publication is sponsored. CryptoDnes does not endorse and is not responsible […]

Best Meme Coins To Buy Now As Dogecoin Tries to Patent its Protocol

Crypto’s recent run has mostly played out at the top. Bitcoin reclaimed dominance, Ethereum followed with steady momentum, and capital has rotated across major sectors. Yet meme coins, for all their influence in prior cycles, have barely stirred. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, […]

-

1

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

2

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

3

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

4

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

5

Best Crypto to Buy Now as Ethereum ETFs Hit Record Inflows

19.07.2025 16:34 7 min. read