Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now: Ultimate Guide For Best Altcoin To Buy Now

18.02.2025 15:19 4 min. read Kosta GushterovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The market is full of investment options, but some altcoins stand out with major upgrades, increasing adoption, and growing institutional interest.

Our top picks—Ethereum (ETH), Dogecoin (DOGE), and Cardano (ADA)—are all seeing key developments that could shape their future and disrupt the market.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

A Layer-2 Solution That Could Improve Bitcoin

On the other hand, PlutoChain ($PLUTO) could be interesting to watch. This hybrid Layer-2 project might make BTC more useful for everyday payments while also adding DeFi and smart contract capabilities.

Let’s break down!

PlutoChain ($PLUTO): A Hybrid Layer-2 That Could Make Bitcoin Faster, Cheaper, and More Functional

Bitcoin is powerful but not practical for everyday use. With slow transaction times and high fees, it struggles to compete with modern payment systems.

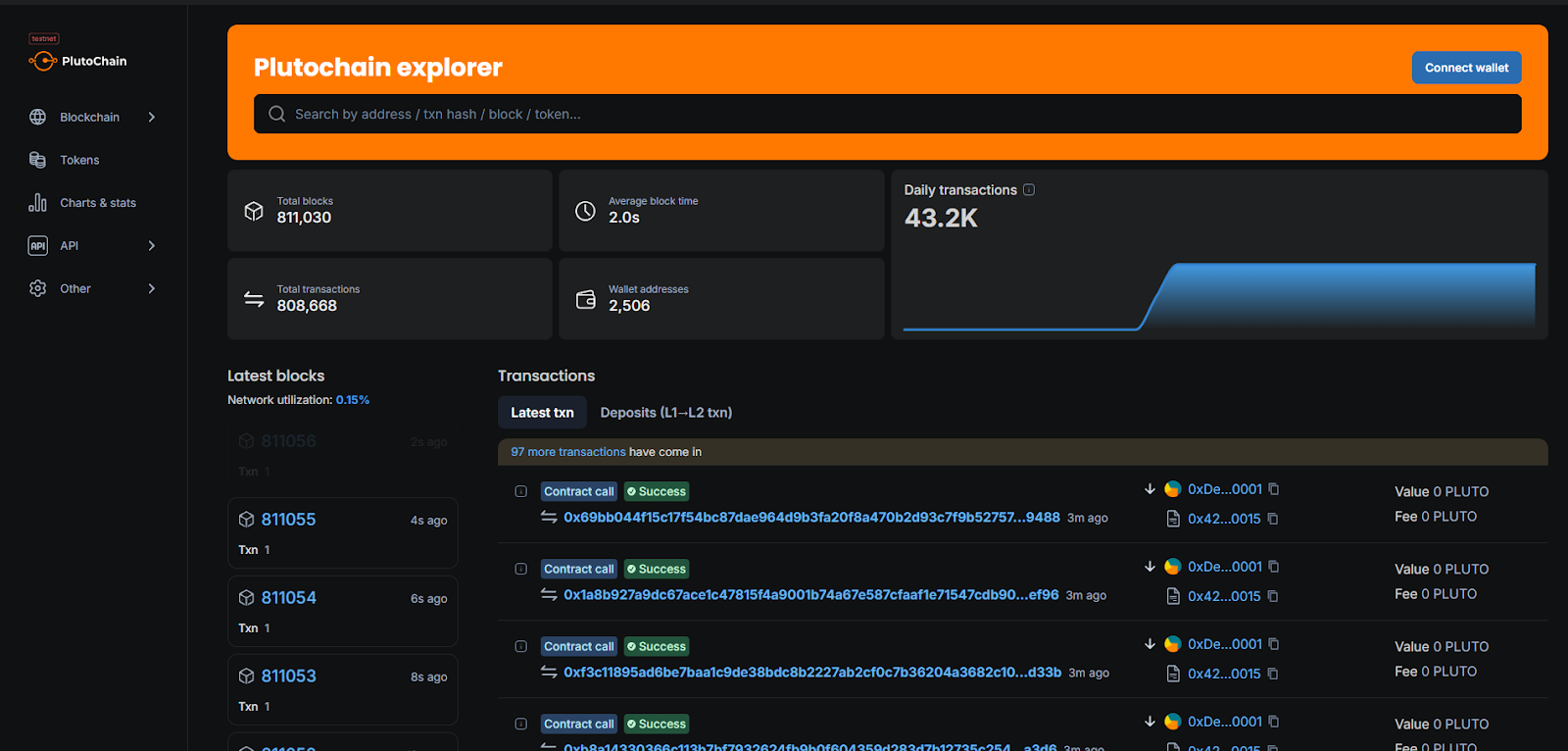

PlutoChain ($PLUTO) is a hybrid Layer-2 solution built to potentially fix Bitcoin’s biggest limitations. Running on its own high-speed blockchain, PlutoChain brings block times of just two seconds, which could allow BTC payments to be nearly instant.

Now, let’s talk about costs. Bitcoin fees can be expensive, especially for small transfers and microtransactions. PlutoChain could slash these costs and make BTC more accessible and affordable for everyday use.

But, PlutoChain is about more than payments. With EVM compatibility, it could support DeFi applications, NFTs, and even AI-powered blockchain tools—something Bitcoin was never designed for.

This could bring smart contracts and dApps to Bitcoin’s ecosystem while opening up new use cases.

Its testnet has already processed over 43,200 transactions in a single day, which demonstrates its scalability. And to guarantee a high level of security, PlutoChain has undergone comprehensive audits from SolidProof, QuillAudits, and Assure DeFi.

Its testnet has already processed over 43,200 transactions in a single day, which demonstrates its scalability. And to guarantee a high level of security, PlutoChain has undergone comprehensive audits from SolidProof, QuillAudits, and Assure DeFi.

Lastly, with decentralized governance, the community has a say in PlutoChain’s future. By making Bitcoin faster, cheaper, and more versatile, PlutoChain could help bring BTC into everyday life.

Ethereum (ETH): The Smart Contract Platform for DeFi, NFTs, and Web3 Innovation

Ethereum continues to grow in both adoption and network upgrades. Recently, a whale withdrew 7,347 ETH (about $19.95 million) from Binance, which means there’s confidence in the asset’s long-term potential.

On the development side, Ethereum’s ecosystem is evolving, with a strong focus on scalability and user experience. Ongoing improvements are meant to make transactions faster, reduce costs, and ultimately ensure a smoother experience for users and developers.

Crypto analyst Susu (Ø,G) says that Ethereum will break out above $2,800 soon, possibly reaching $3,000+ next week, after a few more days of consolidation.

Dogecoin (DOGE): The Meme Coin With Strong Community Backing

One of the biggest recent developments for DOGE is Grayscale Investments launching a Dogecoin Trust, which allows accredited investors to gain direct exposure to the meme coin.

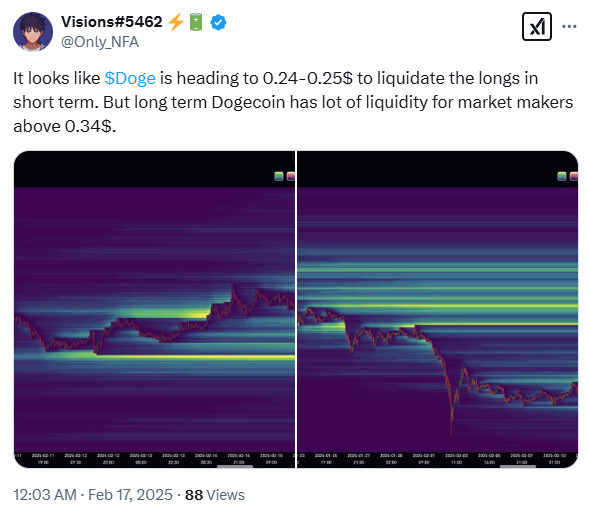

Meanwhile, the SEC has acknowledged filings for Dogecoin ETFs, which, if approved, could attract more traditional investors to the asset. Crypto analyst Visions#5462 says that Dogecoin may drop to $0.24-$0.25 in the short term to liquidate longs, but sees strong liquidity above $0.34.

Cardano (ADA): A Scalable Blockchain Focused on Smart Contracts and Sustainability

Cardano (ADA) has been gaining momentum thanks to institutional interest and buzz around a possible Cardano Spot ETF. Some analysts believe there’s a 60% chance the SEC could approve it by March 2025, which would be a huge milestone for ADA’s growth.

Crypto analyst Tyler Burke says that ADA could follow previous bull cycles and reach $5–$7 by spring this year. On the development side, the Plomin hard fork was recently implemented to enhance governance and decentralization. While this upgrade strengthens Cardano’s ecosystem, it has yet to result in a significant price increase.

The Takeaway

As Ethereum strengthens its role in DeFi, Dogecoin gains institutional attention, and Cardano enhances its governance, these tokens continue to push the market forward. Each brings unique innovations, but Bitcoin still faces major limitations.

PlutoChain ($PLUTO) could step in to address these challenges, integrating smart contracts and scalability solutions to transform BTC from a passive store of value into a functional network for payments and decentralized applications. This hybrid Layer-2 approach could be the key to making Bitcoin practical for everyday transactions.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

2

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

3

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

4

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

5

Best Crypto to Buy Now as Ethereum ETFs Hit Record Inflows

19.07.2025 16:34 7 min. read

Vine Coin Explodes 250% After Elon Musk Tweet: Could TOKEN6900 Be Next?

Vine Coin (VINE), a viral meme coin inspired by the iconic short-form video app, has just skyrocketed nearly 250% in the past two weeks and over 500% in the past month. The rally followed Elon Musk’s tweet that Vine could return in a new, AI-powered form, triggering a surge of investor interest. As traders debate […]

XRP Price Prediction: Is XRP the Best Altcoin to Buy or Will ALGO and HYPER Pump Higher?

The cryptocurrency market cap has bounced back to a valuation of $4.02 trillion, marking a 15.85% month-over-month uptick. During this period, XRP has emerged as one of the top-performing altcoins, soaring by more than 50%. As the popular altcoin reached a new local high (ATH) of $3.65 – just under its 2018 ATH of $3.84 […]

Best Crypto to Buy Now as New Trump Tariffs Pause Turns Market Bullish

A new round of US-China trade talks kicked off in Stockholm, and already the impact on crypto has been immediate. With a fresh 90-day extension on the table, the threat of new tariffs has been pushed back, giving global markets room to recalibrate. This publication is sponsored. CryptoDnes does not endorse and is not responsible […]

Best Meme Coins To Buy Now As Dogecoin Tries to Patent its Protocol

Crypto’s recent run has mostly played out at the top. Bitcoin reclaimed dominance, Ethereum followed with steady momentum, and capital has rotated across major sectors. Yet meme coins, for all their influence in prior cycles, have barely stirred. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, […]

-

1

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

2

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

3

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

4

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

5

Best Crypto to Buy Now as Ethereum ETFs Hit Record Inflows

19.07.2025 16:34 7 min. read