Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

On June 26, CNBC highlighted a notable shift in Bitcoin’s on-chain dynamics: investors holding Bitcoin for at least 155 days are easing up on their HODL strategies and starting to sell. This change from the typically patient group comes as spot Bitcoin ETFs continue to attract capital at an unprecedented pace.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

Why does this matter? When whales decide to realize gains, they can significantly influence market sentiment and even counteract the impact of institutional inflows. With this tug-of-war between profit-taking and fresh demand, traders are asking: what’s the smartest play? Welcome to your guide to the best crypto to buy now.

Bitcoin Ownership Shifts as Whales Sell, Forcing Trader Adaptation

Bitcoin ETFs continue to draw strong interest, marking 12 straight days of fresh inflows. Investors added $548 million across five major funds yesterday, with BlackRock’s IBIT leading the way, pulling in $340 million. Fidelity’s FBTC and Ark’s ARKB followed closely, with $115 million and $70 million, respectively.

#Bitcoin Spot ETF saw a total net inflow of 547.72M USD yesterday, marking a 12 days of consistent inflow pic.twitter.com/kwHgSfrUjB

— MetaPath (@MetaPath_me) June 26, 2025

Despite steady institutional demand, Bitcoin’s price remains surprisingly sluggish, sparking debate and raising concerns about custody practices. The influx of funds is not pushing the price higher as expected, triggering speculation across the market.

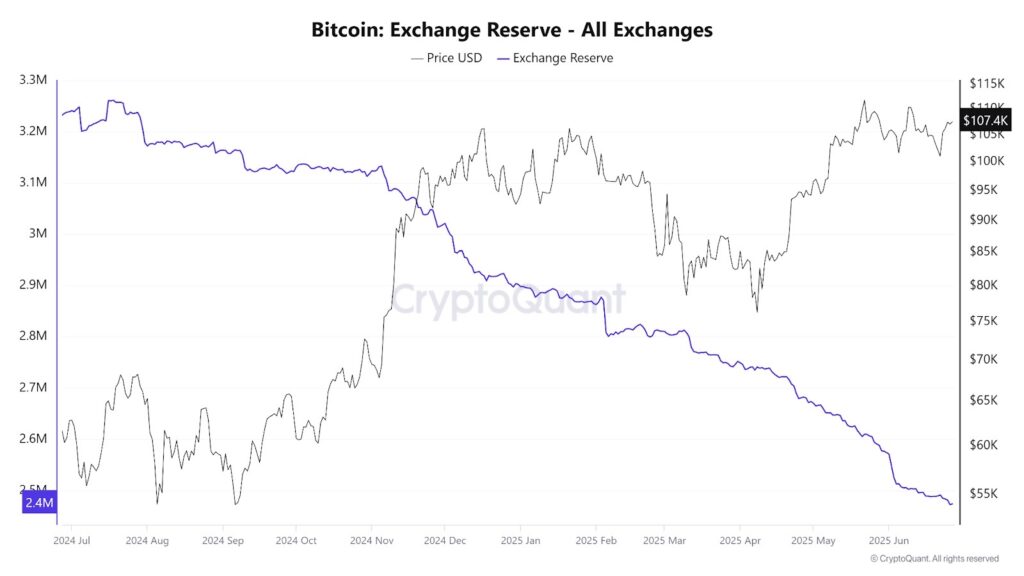

Massive ETF buying, totaling $4 billion this month, contrasts sharply with Bitcoin’s modest 3% gain. The key factor appears to be the presence of major sellers, with data from CryptoQuant indicating that ‘whales,’ likely Chinese miners, are offloading their holdings, offsetting the ETF purchases.

This shift in market dynamics reveals a significant trend: large holders (with 1,000+ BTC) are selling, while institutional ETFs and corporations are buying. Retail investors with under 1 BTC are also selling, though their actions now have less impact. Traders may begin turning to more complex options or Bitcoin stock proxies in response to this changing market landscape.

Bitcoin Price Analysis

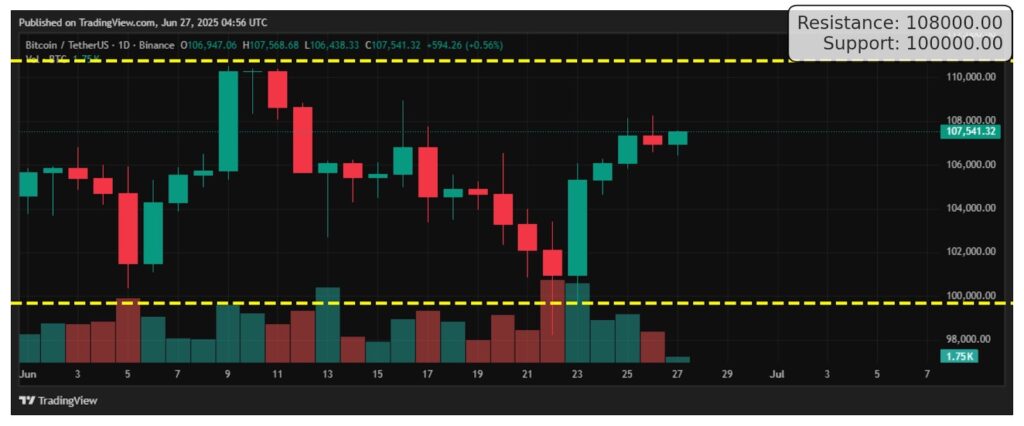

The Bitcoin daily chart reveals two key levels: resistance at $108,000 and support at $100,000. The price is currently stalling near the $108K resistance, which aligns with highs from earlier in June, suggesting that sellers are stepping in around this level. On the other hand, the $100K support zone has previously acted as a safety net, with buyers stepping in to defend the price, as seen during the sharp bounce on June 23.

After bouncing strongly off the $100K support, BTC has gradually climbed back up. The series of green candles and rising volume suggest bullish momentum. However, the repeated rejection near the $108K resistance raises caution. If Bitcoin can break through this level with strong volume, it could signal a bullish breakout. Otherwise, we may see consolidation or a pullback toward the support level.

This pattern resembles a rounded base or cup-like formation, where the price drops, recovers, and tests previous highs, often indicating accumulation before a potential breakout.

Block Diversity, a crypto analyst on X, reports that Bitcoin is currently range-bound between $106K and $108K, with heavy liquidations taking place.

$BTC complete analysis

– still in range and $108k is level to flip

– Dominance is high, needs to break down below 64% for alts for any gain

– Heatmap, fully loaded with longs from $106.4k and shorts from $108.6kSummary: range bound 106k-108k, a lot of liquidations. $BTC ATH… pic.twitter.com/nYIAJvsDwH

— Block_Diversity v.8 ™️ (@i_bot404) June 26, 2025

Best Crypto to Buy Now

As long-term holders trim positions and ETFs keep their foot on the gas, the market is splitting into two camps: strategic accumulation versus profit-taking. This divide sets the stage for targeted opportunities in tokens that thrive on both institutional momentum and on-chain fundamentals. Let’s cut through the noise and zero in on the best crypto to buy now.

Bitcoin Hyper

Riding the ETF wave, Bitcoin Hyper uses yield-generating strategies on Bitcoin positions. As institutions enter and whales exit, the token’s compounding mechanism could take advantage of both inflows and spot-funding arbitrage.

Bitcoin Hyper has quickly gained attention as a groundbreaking crypto project, introducing major innovations to the space. As the first Layer-2 solution for Bitcoin, it aims to overhaul the network and address its key limitations.

By speeding up transactions and reducing fees, Bitcoin Hyper offers a more efficient alternative for everyday purchases. Its solution connects to Bitcoin’s main chain via a decentralized bridge, combining Bitcoin’s security with Solana’s fast transaction speeds.

Using the SVM, Bitcoin Hyper ensures a seamless experience, allowing users to lock BTC, mint wrapped tokens, and enjoy faster, low-cost transactions. Zero-knowledge proofs maintain security and integrity while enabling high throughput.

After users are finished, they can burn wrapped tokens and recover native BTC via the trustless bridge. HYPER token is at the center of this system, facilitating transactions, staking, governance, and network incentives.

Bitcoin Hyper seeks to unlock innovative use cases for Bitcoin, such as lending, trading, and smart contracts, without compromising the decentralization and security that are the founding principles of the Bitcoin network.

BTC Bull

When whales cash out, volatility increases, and BTC Bull is designed to capitalize on that movement. Its momentum-driven structure makes it an ideal choice for traders looking to gain amplified exposure to Bitcoin’s fluctuations.

BTC Bull has raised $7.3 million in its presale, positioning itself as a prime token for Bitcoin maximalists who believe Bitcoin can replace fiat. Holders are also rewarded as Bitcoin hits key milestones.

When Bitcoin hits $125k, $175k, and $225k, BTCBULL tokens will be burned. At $150k and $200k, Bitcoin airdrops will trigger, and at $250k, a BTCBULL airdrop will distribute 10% of the tokens to the community.

The token’s mascot, a soldier-clad bull, symbolizes the resilience required in investing. Beyond milestone rewards, users can also stake their BTCBULL tokens for additional benefits.

Over $7M raised. This is not a drill. 🐂🔥 pic.twitter.com/S7Mq8LPWq7

— BTCBULL_TOKEN (@BTCBULL_TOKEN) June 24, 2025

To participate and earn rewards, users need a decentralized (DeFi) wallet, with the team recommending Best Wallet, a non-KYC option available on iOS and Android.

Best Wallet Token

As custody questions swirl, Best Wallet Token offers on-chain governance and enhanced security features. This crypto bridges institutional trust and retail usability, positioning it to benefit when large holders and newcomers alike demand safer storage solutions.

Best Wallet Token launched in 2024 and has already raised over $13.5 million in its presale. With a growing feature set and attractive early incentives, it’s quickly becoming a popular choice among traders.

Aimed at both crypto professionals and newcomers, Best Wallet is a non-custodial mobile wallet built for ease of use. It supports over 60 blockchains, allowing users to manage a wide range of assets in one place.

At the core of Best Wallet is Multi-Party Computation (MPC) technology, which ensures top-tier security without the need for a long seed phrase. It’s like a vault that requires multiple keys to open, offering strong protection.

Being a non-custodial wallet, Best Wallet provides users with complete control of their private keys and cryptocurrencies, with the result that it is a good option for privacy-focused users. The application has been engineered to make the users masters of their funds.

One of the highlights is the “Upcoming Tokens” tab, in which users can find promising initial projects before they launch. Best Wallet’s BEST token serves as the pivot of the ecosystem, fueling fees, governance, and special perks.

BEST token holders get reduced transaction charges, increased staking benefits, and priority access to verified token sales. Also part of the plan is a staking aggregator for improved yields and upcoming Best Card for spending cryptocurrencies with cashback rewards.

ClayBro, a prominent figure in the crypto YouTube community, forecasts that 2026 could be a major year for Best Wallet.

Conclusion

The tug-of-war between profit-taking long-term holders and steady ETF inflows highlights a turning point in Bitcoin’s maturation. While whales are cashing in, institutional demand remains strong, and this dual force could keep markets volatile yet full of selective opportunities.

Investors who focus on tokens that offer both yield strategies and secure custody stand to benefit as the landscape evolves. Stay attentive to how these dynamics reshape on-chain flows and fund allocations, as timing is crucial in volatile markets. And remember: the best crypto to buy now.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

TOKEN6900 Presale Soars as Meme Coin Prices Explode: Next SPX6900?

11.07.2025 15:13 5 min. read -

2

Best Crypto to Buy Now as Trump Media Launches ‘Blue Chip’ Crypto ETF

09.07.2025 20:59 7 min. read -

3

Google’s AI Gemini Predicts Price of Dogecoin, Pepe, SPX6900 by End of 2025

09.07.2025 11:45 5 min. read -

4

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

5

How to Buy $PUMP Token (Pump.fun) – MEXC Bonuses, ICO Date & Price Prediction

11.07.2025 10:15 3 min. read

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

The much‑anticipated “Crypto Week” kicked off on July 14 with high hopes for landmark legislation to formalize digital assets in the U.S. Instead, a procedural vote derailed the GENIUS Act, forcing House Speaker Mike Johnson to pull the remaining measures. Stepping into the fray, President Donald Trump convened key Republicans in a last‑ditch effort to […]

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

Meme coins are exploding this week, and traders are profiting. Bonk and Pepe have posted strong moves – and now there’s talk that a full-blown “meme coin season” could be incoming. Low cap meme coins – like TOKEN6900 – are also rocketing and taking advantage of the same retail trader demand. Currently in presale, T6900 […]

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

When gold proponent Peter Schiff sounded the alarm on July 14, he wasn’t cheering for Bitcoin adoption. He was warning of a brewing crisis. Schiff argues that today’s rally isn’t driven by grassroots interest but by corporations piling up Bitcoin on their balance sheets, turning digital gold into a speculative asset class. Bitcoin demand has […]

Ethereum Price Prediction: ETH Soars 20% as Bitcoin Dominance Drops, Can Ethereum Hit $4,000 in Altcoin Season?

Ethereum’s (ETH) latest bout of recovery is igniting hopes of an altcoin season, especially as Bitcoin’s market dominance has been slowly declining since June 27. ETH surged nearly 20% over the past week, reclaiming the $3,100 level for the first time in over five months. At the same time, BTC (which remains in price discovery […]

-

1

TOKEN6900 Presale Soars as Meme Coin Prices Explode: Next SPX6900?

11.07.2025 15:13 5 min. read -

2

Best Crypto to Buy Now as Trump Media Launches ‘Blue Chip’ Crypto ETF

09.07.2025 20:59 7 min. read -

3

Google’s AI Gemini Predicts Price of Dogecoin, Pepe, SPX6900 by End of 2025

09.07.2025 11:45 5 min. read -

4

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

5

How to Buy $PUMP Token (Pump.fun) – MEXC Bonuses, ICO Date & Price Prediction

11.07.2025 10:15 3 min. read