Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Trump’s World Liberty Financial Eyes Stablecoin Launch

25.03.2025 14:31 7 min. read Kosta GushterovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

After a successful $550 million raise for its WLFI token, Donald Trump’s crypto foundation, World Liberty Financial, recently deployed its stablecoin—currently labelled USD1—on Ethereum and the BNB Chain earlier this month. While the token is not tradeable yet, there has been considerable transaction activity—a fact that has caught the attention of investors.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

The TRUMP token and the Trump-themed meme coin ecosystem as a whole saw a surge in demand following such updates, which indicated major potential developments from the crypto entity. This, in turn, has now resulted in an increase in demand for top meme coins, as well as undervalued projects that have already been trending.

Best Crypto to Buy Now

BTC Bull

With political meme tokens grabbing attention again thanks to Trump’s WLFI updates, BTC Bull finds itself in a favorable lane. It draws from the kind of symbolism that tends to resonate in politically charged markets—Bitcoin strength, retail participation, and high-upside speculation—all layered into a meme token with structure.

What separates BTC Bull from the wide variety of themed coins is its actual reward mechanism. The token deploys milestone-based airdrops to incentivize long-term holding. As the project reaches certain growth points, new rewards are unlocked and distributed directly to the community, encouraging collective momentum rather than short-term pumps.

It also burns supply gradually, introducing a steady deflationary mechanic that could become more important if demand continues building during election-season market surges. These features give BTC Bull more staying power than the average meme asset, making it more than just a thematic play. At the time of writing, BTCBULL presale has raised more than $4 million.

As meme-based investments tied to political movements return to the spotlight, BTC Bull may attract attention not only because of its meme alignment, but also because it provides a more thought-out framework for community growth. It offers the narrative alignment that attracts clicks—and the project structure that holds them.

If the wider meme sector gains momentum again, this could be one of the few entries that carries both energy and underlying support.

Meme Index

When meme coins pump in groups, not knowing which one will lead the run can make entry feel like a guessing game. Meme Index answers that challenge by offering curated exposure to a rotating set of high-traction meme tokens, without the need to pick individual winners.

It functions like a bundle—holding several active meme assets, updated based on relevance, activity, and performance. This approach makes sense in a time like now, where political themes, influencer-driven tokens, and election-year narratives are creating fast-moving waves. Rather than betting on a single meme to explode, investors can gain indirect exposure to the whole surge.

The timing couldn’t be better. Trump’s WLFI developments have reignited interest in politically adjacent meme coins, and Meme Index positions itself right at the intersection of speculation and strategy. It’s not just watching the trends—it’s actively designed to adapt to them. Thanks to its concept, the project now sits at a total presale value of more than $4.2 million.

For anyone wanting to benefit from this cycle’s meme resurgence without the anxiety of single-token speculation, Meme Index becomes a logical entry point. The structure works best in periods of broad meme activity—like the one we’re seeing unfold now—and it does so by keeping exposure flexible and data-informed.

As momentum builds across the sector, this model could end up offering a rare mix of speed and simplicity.

MIND of Pepe

Meme tokens often follow emotion, trend cycles, and sudden shifts in crowd behavior—and that’s exactly where MIND of Pepe aims to leverage with its AI concept. At its core is a real-time sentiment engine built to track chatter, detect early spikes in interest, and gauge which tokens might be heating up before their charts reflect it.

That kind of tool becomes especially useful in moments like this. With Trump-related tokens suddenly gaining volume, other projects are riding the wave—but only some will sustain it. MIND of Pepe attempts to decode the social signals early, identifying where attention is forming before momentum goes mainstream.

The AI system pulls from Twitter, Telegram, trading forums, and more, constantly analyzing tone, frequency, and shifts in engagement. It turns this mass of noise into directional insight—not just for holders of the token itself, but for anyone seeking to stay ahead of speculative cycles.

Popular YouTuber and crypto analyst ClayBro was among the various content creators in the crypto space who appreciated the concept MIND of Pepe via their channels. While packaged as a meme coin, MIND of Pepe goes further by offering a functional utility behind the branding. It’s both a participant in the meme wave and a tool for navigating it.

With political headlines now stirring the waters again, tokens that can monitor, interpret, and adapt to real-time sentiment may gain more relevance than ever—and this one is built exactly for that.

Solaxy

While most of the attention right now is focused on meme coins and politically charged assets, infrastructure quietly gains ground during these bursts of activity. That’s where Solaxy operates—offering real, hands-on utility that supports the increased network movement during speculative spikes.

Solaxy functions as a Layer 2 that streamlines asset interaction across Ethereum and Solana, making it easier for users to move, trade, and stake without the delays and high costs typical of congested mainnets. As new tokens—especially those gaining traction from political hype—launch across different chains, this type of infrastructure becomes far more relevant.

What strengthens the case for Solaxy right now is how it positions itself not as a competing chain, but as an intermediary layer that clears the path. Add to that a native staking system that rewards network supporters, and you have a system that incentivizes engagement while making cross-chain usage easier.

While others chase headlines, Solaxy is the type of project that absorbs value passively. It doesn’t need to dominate narratives—it needs people to transact, swap, and move assets. And with meme activity surging again, especially across ETH and BNB-based tokens, tools like this could quietly benefit as the rails beneath the hype.

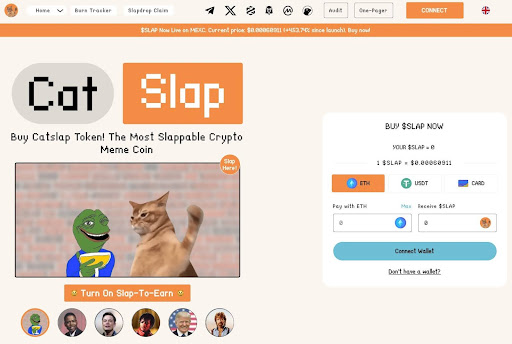

Catslap

Catslap doesn’t lean on complexity—it offers immediate recognizability, strong visual branding, and community-first energy that keeps it active even during quiet patches.

The token saw earlier traction and has recently undergone a sharp correction, leaving it at a potentially attractive level for buyers who missed its first pump. That reset in price coincides with renewed interest across the meme coin category, especially as Trump-themed tokens drive volume across platforms.

While Catslap isn’t directly linked to politics, its appeal fits well in the current climate. It’s bold, meme-heavy, and simple to understand—which are often the exact ingredients that fuel quick growth when speculative traders are cycling through new tokens.

There’s also a long-term angle developing: hints at game-based utilities tied to the slap theme, giving the token room to evolve past pure meme speculation. Whether those features land this cycle or the next, early holders may benefit from being part of that early community layer.

As traders rotate between political tokens and viral assets, Catslap offers a project that doesn’t need explanation—it just needs a spark. And in the current meme-driven environment, that spark could arrive faster than most expect.

Conclusion

Trump’s WLFI update didn’t just revive his ecosystem—it sent a signal. When high-profile moves hit the chain, money doesn’t stay still. It moves to where the energy is, and right now that energy is spilling beyond politics into meme tokens, utilities, and early-stage ideas that were already catching attention.

Projects with working systems, strong themes, or timing on their side won’t stay quiet for long. In a market like this, the smart money often gets there before the noise does. Parking funds into high-potential or trending tokens—especially like the ones mentioned above—could be a good way of being ahead as a retail investor and make good profits in the coming weeks or months.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

The recent ceasefire between Iran and Israel brought temporary calm to global markets, and the crypto sector responded quickly. Bitcoin is back above $106K as buying pressure returns and investor confidence stabilizes. With traders now positioning for a potential move to $120K and beyond, one project stands to benefit the most. BTC Bull Token (BTCBULL) […]

Best Crypto to Buy Now as Bitcoin ETFs Log a 9-Day Inflow Streak

Institutional investors just extended their love affair with Bitcoin ETFs to a ninth consecutive day, even as the post-Juneteenth trading session delivered only a murmur of activity. Despite a modest $6.37 million net inflow on Friday, the streak underscores how major players remain committed to on-chain exposure. This publication is sponsored. CryptoDnes does not endorse […]

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

The crypto market is gearing up for the third quarter with renewed optimism following several positive developments. Bitcoin (BTC) fell under $100,000 after the US struck Iran with airstrikes over the weekend. But the leading cryptocurrency has now surged to over $104,000 amid the expectation of a complete ceasefire between Iran and Israel. Meanwhile, the […]

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

Over the weekend, escalations of the conflict in the Near East shook global markets after the US launched an airstrike on Iran’s nuclear sites. The impact was felt in crypto too, with Bitcoin pushed into a resistance test and slipping just below the $100,000 level for the first time in six weeks, before rebounding. The […]

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read