Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Precious metals enthusiast Peter Schiff has sounded the alarm on silver’s rally, dismissing Bitcoin’s latest highs as nothing more than a distraction. His comments come as silver reclaims levels not seen in over a decade, reigniting debates about where true value lies.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

For crypto investors, this highlights the ongoing clash between digital assets and traditional stores of value. As markets weigh Bitcoin’s record-breaking surge against silver’s underappreciated potential, deciding which asset holds more long-term value becomes crucial.

This conversation also opens the door to discussions about the best crypto to buy now. Silver is a utility-driven asset, while Bitcoin is largely seen as a “store of value.” The best crypto picks today might be those that combine real-world utility with the viral momentum that helped Bitcoin go mainstream.

Schiff Takes Jabs at Bitcoin, Bets Big on Silver’s Path to $50

Precious metals advocate and entrepreneur Peter Schiff has been casting a spotlight on silver’s recent strength, while taking pointed digs at Bitcoin, dismissing it as a “distraction.” As Bitcoin blasted past its all‑time highs this year, Schiff highlighted that silver surged above $37 per ounce up almost 2% in a single session, yet silver mining stocks barely budged.

He argued that once silver breaks above $40, a rapid move to $50 could follow, and that equities tied to silver extraction are not reflecting this near‑term upside. Schiff’s longstanding disdain for Bitcoin remains undiminished; even as Bitcoin climbed to a record $118,839, he insisted that only a wholesale shift to pricing everything in BTC would force him to reconsider.

On the following trading day, Schiff doubled down, noting silver flirting with $38 the highest price since March 2012 and observing that silver and gold mining shares were still muted despite bullion gains. His refrain was clear: “Investors are being distracted by Bitcoin.” Schiff views the sluggish reaction in precious‑metal equities as a clue that the market is underestimating silver’s breakout potential.

Yet as Bitcoin continues to set fresh records and draw institutional capital, his tunnel vision on metals may overlook crypto’s broader structural maturation. By underestimating blockchain’s disruptive reach and overestimating the worth of traditional assets, Schiff paints Bitcoin as a passing fad rather than a legitimate financial innovation.

Bitcoin Price Analysis

Despite criticism from figures like Peter Schiff, Bitcoin continues its impressive rally, recently breaking out of a two-month consolidation phase late Thursday. This surge coincided with former President Trump announcing new trade policies that rattled traditional stock markets. The cryptocurrency soared past $118,000 for the first time, with some optimistic options traders even targeting levels as high as $150,000.

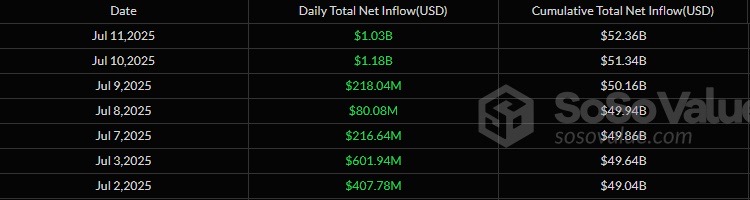

Bullish momentum is clearly building. Making waves, Bitcoin ETFs shattered their 2025 inflow record on Thursday, June 11th, attracting a massive $1.03 billion as the price surged to new all-time highs.

Currently hovering above $117,700 and pushing towards $118,000, Bitcoin’s rise has significantly boosted the theoretical wealth of its anonymous creator, Satoshi Nakamoto. Satoshi now ranks as the 11th wealthiest person globally, just ahead of Michael Dell, Dell Technologies’ founder and CEO.

The next critical challenge is the psychological $120,000 resistance level; breaching this is key, though sellers might emerge there. On the flip side, the $109,000 area proved reliable short-term support during consolidation around July 8-10, where buyers stepped in decisively before the current breakout.

This move strongly resembles a breakout from the $109,000 support base, characterized by robust green candles and increasing trading volume – clear signs of bullish strength. A sustained close above $120,000 would confirm the breakout and likely fuel further gains. Conversely, falling back below $109,000 would indicate a failed breakout and risk a deeper pullback.

With Bitcoin’s current uptrend, many analysts have turned overly bullish. Some, like Jake Brukhman, even argue that institutional investors aren’t bullish enough.

Best Crypto to Buy Now

Schiff points to the contrast between blockchain’s explosive growth and metals’ timeless value. Bitcoin’s highs get all the headlines, but silver’s low-key rally displays promise in mainstream markets. Portfolio balancing with both digital scarcity and real assets is a formula for long-term strength. Investors should now look for the assets that provide both growth and stability during volatile times.

Best Wallet Token

Best Wallet Token provides access to a secure and reliable platform for managing digital assets. The platform’s simple tools are reportedly designed to offer peace of mind, much like silver’s steady growth in uncertain markets.

Best Wallet is a top choice for mobile cryptocurrency users, offering a secure, non-custodial wallet app for both iOS and Android. It combines convenience and strong protection, storing the private key directly on your device with encryption.

In addition to popular tokens like Bitcoin, Ethereum, and Dogecoin, Best Wallet also accommodates secondary tokens such as ERC20 tokens. These can be added to your balance instantly and with ease.

Best Wallet is free for storing and receiving crypto, though there is a small network fee for outgoing transfers. Users can also swap tokens directly via decentralized exchanges within the app.

Beyond being a non-custodial wallet, Best Wallet serves as a full Web 3.0 ecosystem. One can purchase cryptocurrencies using local currencies through Visa, PayPal, and other methods, while also accessing investment opportunities through its launchpad.

The platform’s extensive features, from token swaps to early-stage investments, make it a top contender for 2025, offering both security and convenience for cryptocurrency users.

Snorter

Just as silver’s unexpected rally surprised many, Snorter excels at uncovering undervalued opportunities. Its on-chain analytics identify hidden momentum, revealing breakout potential for Solana-based tokens before the broader market notices. It’s ideal for investors looking to stay ahead.

Snorter ($SNORT) is a new crypto presale project designed for traders who are always analyzing charts. The project introduces Snorter Bot, a Solana-based trading bot with low fees and quick execution.

The bot offers exclusive access to new tokens, front-running protection, automated sniping, and rug-pull defense. All functions are controlled through an easy-to-use Telegram interface, eliminating the need for multiple tools.

$SNORT’s bot automatically buys tokens as soon as they are listed on exchanges. It will support both EVM chains and Solana, with a full trading API expected in stage 4 of the roadmap.

The project also plans to form DeFi partnerships, which should increase the utility and popularity of $SNORT. The bot’s safety features protect users from risks like honeypots and malicious bots. Renowned crypto YouTuber 99Bitcoins believes Snorter has the potential to generate 100x returns.

$SNORT serves as the ecosystem’s native token, offering reduced trading fees of just 0.85% for holders. The tokenomics are designed to encourage long-term community involvement, with a capped supply of 500 million tokens.

Bitcoin Hyper

When Bitcoin reaches new highs, few tokens capture that momentum like Bitcoin Hyper. Designed for rapid exposure, it leverages Bitcoin’s movements, allowing one to benefit from each cycle while staying aligned with the network’s long-term potential.

Bitcoin Hyper addresses the limitations of Bitcoin by offering a highly scalable network with smart contract support. This allows developers to build decentralized apps (dApps) and opens up new opportunities for Bitcoin yield.

It employs a non-custodial bridge, allowing users to deposit Bitcoin, which is then wrapped and unlocked on the Layer 2 side. This process uses zero-knowledge proof cryptography to ensure security.

The staking rewards on Bitcoin Hyper change dynamically based on the amount deposited into the staking pool. This adds an incentive for users to act quickly and lock in higher returns.

Bitcoin Hyper addresses key scalability issues and governance challenges that have hindered Bitcoin’s programmability. Its innovative approach offers a practical solution to unlock Bitcoin’s full potential.

Conclusion

Peter Schiff’s relentless focus on silver versus Bitcoin highlights a deeper debate over which assets deserve center stage. His view reflects an enduring trust in tangible stores of value, but Bitcoin’s unbroken rally and growing institutional adoption underscore crypto’s rising legitimacy. This has created a fear in Peter, perhaps irrational, that voices like his could become irrelevant if the cryptocurrency market keeps growing.

However, it’s this very fear that investors should leverage to find the best crypto to buy now. As more skeptics come forward to call crypto’s rise a distraction, more rebellious investors, driven by their belief in digital assets, emerge, fueling blockchain innovation and unlocking unique investment opportunities.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

4

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

Crypto markets are roaring back to life. Bitcoin has broken past $118,000, marking a new all-time high as optimism returns across the financial landscape.

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

Bitcoin isn’t just for retail buyers anymore – corporations are piling in, and fast. With corporate holdings now topping $91 billion, public companies are quietly turning Bitcoin into a mainstream treasury asset. That shift is a huge win for BTC, but it’s also an endorsement of the entire crypto market. So, if you’re hunting for […]

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

Bitcoin has just posted a new all-time high, Ethereum has broken above $3,000 again, and the entire crypto market cap has passed $3.6 trillion. This week’s rally is showing no signs of easing up – driven by massive ETF inflows, short squeezes, and big institutions ramping up their exposure. But picking the best cryptocurrencies to […]

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

Growing by 8.27% over the past seven days, Bitcoin (BTC) peaked above $118,856 on July 11th, setting a new all-time high (ATH). As the leading cryptocurrency appears ready to grow even further, a project currently in its presale, Bitcoin Hyper (HYPER), aims to permanently transform Bitcoin from primarily a store of value into a versatile blockchain. […]

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

4

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read