Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Metaplanet Overtakes Coinbase’s Bitcoin Stash

17.06.2025 18:51 8 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

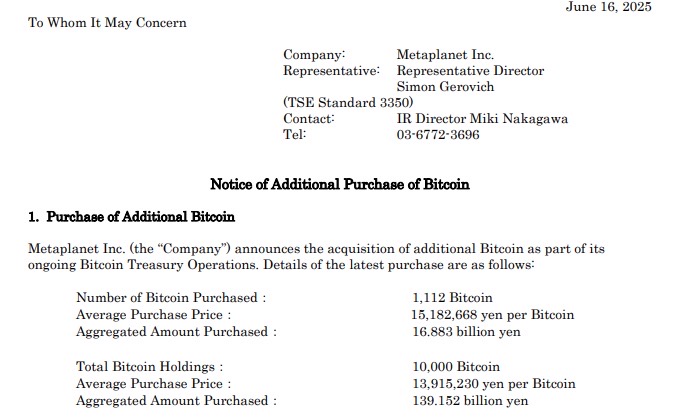

Tokyo-based investment firm Metaplanet made headlines on June 16, 2025, by purchasing 1,112 BTC for around $117.2 million. This move pushed its treasury past the 10,000-coin milestone and placed it ahead of Coinbase on the list of public holders.

*Metaplanet Acquires Additional 1,112 $BTC, Total Holdings Reach 10,000 BTC* pic.twitter.com/XlM13kQnS9

— Metaplanet Inc. (@Metaplanet_JP) June 16, 2025

The purchase highlights the increasing confidence institutions have in Bitcoin as a strategic reserve asset. As more companies increase their crypto investments, investors are rethinking the role of digital gold in their portfolios and asking: what is the best crypto to buy now?

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Metaplanet Hits 10k Bitcoin Milestone, Sets Sights on 210k BTC

Japanese investment firm Metaplanet has more than doubled its holdings in Bitcoin, buying another 1,112 BTCs. The $117.2 million purchase, reported on Monday, brings their overall holdings to a neat 10,000 BTC. This milestone is a significant one, reaching the firm’s first target for 2025 as it started building its Bitcoin reserves in April.

Metaplanet’s forceful acquisition strategy has now positioned it as one of the world’s largest public BTC holders. Its 10,000 BTC is more than the amount held by crypto exchange Coinbase, which Bitbo shows to be holding 9,267 BTC. Investors welcomed the news, pushing the stock price of Metaplanet more than 17% higher to 1,769 yen in Tokyo trading.

Looking forward, Metaplanet has dramatically raised its ambitions. While originally targeting 21,000 BTC by 2026 under its “21 Million Plan,” the company revised its goals this June. It now aims to hold 100,000 BTC by the end of 2026 and a substantial 210,000 BTC by 2027. Reaching this final target would mean controlling roughly 1% of all Bitcoin.

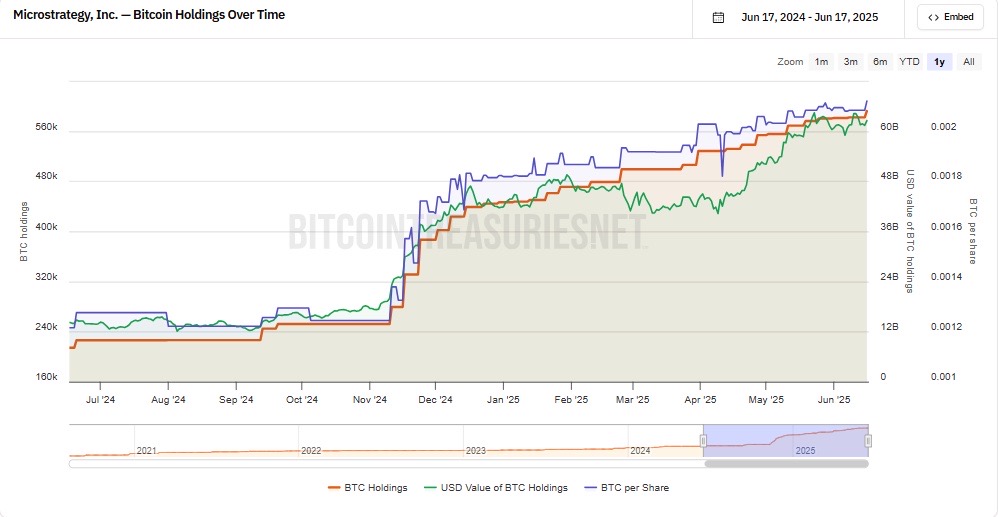

Metaplanet’s move reflects a wider trend of companies holding Bitcoin. Data from BitcoinTreasuries.NET shows 116 public companies now hold Bitcoin, including recent additions GameStop and Sweden’s H100.

Giants like Tesla and Marathon Digital still lead with over $1 billion each. Institutional interest remains strong even after Bitcoin’s dip from $110,000 to $103,000 last week, with US spot bitcoin ETFs seeing five consecutive days of inflows totaling over $1.3 billion.

The opportunity for Bitcoin isn't just gold.

It's the $30T+ using Treasuries as a store of value. https://t.co/xOHG2NkPg0

— Hunter Horsley (@HHorsley) June 13, 2025

This corporate adoption continues to spark debates. Bitwise CEO Hunter Horsley suggests Bitcoin could eventually rival the massive $30 trillion US Treasuries market. Meanwhile, MicroStrategy’s Michael Saylor reaffirmed his company’s commitment to buying BTC, highlighting how the “Bitcoin standard” concept still influences corporate treasury strategies globally.

Bitcoin Price Analysis

Bitcoin’s price is hovering around $106K, with a market capitalization of approximately $2 trillion. Looking at the technical analysis of Bitcoin’s one-day chart, we can see that the resistance level is around $108K to $109K, while the support level is around $104.5K.

If Bitcoin fails to reclaim $108K, there’s a chance it could drop below $104.5K, signaling a deeper pullback. However, a bullish trigger would occur if Bitcoin breaks above the orange resistance line. A decisive close above $108.5K to $109K on strong volume would shift momentum back to the bulls.

According to well-known X-based crypto analyst HeLIN, a clean break above $112K could quickly propel the price toward $130K or higher. Until that happens, the strategy is to bid on every dip near $104K, while keeping an eye on broader macro trends.

BITCOIN

IT IS POST-ATH COMPRESSION

– 50-day MA crossing above 200-day MA

– RSI staying in the neutral to bullish zone

– MACD signal line confirmation holding

A clean break above $112k, and I am looking at $130k+ fast

Until then, I’m bidding every dip near $104k with… pic.twitter.com/bcJ3wt3uqB

— HELiN (@turkish_babby) June 15, 2025

Best Crypto to Buy Now

Metaplanet’s record-breaking build-up highlights the extent to which increasing institutional participation can have ripple effects throughout the marketplace. This can make markets more liquid, give investors greater confidence, and stimulate competition between altcoins and tokens.

For investors intent on capitalizing on future waves of growth, selecting the right timing and tokens has never been more crucial. The question remains: what is the best cryptocurrency to buy now?

BTC Bull

With staking rewards that follow Bitcoin’s rising market trends, BTC Bull turns optimism into earnings. It’s an ideal choice for those looking to capitalize on Metaplanet’s record purchase as confidence in crypto continues to grow.

BTC Bull Token ($BTCBULL), a new Bitcoin-themed meme coin, is gaining attention due to its unique approach to rewarding holders. The project is currently in its presale phase and has already raised $7.1 million.

In contrast to other meme coins, which usually suffer from volatility and short-term trendiness, $BTCBULL has quantified its value in terms of Bitcoin price action and provided a more stable, long-term returns system for holders.

The token will dispense actual Bitcoin to its holders when Bitcoin hits significant price thresholds: $150,000, $200,000, and $250,000. But there’s a catch: only the participants in the presale will become eligible for these rewards.

Investors who sell their tokens will lose access to future Bitcoin airdrops. This setup encourages holders to keep their $BTCBULL tokens, potentially boosting demand when the token lists on exchanges.

Gm. It’s time to lock tf in. 🚀 pic.twitter.com/Y7skZLd4UI

— BTCBULL_TOKEN (@BTCBULL_TOKEN) June 16, 2025

Another key feature of the project is a burning mechanism. As Bitcoin reaches certain price levels, a portion of the $BTCBULL supply will be destroyed, reducing the total number of tokens and increasing scarcity. The first burn will occur when Bitcoin hits $125,000, with more scheduled at $175,000 and $225,000.

With its growing community, low entry price, and Bitcoin-based rewards system, $BTCBULL offers a fresh opportunity for investors. If the project continues to gain momentum, it could provide a unique chance to profit from both the meme coin craze and the long-term growth of Bitcoin.

Bitcoin Hyper

Bitcoin Hyper is a fast Layer-2 protocol designed to speed up Bitcoin transactions. It takes advantage of growing institutional interest to solve Bitcoin’s scaling issues, combining efficient on-chain performance with strong market support.

Bitcoin was never built to support sophisticated applications or smart contracts. Its intentionally limited scripting language can constrain what developers can create on the network in the first place.

Bitcoin Hyper aims to bridge these gaps and retain Bitcoin’s fundamental strengths. Now in presale, the project is gaining traction for being able to provide quicker transactions, reduced fees, and support for smart contracts all atop Bitcoin’s secure foundation layer. This blend is designed to tackle Bitcoin’s sore spots without diluting its core tenets.

One of the most notable aspects of Bitcoin Hyper is its compatibility with the Solana Virtual Machine (SVM), enabling developers to execute sophisticated smart contracts at high speeds. This facilitates an environment for application development that would be unthinkable to implement directly on Bitcoin. Doing so extends Bitcoin’s capabilities without compromising its stability.

In the view of popular crypto YouTuber 99Bitcoins, Bitcoin Hyper has the potential to generate returns of 10x to 100x.

For long-term investors, Bitcoin Hyper offers a promising opportunity. Staking $HYPER tokens allows holders to earn rewards based on network activity, while token-gated access gives exclusive entry to upcoming DeFi protocols, premium tools, and high-yield products.

Developers also stand to benefit. Those who use $HYPER in their deployed contracts can qualify for grants, ecosystem incentives, and fee rebates, fostering organic growth and innovation from the outset.

Best Wallet Token

Best Wallet Token offers smooth cross-chain integrations and strong security, making it a reliable choice as corporate investments in crypto rise. It provides users with a fast and secure way to manage digital assets when timing matters most.

Best Wallet is a decentralized, non-custodial crypto wallet that gives users full control over their digital assets, making it a strong alternative to centralized systems like the upcoming digital euro.

What sets Best Wallet apart are its advanced features that go beyond traditional wallet functions. Users can access derivatives trading, a staking aggregator, cross-chain swaps, MEV protection, and gas-free transactions, features that are rarely available in other crypto wallets.

The app will soon add support for more than 1,000 cryptocurrencies and 60 blockchain networks, allowing users to handle, purchase, and exchange a vast array of digital assets in a secure, one-stop shop.

Best Wallet also features a native token, $BEST, which comes with various in-app rewards. $BEST reduces the fees for transactions and confers governance rights to the user over the ecosystem.

This enables token holders to vote on significant choices, like which blockchains or cryptocurrencies to include, thus ensuring the platform is community-appropriate in terms of privacy, trading options, and accessibility.

Conclusion

Metaplanet’s transition to 10,000 BTC is not just a front-page headline; it represents a warning signal of the market’s shift towards corporate treasuries controlling the supply and demand of Bitcoin. The transition represents a broader pattern in which companies are now seriously thinking about owning Bitcoin as a top asset to act as collateral, rather than just as a hedge.

For investors, it means aligning their strategy with a judicious mix of assets, blending tried-and-true blue-chip cryptocurrencies with high-yielding layer-2 solutions and tokenized utility plays. With a market that has institutional buying to go along with retail demand, determining the best crypto to buy now can be a difference maker.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

2

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read -

3

BTC Bull Token Enters Final 3 Days of Viral Presale: Next 100x Crypto?

27.06.2025 15:55 4 min. read -

4

Best Crypto to Buy Now as Ethereum Plans to Cut Block Times in Half

25.06.2025 17:54 7 min. read -

5

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read

Best Crypto to Buy Now Before New Trump Tariffs In August

On August 1, President Donald Trump will impose sweeping 25 to 40 percent duties on imports from the 14 nations, reigniting trade tensions just weeks after shelving his most aggressive “Liberation Day” tariff plan. Markets are bracing for fresh volatility as the US shifts deadlines and threatens extra levies against BRICS‑aligned nations. Trump extends tariff blitz: 14 […]

Best Crypto to Buy Now as Arthur Hayes Makes New Bitcoin Price Prediction

When macro strategist Arthur Hayes, co-founder of BitMEX and now at Maelstrom, flagged a possible retracement of Bitcoin to the $90,000 zone, it grabbed the market’s attention. His thesis centers on the U.S. Treasury’s plan to refill its Treasury General Account, which could temporarily pull liquidity from the financial system and pressure risk assets. This […]

Best Crypto Presales to Invest in this Month: 4 Projects with Huge Potential

The overall crypto market cap is now valued at $3.47 trillion, marking a 2.36% jump over the past week and a near 50% increase year-on-year. This wave of bullish sentiment is partly driven by fresh macro developments, including the U.S. government’s pro-crypto stance and new housing policies that could soon allow crypto assets to count […]

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

BTC Bull Token has reached a critical moment. With less than 24 hours left in its presale, the project has already raised $8 million, signalling huge investor confidence. Buyers now have one last chance to secure tokens at a lower price before claiming goes live and the token becomes tradable on exchanges. Many crypto traders […]

-

1

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

2

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read -

3

BTC Bull Token Enters Final 3 Days of Viral Presale: Next 100x Crypto?

27.06.2025 15:55 4 min. read -

4

Best Crypto to Buy Now as Ethereum Plans to Cut Block Times in Half

25.06.2025 17:54 7 min. read -

5

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read