Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as JPMorgan Opens the Bitcoin Floodgates

20.05.2025 14:04 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

In a notable shift for Wall Street, JPMorgan CEO Jamie Dimon—a longtime Bitcoin skeptic—has acknowledged evolving market realities. Despite previously labeling Bitcoin a “fraud,” the bank will now display Bitcoin holdings on client statements (without offering custody). This marks a symbolic pivot as traditional finance cautiously engages with decentralized systems.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Amid economic uncertainty and currency volatility, the Best Crypto to Buy Now is no longer speculative jargon—it’s a practical consideration for investors diversifying into digital assets. While JPMorgan’s move signals growing institutional acceptance, it underscores the need for assets balancing innovation with stability in turbulent markets.

JPMorgan’s Bitcoin Flip-Flop: “Buy It, But Don’t Ask Us to Hold It,” Says Jamie Dimon

Jamie Dimon, Wall Street’s most vocal Bitcoin skeptic, just made a U-turn—sort of. At JPMorgan’s investor day this week, the CEO announced that clients can soon buy Bitcoin through the bank, but there’s a catch: they won’t touch custody.

“We’ll let you buy it, put it on your statements, but we’re not babysitting your crypto,” Dimon said, doubling down on his infamous “Bitcoin is a scam” stance. It’s like a bartender selling you whiskey while lecturing you about liver damage—awkward, but business is business.

Let’s unpack this. Dimon’s still throwing shade, ranting about Bitcoin’s ties to “sex trafficking and terrorism” (yes, he went there).

But with rivals like Morgan Stanley already hawking Bitcoin ETFs, JPMorgan’s joining the party—grudgingly. “I wouldn’t smoke, but I’ll sell you the pack,” he quipped, comparing Bitcoin to cigarettes.

Here’s the twist: Dimon’s been trashing Bitcoin for years, once vowing to “shut it down” if he ran the government. So why the change? Simple: money talks.

With Bitcoin ETFs pulling in over $50 billion this year and retirees FOMO-buying, JPMorgan can’t afford to play the purist.

But by refusing custody, they’re walking a tightrope—cashing in on crypto mania while keeping it at arm’s length. “If Bitcoin tanks, Dimon gets to say ‘I told you so.’”

Love it or hate it, JPMorgan’s half-in, half-out move signals a seismic shift. Even Wall Street’s old guard can’t ignore crypto’s siren song—but they’ll hedge their bets like your aunt buying “a little Bitcoin” just in case.

Best Crypto to Buy Now

As institutional giants like JPMorgan pivot towards crypto, the landscape is transforming. This isn’t just about Bitcoin’s ascent; it’s about a broader awakening to the potential of decentralized finance. Investors are now eyeing the best crypto to buy now—tokens that resonate with this new paradigm and blend innovation with resilience.

MIND Of Pepe (MIND)

Emerging from the internet’s cultural tapestry, MIND of Pepe isn’t just another meme coin. It embodies the spirit of decentralized communities challenging traditional narratives. In a world where satire meets substance, this token captures the zeitgeist of a generation seeking both humor and empowerment in their investments.

With the recent launch of its AI agent, MIND is taking the crypto community by storm. It is not just an AI agent but also a trading companion.

What’s more, it can scan large amounts of data and identify market sentiment to deliver detailed insights to traders, tailored to their needs and preferences.

MIND users won’t have to wait long to access all of its features. These will only be available after the official token launch; until then, users can interact with the AI agent, but they will not be able to trade or make transfers.

Undoubtedly, it is the perfect blend of fun and utility, capable of competing with AI agents like Grok and ChatGPT in providing trading advice. According to famous crypto YouTuber ClayBro, MIND is expected to see 100x gains.

Moreover, MIND has the potential to launch its own tokens, offering users insider access so they can buy at the ground-floor price.

BTC Bull (BTCBULL)

BTC Bull symbolizes the bullish momentum propelling Bitcoin into mainstream finance. As banks like JPMorgan embrace Bitcoin, this token reflects the confidence of investors betting on the continued institutional adoption of crypto. It’s not just a token; it’s a statement of belief in Bitcoin’s enduring ascent.

BTC BULL is a meme coin designed to mirror the excitement of Bitcoin’s bullish trajectory. As Bitcoin outperforms gold this month and continues to attract institutional interest, BTC BULL rides on that momentum.

It empowers its users through two simple mechanisms: token burns and airdrops, both of which are synced with Bitcoin’s price movements.

These mechanisms activate only when certain conditions are met. For example, to receive real Bitcoins in your wallet, Bitcoin must cross preset milestones such as $150K, $200K, and $250K.

By burning its own tokens, BTC BULL creates deflationary pressure, which increases scarcity and self-propels its value—a proven formula for demand.

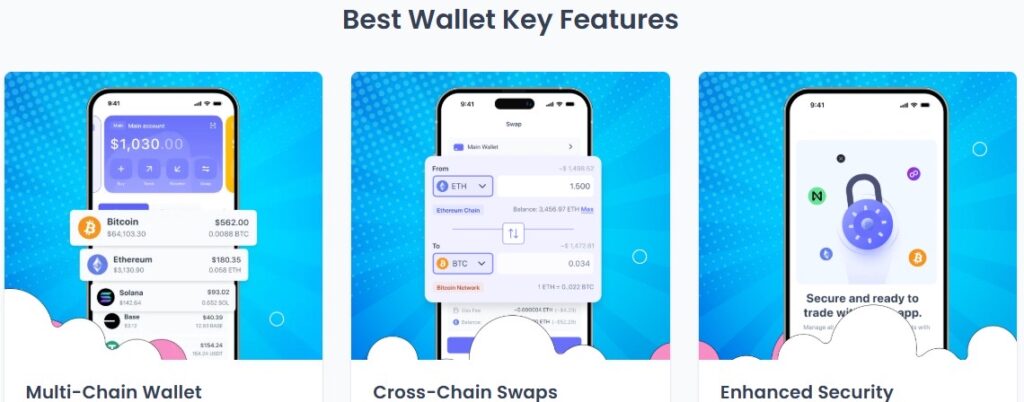

Best Wallet Token (BEST)

In the changing landscape of digital currencies, security and convenience are the watchwords. Best Wallet provides users an easy on-ramp to care for their crypto portfolio. As more people step into the realm of cryptocurrencies, this token comes at the juncture of easy-to-use design and strong protection and is a must-have for both new and old players.

BEST powers a cryptocurrency wallet that offers a clean, easy-to-use experience and is offered for both iOS and Android, rapidly becoming one of the most sought-after wallets, with hundreds of thousands of downloads.

Founded on the Web3 platform, Best Wallet is a non-custodial wallet, which makes it the perfect choice for both traders and investors in crypto.

It emphasizes security and owner control by keeping private keys on the owner’s device, so only the owner can access their money.

Less than 7% of the global population holds cryptocurrency.

You’re still early. 🎯

— Best Wallet (@BestWalletHQ) May 19, 2025

In addition to safe storage, BEST also offers a native DEX aggregator, enabling users to buy, sell, and exchange cryptocurrencies directly within the wallet.

Ethereum (ETH)

Beyond the headlines, Ethereum continues to be the bedrock of decentralized applications and smart contracts. Its adaptability and widespread adoption make it a cornerstone of the crypto ecosystem. As traditional finance integrates with blockchain technology, Ethereum’s role becomes ever more critical, bridging the old with the new.

Bitcoin is often viewed as a scarcity-based store of value, while Ethereum is seen as a platform for building and extending applications.

Ethereum operates within a positive-sum ecosystem, where users are encouraged to build and innovate. Its dominance in the market is evident, with over 100 Layer 2 networks in operation—20 times more than any other ecosystem, including Bitcoin and Solana.

Recently, Ethereum’s co-founder, Vitalik Buterin, proposed the use of “simpler nodes” to protect trustless, independent access to the network. Currently, most users connect to Ethereum through external RPC (Remote Procedure Call) services provided by large firms, raising serious concerns such as blocking users or surveillance targeting.

To address this, Buterin recommends fast-tracking EIP-4444, a proposal that would allow partially stateless nodes, enabling users to store only the relevant data they need.

In technical terms, it is currently trading at around $2500 with a market cap of $310.54 billion, securing its position in 2nd place. It has shown a 8.24% growth in the past 24 hours, suggesting that the saturation point is still far off, creating an opportunity for potential buyers to capitalize on upcoming opportunities.

Conclusion

Jamie Dimon’s evolving stance on Bitcoin signals traditional finance’s gradual acceptance of digital assets’ growing relevance. As banking and crypto integration progresses, strategic investors are exploring new opportunities. The Best Crypto to Buy Now isn’t about chasing trends—it’s identifying assets aligned with this structural shift in finance, where decentralization and institutional adaptation redefine how value is stored and transferred.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

2

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

3

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

4

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

5

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read

Best Crypto to Buy Now As Ethereum ETF Inflows Indicate Growing Altcoin Strength

One of the clearest market signals this year has come not from price charts, but from ETF flows. In 2025, the pace and direction of institutional capital via spot ETFs has shaped the market’s strongest rallies. While Bitcoin enjoyed most of the spotlight early on, a quiet reversal appears to be underway. This publication is […]

Best Meme Coins to Buy Now After PUMP’s Price Drop Has Investors Wondering

The much-hyped PUMP token from Pump.fun has fallen hard after its explosive $600 million launch, crashing more than 60% within just two weeks. What was supposed to be the crowning moment for Solana’s top meme coin launchpad has now left investors confused, cautious, and looking elsewhere. This publication is sponsored. CryptoDnes does not endorse and […]

Jacob Crypto Bury’s Discord Hits 40k Members – Best Crypto Discord?

Rated as one of the most active Discord communities for exclusive crypto signals, educational discussions, and in-depth market analyses, Jacob’s Crypto Clan has smashed the 40k membership milestone, reflecting its growing popularity among day-to-day traders and long-term investors alike. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, […]

Bitcoin Hyper Presale Raises $1M in Just 5 Days, Bringing Total to Raise to Over $5M: Next Crypto to Explode?

The crypto market experienced a slight pullback this week after the rally of the previous fortnight. But despite the drop, Bitcoin (BTC) is holding strong above $117,000, up by 10% over the past month. With this resilience, many investors are not only holding BTC but also scouting for new BTC-themed tokens that may offer greater […]

-

1

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

2

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

3

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read -

4

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

12.07.2025 17:44 8 min. read -

5

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read