Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now As Institutions Likely to Up Crypto Allocations

20.03.2025 16:02 8 min. read Kosta GushterovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

A recent study by Coinbase and EY-Parthenon revealed that institutional investors—about 83% of them—plan to increase their allocation of cryptos to their portfolios this year. While there were obvious signs of large investors getting into crypto and purchasing in strong quantities, this report cements the possibility of increased adoption throughout the ongoing bull run.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

With institutions set to take cryptos seriously, a huge influx of funds may be seen in a variety of projects, starting with large-cap tokens. The funds may flow to smaller tokens too, which could give early investors a chance to multiply their investments if they buy in early.

We have covered some projects that may be worth paying attention to right now, with scope for whale purchases soon over the next couple of weeks or months.

Best Crypto to Buy Now – Top Tokens Likely to Grab the Attention of Whales

BTC Bull (BTCBULL)

As institutions gear up to inject billions into crypto markets, Bitcoin is naturally the first asset on their radar. But what if a meme coin captured the spirit of Bitcoin itself while offering early-stage growth potential?

That’s precisely where BTC Bull comes in. Built around the idea of honoring Bitcoin’s dominance while adding a playful meme coin energy, BTC Bull aligns with the broader industry trend of capital gravitating toward Bitcoin-centric projects.

What sets BTC Bull apart is its milestone-driven approach—a feature that adds layers of engagement for investors looking beyond speculation. The project has a structured airdrop system, rewarding holders as BTC Bull progresses through its roadmap. This setup is reminiscent of past high-growth tokens that used airdrops effectively to expand their holder base and build organic demand.

The project also incorporates a token-burning mechanism, ensuring that supply reduces over time. For institutions that focus on scarcity-driven appreciation (as seen with Bitcoin itself), this deflationary approach may prove appealing. Combined with the natural market cycles of Bitcoin, BTC Bull presents a structured way to ride BTC’s bullish momentum while benefiting from additional incentives.

As Bitcoin solidifies its dominance in the institutional market, projects tied to its growth narrative—especially those integrating staking, burns, and milestone-based rewards—could become key beneficiaries.

BTC Bull, having raised more than $3.8 million in presale, offers that layered approach, positioning itself as more than just a meme coin but as a strategic play in an era where institutional capital is shaping crypto’s next major moves.

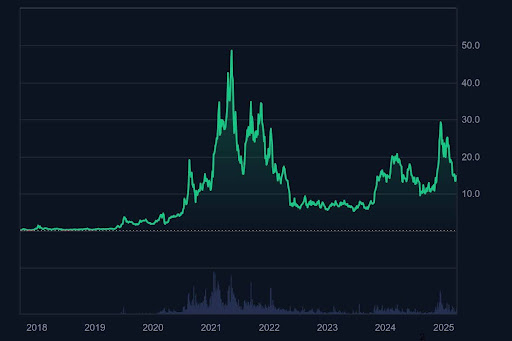

Chainlink (LINK)

It’s one thing for institutions to buy crypto; it’s another for them to operate within the ecosystem. Chainlink’s role as the dominant oracle provider makes it a foundational piece of blockchain infrastructure—something that traditional finance firms can’t sidestep as they integrate with digital assets.

Institutional interest isn’t just about owning tokens; it’s about building tools, smart contracts, and decentralized finance (DeFi) solutions that require secure, tamper-proof data feeds. That’s where Chainlink thrives. Its oracles power countless applications across DeFi, gaming, and real-world asset tokenization, making it a backbone for institutional-grade adoption.

If the institutional money wave extends beyond simple purchases and into on-chain activity, Chainlink’s position strengthens even further. Every fund, bank, or enterprise exploring blockchain-based services will likely touch Chainlink’s technology in some way.

Its adoption in traditional markets has already begun, with integrations across banks, asset managers, and payment providers. It is priced at a very low range right now too, over 75% lower than its all time high, which could be one of the best times to accumulate the token.

As institutions scale up their exposure, Chainlink could serve as a key piece of infrastructure supporting their blockchain endeavors, creating an opportunity for LINK to appreciate as adoption deepens.

Meme Index (MEMEX)

Meme coins have proven time and again that they can outperform traditional assets when momentum strikes. Institutions are aware of this but often lack the ability—or willingness—to pick individual meme tokens. That’s where Meme Index comes into play.

Offering a structured, diversified approach to meme coin investing, Meme Index simplifies institutional entry into this notoriously volatile space. Rather than betting on a single project, it provides a basket of meme assets, grouped based on risk tolerance and market dynamics. This setup appeals to funds and investors looking to gain exposure to high-reward meme coins while managing risk through diversification.

With mainstream funds experimenting with crypto ETFs and structured investment vehicles, Meme Index could be positioned as an early-stage product catering to institutional investors who want to engage with the meme coin economy without diving into individual tokens.

If big players begin allocating capital into broader meme coin markets, Meme Index could act as a gateway, pulling liquidity into its ecosystem and enhancing price performance.

“It has never been done before” is how Austin Hilton, a popular and reputed crypto content creator and analyst, described Meme Index in one of his videos featuring the project.

For retail investors, getting in early before institutional flows arrive could mean front-running the potential surge. If meme-based investing matures into a recognized sector, Meme Index may stand at the forefront, offering structured exposure to one of crypto’s most unpredictable yet lucrative niches.

MIND of Pepe (MIND)

Institutional investors don’t just buy assets blindly; they rely on data, analysis, and predictive modeling to inform their decisions. That’s exactly where MIND of Pepe enters the equation—offering an AI-driven insight engine that tracks social media sentiment, market trends, and behavioral signals in ways that traditional models can’t.

With AI’s role in financial markets expanding, the integration of machine learning with crypto analysis is inevitable. Large funds and trading desks already use algorithmic trading and deep analytics to optimize their strategies.

MIND of Pepe, as a self-evolving AI agent, taps into that world by gathering real-time sentiment data from the social sphere—a crucial element in crypto’s volatile market cycles.

The project stands at the intersection of two institutional interest points: AI and crypto. While hedge funds and trading firms refine their AI models for traditional markets, a crypto-native AI tool focused on sentiment analysis could prove invaluable for navigating meme coins, narratives, and market momentum shifts.

With over $7.4 million raised, the MIND token presale is definitely one that investors may want to watch out for if they seek high gains in the short term.

Best Wallet Token (BEST)

With institutions increasing their crypto exposure, secure and efficient asset management becomes a top priority. Unlike retail investors who hop between multiple wallets and platforms, institutions require high-level security, cross-chain access, and deep liquidity tracking—all areas where Best Wallet excels.

The Best Wallet Token fuels an ecosystem that offers more than just storage. Its integration with a quality DEX, presale aggregator, high-APY staking, and market analytics creates an infrastructure that aligns with the needs of serious investors.

While traditional custodians like Coinbase and Fidelity have offered institutional crypto services, decentralized solutions that provide non-custodial, cross-chain compatibility are still lacking.

Best Wallet bridges that gap by giving investors a multi-chain portfolio manager with staking and trading functionalities, all within a secure ecosystem.

The BEST token presale is currently a successful ongoing presale with over $11 million raised already, likely to finish its presale soon. With a strong existing user base and a growing push toward self-custody in institutional circles, Best Wallet Token could become a pivotal asset as large investors seek efficient ways to manage their holdings across multiple blockchains.

Solaxy (SOLX)

As institutional funds enter the crypto space, staking becomes a major focus area. Passive yield generation through secure and scalable infrastructure is a natural fit for investors looking to earn returns without active trading. This is where Solaxy, a Layer 2 solution bridging Solana and Ethereum, gains relevance.

Institutions favor chains with high throughput, low costs, and strong staking incentives—all aspects that Solaxy offers. While Ethereum dominates the institutional staking market, Solana’s rapid growth has sparked interest among firms looking for alternatives with faster finality and lower operational costs.

Solaxy sits at the convergence of these two ecosystems, allowing capital to move seamlessly between Solana and Ethereum while offering attractive staking opportunities. With over $27 million raised already, it may not be a stretch to consider it one of the most successful meme coin presales in the recent weeks.

$SOLX hits it out of the Stratosphere!🛸

27M Raised! 🔥 pic.twitter.com/ELdJOM2zZb

— SOLAXY (@SOLAXYTOKEN) March 19, 2025

The institutional case for Layer 2 solutions is growing, especially as transaction volumes increase. If funds begin seeking high-yield, low-latency staking alternatives, Solaxy could see liquidity inflows from firms diversifying their blockchain exposure.

For early investors, this presents an opportunity to position ahead of institutional allocation, particularly as staking remains one of the most low-risk yet lucrative strategies in the broader crypto market.

Conclusion

Institutional capital rarely moves without a strategy. It starts with established assets, but as confidence grows, liquidity expands into projects with strong narratives, structured incentives, and unique positioning.

The projects highlighted above each align with trends that institutions are likely to engage with—whether through infrastructure, AI-driven insights, multi-chain accessibility, or tokenized exposure to high-growth sectors.

For those looking to stay ahead of the curve, identifying these narratives before large players fully commit could be the key to securing the kind of early entry that delivers substantial gains. With institutional inflows poised to reshape the market, now may be the time to explore these opportunities before they catch wider attention.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

The recent ceasefire between Iran and Israel brought temporary calm to global markets, and the crypto sector responded quickly. Bitcoin is back above $106K as buying pressure returns and investor confidence stabilizes. With traders now positioning for a potential move to $120K and beyond, one project stands to benefit the most. BTC Bull Token (BTCBULL) […]

Best Crypto to Buy Now as Bitcoin ETFs Log a 9-Day Inflow Streak

Institutional investors just extended their love affair with Bitcoin ETFs to a ninth consecutive day, even as the post-Juneteenth trading session delivered only a murmur of activity. Despite a modest $6.37 million net inflow on Friday, the streak underscores how major players remain committed to on-chain exposure. This publication is sponsored. CryptoDnes does not endorse […]

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

The crypto market is gearing up for the third quarter with renewed optimism following several positive developments. Bitcoin (BTC) fell under $100,000 after the US struck Iran with airstrikes over the weekend. But the leading cryptocurrency has now surged to over $104,000 amid the expectation of a complete ceasefire between Iran and Israel. Meanwhile, the […]

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

Over the weekend, escalations of the conflict in the Near East shook global markets after the US launched an airstrike on Iran’s nuclear sites. The impact was felt in crypto too, with Bitcoin pushed into a resistance test and slipping just below the $100,000 level for the first time in six weeks, before rebounding. The […]

-

1

Best Solana Meme Coins to Buy: Could Snorter Token Outperform Dogwifhat and Bonk?

06.06.2025 12:38 5 min. read -

2

Snorter Token Hits $1.1 Million in Presale as Solana Traders Rush In – Next 10x Crypto?

20.06.2025 14:09 5 min. read -

3

Time to Sell Pepe as Price Dips 18%? New Meme Coin Presale Raises $1 Million

17.06.2025 17:54 5 min. read -

4

Best Meme Coins to Buy Now: Top 5 Picks for Explosive Gains

16.06.2025 6:06 6 min. read -

5

Best Crypto Presales to Buy: 5 New Tokens That Can 100x

15.06.2025 3:04 5 min. read