Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now As Ethereum ETF Inflows Indicate Growing Altcoin Strength

27.07.2025 22:09 10 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

One of the clearest market signals this year has come not from price charts, but from ETF flows. In 2025, the pace and direction of institutional capital via spot ETFs has shaped the market’s strongest rallies. While Bitcoin enjoyed most of the spotlight early on, a quiet reversal appears to be underway.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

Ethereum ETF inflows have not only caught up but significantly surpassed Bitcoin’s over recent weeks. Despite Bitcoin reaching a new all-time high, it is Ethereum that seems to be enjoying the confidence of institutional allocators. This shift comes at a time when Bitcoin dominance has begun to ease, giving altcoins breathing space. For investors looking ahead, this could mark the beginning of a powerful altcoin cycle built around Ethereum’s momentum.

Ethereum ETFs Show a New Phase in Crypto Allocations

The first half of 2025 belonged to Bitcoin. Spot ETFs poured billions into BTC, driving its dominance to cycle highs and propelling its price into six-figure territory. But as Bitcoin finds a short-term ceiling, institutional appetite has not vanished. It has simply pivoted. The numbers tell a story that retail traders have only begun to notice.

In the past month, Ethereum ETFs have seen inflows over three times greater than their Bitcoin counterparts. While Bitcoin ETFs absorbed $144 million in the last twelve months, Ethereum has quietly pulled in over $1 billion. That figure becomes even more compelling when paired with ETH’s subdued price action relative to BTC.

BlackRock’s ETH ETF, now the third-fastest in ETF history to reach $10 billion AUM, reached that milestone in just 251 days. It jumped from $5 billion to $10 billion in ten days flat. This surge has coincided with a 14-day streak of uninterrupted inflows, totaling $4.4 billion, and a single-day record of $726.7 million.

Meanwhile, Bitcoin ETFs, once the star of institutional capital, have faced three consecutive days of net outflows totaling nearly $290 million. These shifts in fund behavior suggest that while Bitcoin may have already priced in much of its ETF enthusiasm, Ethereum’s upside remains underexplored.

it took ~1 year for blackrock to take 50% of the ETH ETF marketshare pic.twitter.com/KP6rmzNxXN

— hildobby (@hildobby) July 23, 2025

As Ethereum draws in fresh capital at a pace never seen before in its history, its price appears overdue for a catch-up rally. And when Ethereum rallies, altcoins follow. Especially now, when Ethereum’s influence over the Layer 2 ecosystem and DeFi sector is stronger than ever.

This window may represent one of the most asymmetric opportunities for altcoin investors in 2025. Capital tends to flow downstream, and if Ethereum becomes the institutional favorite of this phase, high-potential projects across its ecosystem could benefit substantially. For those seeking quality altcoins still trading at early-stage prices, the current landscape may offer ideal entry points.

Best Crypto to Buy Now as Ethereum’s Growth May Impact Other Altcoins Positively

Wall Street Pepe

Wall Street Pepe has managed to gather interest among investors as an established memecoin in recent days, and its traction seems to already be building fast. The project uses satire to draw attention to how traditional finance behaves in irrational ways, often parodying market reactions and institutional double standards.

Its style is loud and absurd, but the timing could end up being clever. With Ethereum ETF inflows crossing historical highs and drawing new capital toward altcoins, projects that are tuned into trader psychology may benefit first.

This token plays on themes that crypto audiences already understand. From front-running news cycles to mocking hedge fund behavior, Wall Street Pepe taps into real tension between legacy finance and online investors.

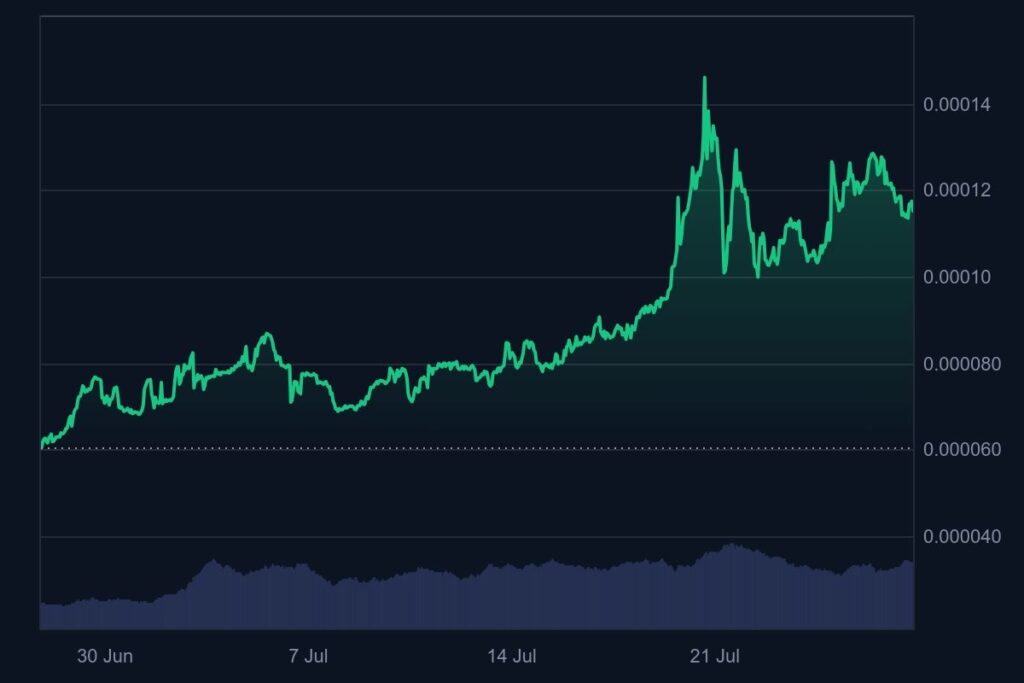

The appeal is not only visual or comedic. It comes from knowing how to provoke conversation at exactly the right moment. In the past month itself, the token has seen a surge of over 90%, with the price having jumped from $0.0000605 to over $0.00012 within a month.

If Ethereum continues to gain ground as inflows rise, the impact will not stay limited to large caps. Retail traders often move in search of quicker upside, and tokens with strong cultural awareness are usually among the first to react. Wall Street Pepe sits on the edge of that shift. As the cycle opens up and capital begins rotating into early-stage names, this project could benefit from being seen as both a statement and an opportunity.

Best Wallet Token

Best Wallet Token is one of the few presale assets tied directly to a live product with a growing user base. It is built around Best Wallet, a Web3 wallet that already supports multiple blockchains and has started to gain traction among those seeking secure, multi-chain access with built-in DeFi and NFT tools. Unlike wallet tokens that rely on future roadmaps, this one is being introduced alongside an app that already works.

The value of the token is tied to the utility users get from holding it. Features include access to exclusive staking options, advanced on-chain analytics, and future governance over wallet integrations. As crypto infrastructure continues to evolve, wallets are quietly becoming some of the most influential points of entry. Ethereum’s recent ETF surge is bringing fresh capital into the ecosystem, and platforms that make access easier could play a key role in absorbing that flow.

With Bitcoin slowing and Ethereum beginning to reclaim market attention, demand for infrastructure-layer assets is expected to climb. Best Wallet Token is structured to grow in parallel with user activity on the wallet itself. That puts it in a strong position going into what could be a decisive period for altcoins.

If Ethereum continues to attract institutional flows, tools that simplify interaction with its ecosystem may become essential. Best Wallet Token reflects that trend, and its early launch window gives it plenty of room to grow if demand accelerates.

Snorter

Snorter is a Telegram-based AI tool built for fast crypto decision-making. It is designed to simplify the way traders interact with markets by offering real-time data, insights, and prompts directly through a familiar messaging interface.

As trading environments grow more competitive, this kind of high-speed support becomes more useful, especially for those dealing with multiple altcoin positions across volatile conditions.

Unlike dashboard-style bots that require setup and onboarding, Snorter works entirely within Telegram. That keeps the experience quick and accessible while still offering in-depth market logic. It can handle everything from trend recognition to portfolio alerts without the need for separate apps or browser tabs. For traders chasing short windows of opportunity, that edge can matter.

Snorter’s relevance becomes clearer as Ethereum ETF flows continue to rise. When capital moves fast and altcoins begin waking up, traders need immediate signals to react. If Ethereum sets off a new leg of this cycle, tools like Snorter that support faster decision-making could see much higher adoption. And since the token is tied to access and premium features, any growth in users could directly increase demand.

Snorter has been featured across top creator videos like that of ClayBro’s, who claimed the project to be a highly profitable opportunity in the coming weeks.

As markets become more reactive and information moves in tighter loops, products that remove friction will gain attention. Snorter already reflects that shift, and with its token still in its early stages, it could benefit significantly from a more active altcoin environment led by Ethereum’s growing momentum.

Bitcoin Hyper

Bitcoin Hyper takes a direct approach to one of the most debated problems in crypto: how to scale Bitcoin without compromising on its core structure. Rather than proposing yet another experiment in cross-chain swaps or wrapped tokens, Bitcoin Hyper builds a dedicated Layer 2 that keeps Bitcoin as the foundation while unlocking far faster transactions and lower costs.

It is built for activity, not just storage. In doing so, it gives users the ability to actually use Bitcoin in decentralized applications, lending, and other real-time environments.

What sets it apart is the technical focus. Every function is meant to extend Bitcoin’s utility without replacing its role. Transactions that once took minutes now take seconds. Fees that once ate into microtransactions are significantly reduced. And for developers, it provides a framework that opens up Bitcoin’s functionality to things that would otherwise only exist on Ethereum or Solana.

The broader timing is worth noting. With Ethereum ETF inflows spiking and its dominance expanding again, altcoins that serve a real structural purpose could benefit from the next wave of capital. Bitcoin Hyper fits this window by bringing attention back to the Bitcoin network but in a way that aligns with the more agile, scalable nature of current ecosystems.

As traders and builders look for utility beyond passive holding, Bitcoin Hyper could grow both in relevance and market value. If Ethereum leads the next rotation, projects with real architecture, especially those touching Bitcoin, could become highly sought after in the process.

TOKEN6900

TOKEN6900 is not here to present use cases. It was never meant to solve a gap in DeFi, nor does it offer whitepaper promises. It is pure degen speculation, wrapped in meme culture, built to run on chaos and collective timing. And that is exactly why it has started to gain attention.

Its strength comes from the way it mirrors the energy of retail trading cycles. No roadmaps, no explanations, just momentum. In the same way early Dogecoin and PEPE runs became social movements more than financial instruments, TOKEN6900 is crafted to ignite FOMO at just the right moment. It is built for movement, not structure.

That does not mean it should be dismissed. In the right cycle, tokens like this often outperform their more established peers. With Ethereum now leading ETF inflows and altcoin traders waiting for signals, projects that can capture sudden attention are well positioned to move quickly. Ethereum’s growing traction means more eyes on the broader space, and that includes meme assets that trade on sentiment and speed.

TOKEN6900 RAISED $1M. pic.twitter.com/6WYygEshhq

— Token6900 (@Token_6900) July 23, 2025

TOKEN6900’s early-stage nature gives it an open field. If it catches momentum, there are few ceilings in its way. These tokens do not follow utility patterns. They follow energy. And in moments where liquidity shifts rapidly, they often benefit first.

For traders looking at short-term moves during a larger Ethereum-led surge, TOKEN6900 offers a pure bet on timing, reaction, and the next wave of retail appetite.

Conclusion

ETF inflows have reshaped the conversation this year, not with noise but with clear numbers. Ethereum’s lead in that space suggests that capital is no longer moving out of habit but with intention. That opens a path for altcoins that are either solving real problems or capturing real attention.

The market has not fully reacted to this change yet, which gives individual investors a rare advantage. Some of the most promising projects, such as the ones mentioned above, are still at early valuations, operating quietly while conditions start turning in their favor.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

2

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read

Best Meme Coins to Buy Now After PUMP’s Price Drop Has Investors Wondering

The much-hyped PUMP token from Pump.fun has fallen hard after its explosive $600 million launch, crashing more than 60% within just two weeks. What was supposed to be the crowning moment for Solana’s top meme coin launchpad has now left investors confused, cautious, and looking elsewhere. This publication is sponsored. CryptoDnes does not endorse and […]

Jacob Crypto Bury’s Discord Hits 40k Members – Best Crypto Discord?

Rated as one of the most active Discord communities for exclusive crypto signals, educational discussions, and in-depth market analyses, Jacob’s Crypto Clan has smashed the 40k membership milestone, reflecting its growing popularity among day-to-day traders and long-term investors alike. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, […]

Bitcoin Hyper Presale Raises $1M in Just 5 Days, Bringing Total to Raise to Over $5M: Next Crypto to Explode?

The crypto market experienced a slight pullback this week after the rally of the previous fortnight. But despite the drop, Bitcoin (BTC) is holding strong above $117,000, up by 10% over the past month. With this resilience, many investors are not only holding BTC but also scouting for new BTC-themed tokens that may offer greater […]

We Asked 3 AIs to Predict the Next 1000x Crypto

Scrolling through Crypto Twitter or Discords searching for the next 1,000x gem? There’s no need – smart traders are now using AI tools to do the analysis for them and find hidden altcoins before they explode. These tools excel at pattern-spotting, hype-filtering, and cold, hard data crunching. So, we went straight to the three most […]

-

1

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

2

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read