Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Corporate Titans Brace for a Bitcoin Sell-Off

11.06.2025 17:02 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

In recent weeks, growing corporate interest has fueled Bitcoin’s meteoric rise, but a fresh analysis warns of a looming reversal. The Times of India now shows that public companies now hold over 3% of the total Bitcoin supply on their balance sheets.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

While this institutional embrace underscores crypto’s maturation, it also exposes treasuries to sharp price swings. As investors weigh the benefits of corporate adoption against the risk of forced selling, one question looms large: what’s the best crypto to buy now?

Corporate Bitcoin Accumulation Faces New Risks as Market Turns

One of the major driving factors behind the recent price surge in Bitcoin has been growing corporate accumulation of cryptocurrencies. But things are now taking a surprising turn.

Numerous public firms have experienced favorable equity price action in the aftermath of Bitcoin-related news. While corporate equity valuations are increasingly correlated with Bitcoin prices, a steep Bitcoin value reversal could adversely affect these firms’ balance sheets and enhance negative volatility.

Furthermore, many companies over the past few months have been willing to follow in the footsteps of MicroStrategy in embracing Bitcoin as a core component of their corporate treasury strategy.

What’s particularly striking is the shift in institutional interest; currently, there are 110 publicly traded companies globally holding Bitcoin.

In fact, Standard Chartered’s global head of digital asset research, Geoff Kendrick, said in a June 3 report that the bank’s analysis of 61 companies reveals these firms collectively owned almost 674,000 Bitcoins by the end of May. This represents approximately 3.2% of Bitcoin’s total supply.

The bank further discovered that the holdings of these corporate investors had doubled in just two months, with nearly 100,000 new Bitcoins added during that period.

Additionally, Standard Chartered observed that most of the newer corporate investors purchased Bitcoin at significantly higher prices than early entrants like MicroStrategy.

These companies are taking risks.

Every company takes risks.

Risks are not binary like 0 or 1.

Risks are a range from 0 – 100.

With the right balance, you can achieve the best risk/ROI ratio that works for you.

Risks can/must be managed.

Not taking risks is a risk in itself. https://t.co/LXsQceWNRZ— CZ 🔶 BNB (@cz_binance) June 3, 2025

If Bitcoin’s price were to fall below $90,000, or more than 22% below the average purchase price for many of these companies, it could create significant challenges for their corporate treasuries, potentially triggering a domino effect.

Bitcoin Price Analysis

As the Bitcoin price hovers around $109K with a market capitalization of approximately $2 trillion, it has shown strong upward movement in recent weeks, bouncing back from earlier lows near $101,000. Currently, Bitcoin is trading between $109,000 and $110,000, indicating bulls trying to hold ground, hoping for another parabolic jump.

On the upside, $111,000 serves as a key resistance level, where many sellers are likely to take profits.

However, a deeper analysis of the price chart shows a spinning top forming yesterday, indicating that a moderate level of exhaustion has set in after the recent bullish move. This could cap Bitcoin’s rise unless demand strengthens further. Investors should wait for another day to see whether the current red is a short-term pullback or a sign of deep reversal.

Best Crypto to Buy Now

With corporate treasuries now deeply tied to Bitcoin’s fortunes, investors should balance institutional momentum with risk management. As big players prepare for potential sell-offs, diversifying into the best crypto to buy now, with solid fundamentals and independent use cases, becomes crucial.

Snorter

If a large-scale Bitcoin sell-off triggers volatility across crypto markets, Snorter’s appeal as a staking-focused token may grow. In turbulent times, investors often seek alternative assets offering steady rewards, making Snorter’s yield mechanisms attractive as a hedge against market swings.

The $SNORT token powers a fast, Solana-based sniper bot designed to help traders avoid losses in the volatile meme coin market. It aims to replace manual trading with smarter, faster automation.

Snorter Bot is engineered to maximize profits by identifying opportunities before pumps happen. With its low transaction fees and high speed, it offers a significant advantage for traders looking to act quickly.

One standout feature is Snorter’s ability to detect potential honeypots and rug pulls in real time. In beta testing, it has proven to be over 85% effective at protecting users from scams.

Although currently built on Solana, the Snorter team plans to expand to networks like Ethereum, BNB, Polygon, and Base, increasing its reach and usability across the crypto landscape.

For those looking for extra security, Snorter Bot scans for red flags like mint traps, liquidity locks, and suspicious token distributions. This feature provides an added layer of protection against bad trades.

Unlike competitors such as Maestro and Trojan, which charge 1% or more per trade, Snorter’s lower fees and lack of daily trade limits make it a top choice for power users and frequent traders.

Solaxy

A Bitcoin price drop and subsequent market shake-up could drive investors toward sustainable, utility-driven projects like Solaxy. Its focus on scalability and green technology may be seen as a safer, future-proof alternative amid corporate Bitcoin uncertainty.

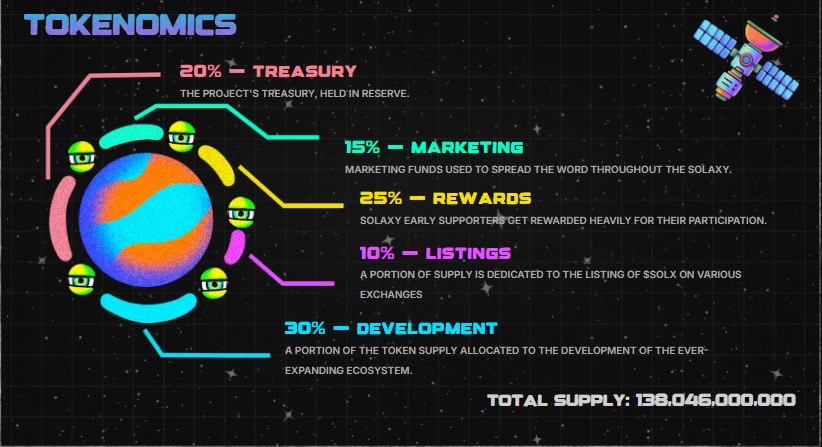

Solaxy ($SOLX), a new meme coin in presale, is attracting attention for more than just its playful image. It aims to improve Solana ($SOL) with the first-ever Layer 2 solution on the blockchain.

By offloading transactions to this Layer 2 sidechain, Solaxy reduces congestion on Solana’s main chain, improving scalability and performance. This could mark a significant technological upgrade for the platform.

According to popular crypto YouTuber 99Bitcoins, there’s only a limited window left to invest in Solaxy and potentially reap a 100x return.

The project also appeals to long-term investors, thanks to its staking program offering up to 87% APY. With over 13 billion SOLX tokens already staked, strong conviction is building ahead of the official launch.

Solaxy blends meme coin appeal with real infrastructure utility. Its quirky mascot, a Pepe the Frog with an Einstein twist, suggests that behind the fun is a project with serious potential.

Approaching Lightspeed! 🚀

47M Raised! 🔥 pic.twitter.com/Iw3eKAhbN3

— SOLAXY (@SOLAXYTOKEN) June 11, 2025

Having raised $47M in early funding, Solaxy has quickly become the largest crypto presale of 2025, attracting both retail investors and crypto whales. It’s a rare mix of meme culture and tech innovation.

Best Wallet Token

With potential Bitcoin sell-offs raising concerns about volatility, Best Wallet Token’s emphasis on security and easy asset management could attract users looking to safeguard their holdings and earn rewards, regardless of broader market instability.

Best Wallet, a rapidly growing non-custodial crypto wallet, now serves over 250,000 monthly active users. This surge reflects a growing demand for secure, decentralized financial tools.

Security has been strengthened with Fireblocks’ Multi-Party Computation (MPC) technology. This system splits private keys into multiple parts, requiring cross-verification for critical actions and reducing key theft risks.

Aside from security, Best Wallet provides customers with the means to exchange crypto for more than 100 fiat currencies and withdraw their money directly into their bank accounts, eliminating third-party exchanges.

The Best Card provides improved user convenience through integration with Google Pay and Apple Pay, giving a maximum cashback of 8% on every purchase. This fills the gap between spending and crypto.

Best Wallet Token holders unlock extra features in the ecosystem, such as reduced transaction fees, making it desirable for regular crypto users.

BEST is also responsible for governance of the platform, enabling token holders to vote on critical decisions that determine the future of the Best Wallet ecosystem.

Conclusion

This analysis highlights a pivotal moment: corporate Bitcoin buying has driven prices to new highs but also created the potential for a sell-off if values fall below key thresholds. It emphasizes two larger trends: growing institutional adoption and the need for risk-aware strategies.

For investors, the takeaway is clear: focus on assets with strong fundamentals and mechanisms that can thrive in uncertain conditions. By choosing wisely, investors can better navigate corporate-driven price swings and secure the best crypto to buy now.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

15.07.2025 19:17 7 min. read -

2

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

17.07.2025 1:36 4 min. read -

3

Dogecoin Can Hit $1 in August, But This Low Cap Meme Coin Could Soar Even Higher

23.07.2025 16:10 5 min. read -

4

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

17.07.2025 17:36 8 min. read -

5

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read

Best Crypto to Buy Now as SEC Pauses Bitwise Multi-Asset ETF

Things on the crypto horizon took a bizarre turn on July 22 when the Securities and Exchange Commission, shortly after approving a multi-asset crypto ETF, decided to stay its decision following a commission review. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other […]

Best Meme Coins to Buy Now as Dogecoin’s Update Points to Utility in Meme Coins

Dogecoin has always been seen as the original memecoin, but recent developments suggest it may be stepping into a more serious role. A new technical proposal, driven by the DogeOS team, indicates that Dogecoin could soon support applications far beyond basic peer-to-peer transfers. This publication is sponsored. CryptoDnes does not endorse and is not responsible […]

Best Wallet Token Emerges as Top Crypto Presale to Buy With $14M Raised

The crypto market’s overall market cap hit $3.85 trillion today, and top-performing cryptocurrencies have provided huge gains for investors in recent weeks. As this bullish momentum brings more investors back into the digital asset space, demand for high-quality crypto wallets is rapidly rising. One project catering to this niche is Best Wallet Token (BEST), the native […]

Best Meme Coins to Buy: Wall Street Pepe to Rally 2,000% Like PEPE in 2024?

The crypto market’s explosive growth over the past month has continued into the meme coin space, pushing the entire sector to a valuation of more than $75 billion. One meme coin that has been outperforming most others in recent times is Wall Street Pepe (WEPE), a community-powered crypto education and trading signals platform aiming to take […]

-

1

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

15.07.2025 19:17 7 min. read -

2

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

17.07.2025 1:36 4 min. read -

3

Dogecoin Can Hit $1 in August, But This Low Cap Meme Coin Could Soar Even Higher

23.07.2025 16:10 5 min. read -

4

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

17.07.2025 17:36 8 min. read -

5

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read