Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Bitcoin Price Dips Below $110K

12.06.2025 16:15 8 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Last week’s U.S. inflation report showed consumer prices edging up just 0.1% in May, bringing annual inflation to 2.4% and slightly under economists forecasts. At the same time, a freshly inked U.S.-China trade agreement sent stock indices to new highs. Yet Bitcoin has barely budged, lingering just below $110,000.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

For crypto investors, this mix of cooling inflation and geopolitical détente could mark a pivotal moment for portfolio positioning. In a market hungry for clarity, knowing which assets stand out matters now more than ever, making a case for the best crypto to buy now.

$110K Ceiling Holds: Trade Deal and Cooling Inflation Fail to Lift Bitcoin

Bitcoin reached above the $110,000 momentarily only to get pulled back to the $107K level after the U.S. released positive inflation data and a new trade deal with China lifted stock markets to record highs. Usually, such bullish developments would give crypto a boost, but Bitcoin remains surprisingly flat.

In May, the Consumer Price Index released by the U.S. Bureau of Labor Statistics rose by just 0.1%, bringing annual inflation to 2.4%, slightly under economist expectations. Analysts at FactSet had forecast a 0.2% monthly increase and a 2.5% yearly rise.

Once the data hit, the S&P 500 added 0.17%, the Nasdaq climbed 0.10%, and the Dow rose 0.49% according to CNBC. Markets breathed a sigh of relief after months of inflation worries.

Meanwhile, President Trump celebrated the CPI report and touted the new U.S.-China trade agreement. Under the deal, a 55% tariff will apply to Chinese imports and a 10% tax will hit U.S. goods entering China.

Trump wrote in all caps on Truth Social that the deal is “done, subject to final approval by President Xi and me,” and he urged the Federal Reserve to cut rates by a full percentage point, tagging Chair Jerome Powell directly.

'Our deal with China is done… Relationship is excellent!' – President Donald J. Trump pic.twitter.com/6NbYDtxuAk

— The White House (@WhiteHouse) June 11, 2025

The U.S. Dollar Index fell to its lowest level in seven weeks, hinting at a split between currency and equity markets. Investors usually flock to the dollar when confidence in stocks rises. This time, however, the greenback took a step back.

Crypto markets saw only modest gains. Bitcoin briefly popped above $110,000 before dipping to $108,700 at publication time. Traders appear cautious, with average funding rates at about 1.3% annualized over the last week, according to a K33 Research report. That level has tended to signal local market bottoms rather than tops.

“Historically, BTC does not top in environments with negative funding; such conditions tend to precede rallies rather than mark peaks,” noted Vetle Lunde, Head of Research at K33. His view suggests that this defensive stance could actually set the stage for the next leg up in Bitcoin’s price.

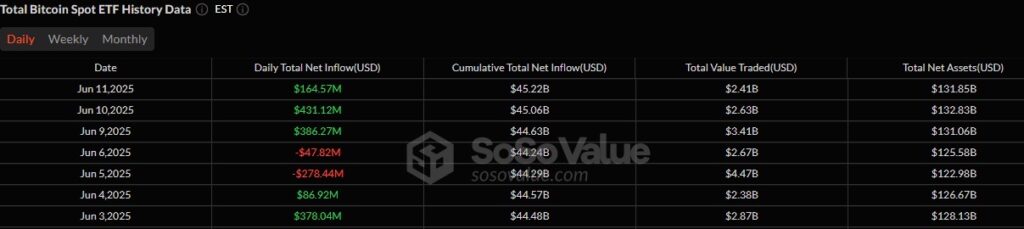

Moreover, Bitcoin ETFs reversed course with a strong $386 million inflow, ending a two-day outflow streak and pushing net assets back over $130 billion.

All eyes now turn to upcoming U.S. jobs data and the Producer Price Index report. These figures will offer fresh clues about inflation and guide the Fed’s interest rate decisions. Analysts warn that Bitcoin’s next moves will hinge on these key economic releases.

Bitcoin Price Analysis

As Bitcoin hovers around $107K with a market capitalization of more than $2 trillion, it is encountering resistance between $108K and $109K. This is where the price recently peaked and faced selling pressure, as indicated by two larger red candlesticks.

After a strong rally, the market is undergoing a healthy pullback, signaling growing caution among traders. Recent candles point to a mild correction, but the overall trend remains cautiously bullish. Inventors should keep their eyes trained on the $105K level since it is Bitcoin’s crucial support right now. A breakdown below this level could lead to the BTC price going through deeper levels of correction.

Best Crypto to Buy Now

With inflation easing and trade tensions cooling, risk assets are in focus, and crypto is no exception. These developments underscore how macroeconomic shifts can reshape demand for the best crypto to buy now and reveal fresh entry points.

Bitcoin Hyper

Bitcoin Hyper broadens the horizon for Bitcoin, which is still lingering around the $107K mark. By combining Solana’s fast, scalable infrastructure with Bitcoin’s robust Layer 1 security, it allows developers to launch applications using familiar Solana tools, with transactions ultimately settling on the Bitcoin network.

Bitcoin Hyper’s presale has crossed the $1 million mark in less than two weeks, marking a major early milestone. A surge of investment from crypto whales helped drive the recent momentum, drawing attention from both seasoned traders and newcomers.

The influx of capital has positioned Bitcoin Hyper as a potential breakout project, with many in the community now calling it the market’s hidden gem. As word spreads, interest in $HYPER tokens continues to rise, with growing speculation around its long-term value.

This hybrid setup unlocks a wide range of possibilities, from payments and dApps to meme coin ecosystems. There’s even talk of a “Pump.fun”-style platform emerging on the network, which could allow everyday users to launch tokens and tap into Bitcoin’s $2 trillion market cap.

Renowned crypto YouTuber 99Bitcoins recommends Bitcoin Hyper as the best meme coin to invest in ahead of Bitcoin’s next all-time high.

With whales backing the project early and retail interest growing, many believe Bitcoin Hyper could become a central player in the next wave of crypto innovation. For now, early adopters see the current presale phase as a rare entry point with strong potential upside.

BTC Bull Token

BTC Bull has set forth mechanics that will reward investors handsomely when Bitcoin breaks the $112K resistance level and crosses key milestones.

BTC Bull Token has raised over $7 million in its ongoing presale, attracting attention with its unique reward model. The project is heating up as Bitcoin flirts with the $110,000 mark, amplifying investor buzz.

Unlike typical meme coins, BTCBULL ties its rewards directly to Bitcoin’s price milestones. As BTC hits key levels, the token unlocks events like permanent supply burns and real Bitcoin airdrops.

The token is designed to activate burns when Bitcoin reaches $125K, $175K, and $225K for the first time. These supply cuts are deflationary, aiming to increase token scarcity and potential long-term value.

BTCBULL also promises real Bitcoin giveaways. When BTC hits $150K and $200K, holders will receive free BTC, offering a form of utility that sets it apart from most meme coins.

The biggest milestone comes at $250K BTC. At that point, BTCBULL plans to airdrop 10% of its total supply, delivering massive rewards to its community in a single event.

Altogether, BTC Bull Token offers more than hype. Its structure combines entertainment with measurable value, giving everyday investors a playful yet practical way to bet on Bitcoin’s future.

SUBBD

Whether or not Bitcoin performs, SUBBD is set to deliver. It’s an AI-powered platform that not only offers storage value but also functions as a utility token tapping into the multi-billion-dollar content industry.

The $SUBBD token presale has already raised over $500,000, gaining strong early traction with the support of more than 2,000 top-earning influencers. The project is drawing attention for its focus on AI-powered tools that help digital creators take control of their content and revenue.

Targeting the $85 billion subscription-based content market, SUBBD combines tokenized experiences with a suite of AI features designed to support both creators and fans. By removing third-party fees and middlemen, the platform allows for more direct and rewarding connections.

For creators, SUBBD offers tools like profile creation, live streaming, video generation, and voice notes, helping streamline content production while boosting earning potential. Fans benefit through personalized access to exclusive content and one-on-one engagement with influencers.

New features are on the way, including an AI image generator, a creator app, and the launch of the platform’s beta version. These additions aim to make SUBBD a full-service content ecosystem powered by AI and blockchain.

Influencers on the platform, known as Honeys, regularly host private Q&A sessions with fans, adding a layer of real-time interaction.

🚨 37,000 users are on the waitlist.

They’re ready to use $SUBBD.

Are you? 👀♥️ pic.twitter.com/jK7Kp6hrpU

— SUBBD (@SUBBDofficial) June 11, 2025

At its core, SUBBD stands at the intersection of three major growth sectors: artificial intelligence, blockchain, and the creator economy. With a strong roadmap and growing user base, it’s positioned as one of the most promising tokens to watch in the current cycle.

Conclusion

This week’s combination of cooler inflation readings and a landmark U.S.-China trade deal has left Bitcoin in a holding pattern, even as traditional markets rally. These developments underscore how policy shifts and macroeconomic trends can influence demand across digital assets.

Smart investors will look beyond the headlines to find tokens with clear use cases, strong communities, and strategic advantages, rather than chasing every market spike. As investors consider their options, keep in mind that steady conviction often outperforms hype. Choose wisely, and focus on the best crypto to buy now.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

2

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

3

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

4

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

5

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

BTC Bull Token has reached a critical moment. With less than 24 hours left in its presale, the project has already raised $8 million, signalling huge investor confidence. Buyers now have one last chance to secure tokens at a lower price before claiming goes live and the token becomes tradable on exchanges. Many crypto traders […]

Best Crypto to Buy Now as $8.6B Bitcoin Whale Awakens After 14 Years

When a Bitcoin whale that had lain dormant since 2011 sprang to life this week, it unleashed a colossal 80,000 BTC, worth about $8.6 billion, onto the blockchain. Such a historic stir not only shattered records for daily movements of decade‑old coins but also underscored how long‑term holders can reshape market dynamics in a heartbeat. THE FINAL […]

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

One of the most talked-about new meme coin launches of 2025, BTC Bull Token (BTCBULL) has already raised over $8 million through its presale, signalling huge investor confidence. BTC Bull Token stands out by tracking Bitcoin’s performance and rewarding BTCBULL holders whenever BTC hits specific milestones for the first time. The concept blends meme coin culture […]

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

When U.S. President Donald Trump made a historic trade deal with Vietnam, cutting tariffs on Vietnamese goods from 46% to 20%, world markets stirred into action. Bitcoin surged more than 3% as institutional investors welcomed lowered friction in international trade, and the Nasdaq and S&P 500 rose in tandem. BREAKING: Trump announced a trade deal with […]

-

1

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

2

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

3

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

4

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

5

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read