Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

15.07.2025 19:17 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

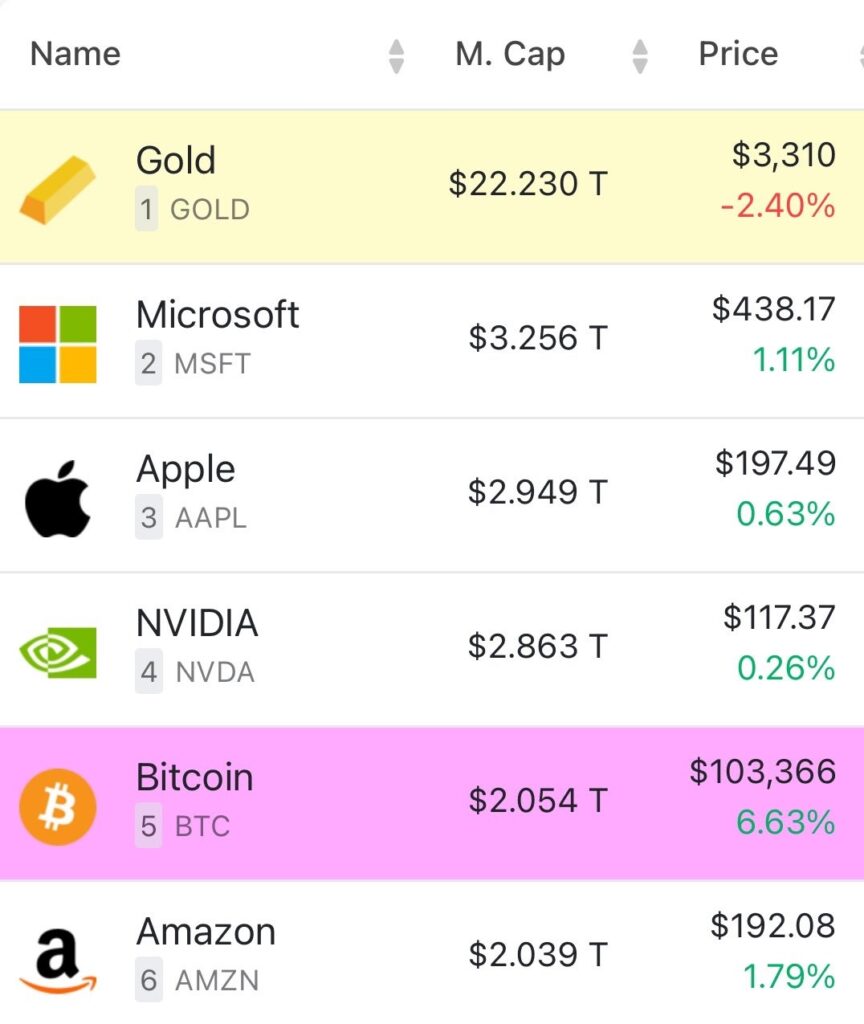

Bitcoin’s latest milestone saw it vault past tech giants Google and Amazon to rank as the fifth most valuable asset on earth. Clocking in at roughly $2.4 trillion in market capitalization, just above Amazon and comfortably ahead of Alphabet, this achievement underscores a turning point for cryptocurrencies.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

Institutional inflows, sparked by the launch of spot Bitcoin ETFs in early 2024 and bolstered by a more welcoming regulatory climate under new SEC leadership, have fueled this ascent. Now, investors are asking about the best crypto to buy now that could benefit from this news.

Bitcoin Surpasses Google and Amazon in Market Value as Rally Hits $120K

Bitcoin’s incredible surge has pushed its value to $120,000, making it the world’s fifth most valuable asset. Its total market worth now sits around $2.4 trillion. That means it’s just a hair above Amazon’s market value and significantly higher than Google parent Alphabet, valued at just under $2.2 trillion. So, this cryptocurrency is actually worth more than these tech giants.

What’s driving this? Institutional money started flooding into Bitcoin right after the first US exchange-traded funds (ETFs) launched in early 2024. Then, Donald Trump’s landslide presidential win in November gave things another boost.

His administration fostered a much friendlier environment for crypto, with the key move being Paul Atkins’ nomination as SEC chairman. Over the past few days, ETF inflows have been consistently positive, with some days seeing more than a billion dollars in investments.

Here’s where it got really interesting. Loads of companies, even those with no obvious link to Bitcoin, began raising huge sums specifically to buy it for their corporate reserves. They were copying the playbook of MicroStrategy (MSTR). Back in 2020, its chairman, Michael Saylor, stumbled onto Bitcoin as a place to park the firm’s $500 million in cash during COVID-19’s near-zero interest rates.

That accidental move paid off massively; MSTR’s value has skyrocketed over 3,700% since then. Seeing this success, a wave of other companies jumped in, triggering a deluge of institutional Bitcoin buying.

In a nutshell, a perfect storm of factors, including ETFs, supportive regulations, and the corporate buying frenzy, created multiple tailwinds. This propelled Bitcoin into new price territory, surpassing the value of these iconic tech firms.

Microsoft, Apple, Nvidia, Google, Amazon: Today's highest valued corporations.

Two companies are putting huge amounts of #Bitcoin on their balance sheet to overtake them.

MicroStrategy + Tether have bought 350+ BTC/day over the past 6 months. 78% of the new daily supply! ⛏️ pic.twitter.com/g2mk96kYVX

— River (@River) May 15, 2024

Although Bitcoin has recorded considerable success this bull cycle, a recent analysis highlights five reasons why its price would still rally twofold from here. Meanwhile, this might be the beginning of Bitcoin’s rally. According to “EliteOptionsTrader,” the premier crypto asset would see another 100% price increase before the end of this year.

Best Crypto to Buy Now

As Bitcoin’s ascension into the top five of global assets ignited fresh interest across institutions and traders alike, market dynamics are shifting rapidly. Against this backdrop of mounting capital and growing corporate interest, several projects are well-positioned to ride the momentum, making them strong candidates for the best crypto to buy now.

Bitcoin Hyper

Bitcoin Hyper builds on Bitcoin’s foundation by adding smart-contract layers designed to attract institutional capital. Its blend of security and utility makes it ready for the next market phase.

Bitcoin Hyper is pioneering a new approach by combining Bitcoin’s security with Solana’s fast execution. This Layer-2 solution aims to enhance programmability and performance where others like Stacks and Rootstock fell short.

The project has already raised over $2.7 million in early-stage funding, with the $3 million milestone expected soon. Investors view Bitcoin Hyper as a rare opportunity, akin to early Bitcoin’s potential for generational wealth.

Bitcoin Hyper integrates the Solana Virtual Machine (SVM), enabling near-instant execution while remaining tethered to Bitcoin through a decentralized bridge. Wrapped BTC is used across the ecosystem while maintaining security through zero-knowledge proofs.

This setup temporarily reduces BTC’s active supply, making it more usable in a variety of applications. The HYPER token plays a key role in this ecosystem and benefits from growing adoption as BTC becomes more functional.

The vision behind Bitcoin Hyper is to evolve Bitcoin beyond a store of value, making it tradable, stakeable, and usable in Web3. This shift positions Bitcoin Hyper as a key player in next-gen decentralized apps.

As Bitcoin approaches the $130,000 mark, crypto analyst 99Bitcoins suggests Bitcoin Hyper could generate 10x returns.

Security is reinforced with zero-knowledge proofs, ensuring transactions are validated before syncing with Bitcoin’s base layer. Future plans include integrating dApps from gaming, NFTs, and DeFi, along with DAO governance for HYPER holders.

Snorter

Snorter’s high-speed protocol gives traders an edge as Bitcoin’s dominance fades. With institutions shifting to altcoins, its fast settlements and DEX integrations put it in a strong position.

Snorter (SNORT) has raised over $1.5 million in just weeks, drawing interest from savvy investors. Its presale momentum signals rising confidence in its real-world trading utility.

The token powers Snorter Bot, a Telegram-based trading tool set to launch after the presale. Built for Solana, it targets retail traders with fast execution and ease of use.

Unlike typical meme coins, Snorter isn’t just hype. It blends crypto culture with working tech, aiming to help users outpace bots and insiders during volatile launches.

The bot connects to decentralized exchanges on Solana and Ethereum, offering sub-second sniping, copy trading, and built-in defenses against scams like honeypots and rug pulls.

SNORT is more than a token. It unlocks lower fees, staking rewards, and full access to bot features. Users pay 0.85 percent on trades instead of the standard 1.5 percent.

Snorter’s success comes from product-first execution rather than viral marketing. Analysts say this hands-on approach is giving it credibility in a market chasing utility over noise.

As Solana meme coins like BONK and dogwifhat post double-digit weekly gains, tools like Snorter may help everyday traders compete for early entries and outsized profits.

Snorter also tracks portfolios, automates stop-loss and limit orders, and mirrors top wallets. All functions run inside Telegram, making the experience fast, simple, and mobile-first.

TOKEN6900

As Bitcoin soars out of reach for new investors, those looking for something wild might find TOKEN6900 appealing with its raw, unfiltered vibe, offering no utility, no plan, and no promises, just pure meme coin chaos.

TOKEN6900 is turning heads with a bold presale on Ethereum, mixing meme culture with social satire. Early buyers get discounted tokens, staking rewards, and a sub-$7 million valuation.

Built with zero utility and no roadmap, $T6900 leans into the chaos. It calls itself “brain rot finance” and caters to traders who live for the joke, not the fundamentals.

The token supply is capped at 930,993,091, with 80 percent going to the presale. This holder-first model may include future burns, boosting scarcity if demand picks up.

Unlike most projects chasing credibility, TOKEN6900 embraces absurdity. It’s a coin for terminally online traders who know the meme is the message and that’s the whole point.

$T6900 is my guy. my buddy. pic.twitter.com/KIpx101bwt

— Token6900 (@Token_6900) July 15, 2025

Like DOGE and PEPE before it, TOKEN6900 bets everything on meme power. Whether it sticks or fades, it’s a reminder of how wild the crypto world still is.

Conclusion

Bitcoin’s unprecedented climb past Google and Amazon underscores the growing clout of digital assets in mainstream finance. This landmark achievement not only confirms Bitcoin’s maturing status but also signals a deeper institutional embrace and a clearer regulatory outlook under the new SEC leadership.

As asset managers and corporate treasuries recalibrate portfolios around cryptocurrency, discerning investors must weigh both established pillars and emerging contenders by exploring the best crypto to buy now. By focusing on projects that combine robust infrastructure with strategic market positioning, readers can align portfolios with this shift.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

The Solana-based crypto launchpad Pump.fun recently made headlines by raising roughly $500 million in just 12 minutes during its PUMP token sale, achieving a fully diluted valuation of $4 billion. But the hype quickly fizzled away after PUMP became available for trading, as its price dropped almost 55% from its peak and fell to around […]

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level. A few market commentators are even more bullish. For instance, the analyst […]

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out? Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking […]

Altcoin Season Is Starting as Bitcoin Soars to $123,000: Which Crypto to Buy Now?

Bitcoin (BTC) has hit the $123,000 mark for the first time in history, as the market-leading cryptocurrency continues the price discovery phase that began after BTC started hitting new all-time highs last Wednesday. Bullish news updates and key market data, from a frenzy of ETF inflows to the start of “Crypto Week” on Capitol Hill, […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

3

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read