Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Bitcoin Faces Existential Crisis from 51% Attack Fears

17.05.2025 17:46 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The crypto industry is undergoing significant discussion. An Ethereum advocate’s recent critique highlights concerns about Bitcoin’s potential vulnerabilities like 51% attacks, questioning the sustainability of its proof-of-work model. This isn’t mere debate—it reflects a broader conversation about blockchain evolution, contrasting older systems with newer scalable, secure networks.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

As Bitcoin’s reliability is being scrutinized alongside Ethereum’s advancements, strategic investors are reallocating toward projects emphasizing modern infrastructure, DeFi innovation, and AI integration. While Bitcoin remains dominant, this scrutiny underscores the need for adaptability in a changing market. In this environment, the best crypto to buy now may be those prioritizing innovation while addressing blockchain’s evolving challenges.

Ethereum Proponent Claims Bitcoin Is Vulnerable to 51% Attacks

Ethereum bigwig Justin Drake just dropped a bombshell—and Bitcoin maximalists aren’t thrilled. While speaking at a blockchain conference last week, Drake referred to Bitcoin’s security model as a “house of cards,” asserting that a 51% attack isn’t just on the horizon—it’s likely.

These comments are the echo of the post written by Grant Hummer on X, which highlighted the shortfalls of Bitcoin.

1. Respectfully, BTC is completely screwed because of its security budget. It would only cost $8B to 51% attack BTC today. When this gets down to $2B (AKA, BTC's security market cap becomes 0.1% of its asset market cap), a 51% attack is virtually certain to happen. This will…

— gphummer.eth 🦇🔊 (@gphummer) May 14, 2025

For the new user, a 51% attack is akin to a hostile takeover: if someone has the majority of the mining power, they can reverse transactions, spend their coins twice, and essentially use the blockchain as their playground. “Bitcoin’s playing with fire,” Drake claimed. “Its antiquated Proof-of-Work system is a bug, not a feature.”

Here’s the beef: Bitcoin relies on miners solving complex math puzzles (PoW) to validate transactions, but Drake claims this makes it a sitting duck.

Why? Mining’s become a rich-kid game—dominated by a few industrial-scale farms in places like Texas and Kazakhstan. “Imagine if a government or billionaire decided to gobble up mining rigs,” he said. “Game over.”

Meanwhile, Ethereum ditched PoW in 2022’s “Merge” for Proof-of-Stake (PoS), where validators lock up crypto as collateral. Translation: attacking Ethereum would cost billions upfront, while attacking Bitcoin? Just rent more machines.

Bitcoin loyalists aren’t biting. “This is FUD,” fired back podcaster Nic Carter, pointing to Bitcoin’s 14-year hack-free streak. But Drake’s got a point: 98% of Bitcoin mining pools are controlled by just four companies.

Whether one buys the doomsday scenario or not, one thing’s clear—the crypto world’s security debate just got spicy. As Drake quipped: “Innovation doesn’t sleep. Neither should Bitcoin.”

Best Crypto to Buy Now

As the crypto world absorbs the latest blows traded between Ethereum and Bitcoin loyalists, a deeper undercurrent brews—trust, decentralization, and narrative control are no longer monopolized by legacy leaders. Emerging as the best crypto to buy now, new players are seizing the cracks in old hierarchies, positioning themselves as the next symbols of resilience, utility, and cultural relevance in a market hungry for fresh conviction.

XRP

In a world where tribal wars between Bitcoin and Ethereum dominate headlines, XRP quietly escalates its mission—redefining global payments with precision and defiance. As old titans clash, XRP thrives in the shadows, building an unstoppable payments rail beyond the noise.

XRP, being the native cryptocurrency of Ripple, has established itself as a unique place in digital assets by providing cross-border payment services with high speed, cost-efficiency, and scalability.

It began with RipplePay, a peer-to-peer network that Ryan Fugger developed in 2004 to facilitate direct transactions without a middleman.

This change has assisted in moving the traditional system, long beset by delay and expense, to a system that facilitates remittances and foreign payments.

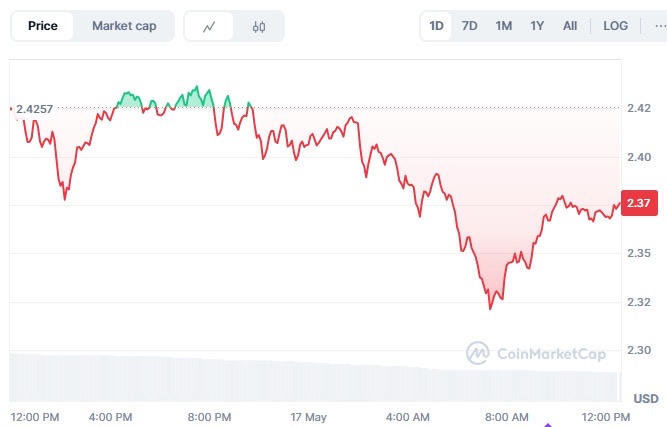

In technical terms, it is currently trading at around $2.37, with a market cap of $139.36 billion, securing its position in 4th place. However, over the past 24 hours, it has been declining, creating an opportunity for potential buyers to benefit from the dip.

There are rumors swirling across the crypto communities about Mark Zuckerberg’s tech giant, Meta, acquiring Ripple Labs. If this happens, it could take XRP to new heights.

BTC Bull

While Bitcoin’s vulnerabilities spark heated debates, the bullish spirit behind its legacy is finding new vessels. BTC Bull embodies that raw energy, channeling the aggression of Bitcoin’s early days into a hyper-charged, fearless narrative for the next crypto generation.

It is high time to invest in BTC Bull, as Bitcoin has been on a roll, with JP Morgan analysts boldly announcing that it could soon replace gold as the new hedge.

BTC Bull does not just follow Bitcoin’s price momentum; it amplifies the effect and rewards its users handsomely through its dual mechanisms of token burn and airdrop.

On top of that, staking rewards are currently over 300% APY, giving users multiple ways to earn. Now, chasing a $6M presale target, BTC Bull is undoubtedly outpacing its competitors.

This is why you don’t fight the bull. 🐂⚔️ pic.twitter.com/kXEtjRd52p

— BTCBULL_TOKEN (@BTCBULL_TOKEN) May 15, 2025

Do not mistake it for a joke meme coin, as it rewards users with real Bitcoin directly in their Best Wallet, which offers unparalleled security.

Best Wallet Token

Amid narratives of protocol flaws and power struggles, the future belongs to those offering simplicity, sovereignty, and accessibility. Best Wallet Token isn’t just watching the drama—it’s arming users with a tool that lets them interact with the crypto market seamlessly.

Since the crypto market remains in its early stages, there are numerous shortcomings, such as the security-related one. Reports of security compromises, including leaks of confidential customer information or, in the worst possible scenario, loss of funds, are unfortunately widespread.

This places much emphasis on decentralization, pseudonymity, and anonymity that has brought about decentralized crypto wallets as a shrewd investment prospect.

Best Wallet Token is the native token of Best Wallet, a non-custodial wallet that cuts out middlemen, allowing data to remain secure.

It is a KYC-free software wallet that features advanced fraud protection, a cross-chain DEX, a crypto debit card, and much more.

Holding the $BEST token provides users with advantages such as free discounts, trading perks, governance rights, higher staking yields, and access to promotions on partner projects.

SUBBD

As fears of 51% attacks and fractured networks ripple through the space, SUBBD emerges as a cultural rebellion—fusing memetics, DeFi, and emotional loyalty into a statement: trust isn’t coded, it’s earned by communities that refuse to kneel.

It’s a cryptocurrency that’s ready to shake up the entire creator economy, power-packed with AI, enabling creators to generate more creative content.

Whether it’s monetization, audience engagement, content generation, or automation, SUBBD has the creators’ backs.

It operates on a Web3 platform, offering its community members the chance to interact with spicy stories and giving them the opportunity to ask their favorite models about their fantasies.

One of the popular crypto YouTubers, ClayBro, has predicted parabolic returns from the SUBBD token.

However, with so much pressure to deliver new and engaging content daily, often leading to burnout, that’s where SUBBD eases things up by eliminating creative blocks and automating half of the process.

Conclusion

Recent critiques from Ethereum advocates about Bitcoin’s limitations have sparked renewed debate about blockchain priorities and speculative discussions. While concerns over vulnerabilities fuel community debates, they also highlight ongoing innovation as the industry evolves. Savvy investors recognize that market uncertainty often precedes growth: scrutiny of Bitcoin’s limitations creates opportunities for alternative projects to gain traction.

From Bitcoin’s long-term holders to Ethereum’s advocates, and from emerging tokens to DeFi innovators, this moment could reshape market dynamics. The best crypto to buy now isn’t about hype—it’s projects that address valid concerns while demonstrating clear utility, adaptability, and sustainable use cases in a maturing ecosystem.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

2

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

3

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read -

4

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

15.07.2025 18:20 5 min. read -

5

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

04.07.2025 22:07 7 min. read

Best Crypto to Buy Now as Trump Injects Crypto Into $9 Trillion Retirement Plans

President Donald Trump is gearing up to sign an executive order that would give American workers unprecedented access to a $9 trillion retirement market by allowing 401(k) plans to hold alternative assets such as cryptocurrencies, gold, and private equity. This landmark move could usher in a new era of institutional capital for digital assets, shifting retirement […]

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

Ethereum (ETH) has just seen a record-breaking $726.74 million daily inflow into its spot ETFs. This helped send its price above $3,600 for the first time since January, with ETH currently up over 20% from this time last week. ETH has been steadily outperforming Bitcoin (BTC) over the past 30 days, hinting at an altcoin […]

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

The much‑anticipated “Crypto Week” kicked off on July 14 with high hopes for landmark legislation to formalize digital assets in the U.S. Instead, a procedural vote derailed the GENIUS Act, forcing House Speaker Mike Johnson to pull the remaining measures. Stepping into the fray, President Donald Trump convened key Republicans in a last‑ditch effort to […]

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

Meme coins are exploding this week, and traders are profiting. Bonk and Pepe have posted strong moves – and now there’s talk that a full-blown “meme coin season” could be incoming. Low cap meme coins – like TOKEN6900 – are also rocketing and taking advantage of the same retail trader demand. Currently in presale, T6900 […]

-

1

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

2

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

3

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read -

4

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

15.07.2025 18:20 5 min. read -

5

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

04.07.2025 22:07 7 min. read