Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Altcoins to Buy for a Potential May Bull Run

30.04.2025 18:49 5 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The crypto market is heating up as Bitcoin climbs closer to the $100,000 mark, signaling renewed optimism among investors. At the same time, altcoins are starting to see more inflows as investors are diversifying their BTC gains, with the largest change happening with smaller-cap tokens that show strong use cases and community traction. This shift in momentum is sparking interest across the board, particularly in projects that offer real utility, scalability, and integrations beyond hype-driven cycles.

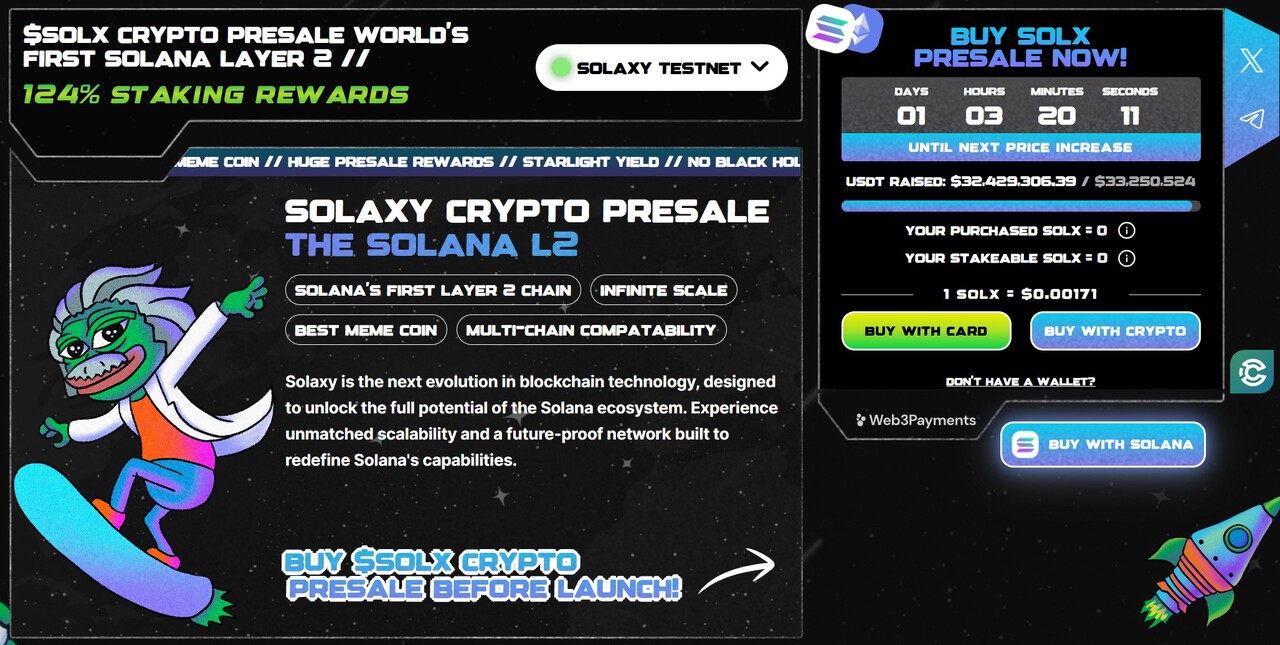

Among the altcoins gaining traction, Solaxy (SOLX) stands out as one of the most promising. As the first-ever Layer-2 built on Solana, it addresses the network’s well-known limitations (congestion and failed/spam transactions) while combining Ethereum’s liquidity with Solana’s unmatched speed. As we explore the best altcoins to buy for a potential May bull run, Solaxy earns its spot at the top.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Why We Could See a May Bull Run

Several factors suggest that the crypto market may experience a bullish trend in May:

- Increased Liquidity and Market Confidence: The global crypto market cap has rebounded to $3 trillion from a dip to the $2.5 trillion mark earlier this month. This is primarily due to the growing M2 money supply, which has increased steadily since a dip in the first quarter of 2025.

- Bitcoin’s Technical Breakout: Bitcoin has reclaimed the $94,000 price point, signaling a potential breakout from previous resistance levels. Such movements often set the tone for altcoin performance, as capital flows into alternative assets in search of higher returns.

- Macroeconomic Tailwinds: The anticipation of interest rate cuts by central banks, particularly the Federal Reserve, could prompt investors to shift toward riskier assets, such as cryptocurrencies. Lower interest rates typically reduce the appeal of traditional fixed-income investments, making crypto assets more attractive.

Solaxy (SOLX)

Solana is on the rebound, trading just below the $150 mark, and investor sentiment around the network is shifting back to bullish once again. This renewed momentum is creating ripple effects for projects building on top of Solana, especially those that offer scalable infrastructure and cross-chain functionality.

Solaxy (SOLX) is the best altcoin, well-positioned to capitalize on this wave, as it introduces the first-ever Layer-2 solution for Solana. By resolving long-standing issues like congestion and failed transactions, Solaxy supercharges the network.

What sets Solaxy apart is its ability to bridge Ethereum’s liquidity with Solana’s low-cost speed, creating a highly accessible platform for developers and meme coin traders alike. Its native token, SOLX, is currently in presale, offering entry at the lowest price tier along with staking rewards that yield a dynamic 124% APY.

With over $32 million raised in its presale, Solaxy could be the best altcoin to buy for the bull run in May.

Kamino (KMNO)

Kamino Finance (KMNO) has emerged as a leading decentralized finance (DeFi) protocol on the Solana blockchain, offering a comprehensive suite of financial products that integrate lending, liquidity provision, and leverage into a unified platform. Users can engage in activities such as borrowing and lending crypto assets, leveraging SOL staking yields, providing leveraged liquidity to decentralized exchanges (DEXs), and earning yields from automated market making.

One of Kamino’s standout features is its sophisticated oracle infrastructure. The recent integration of Chainlink Data Streams, coupled with Kamino’s in-house developed Multi-Price Oracle System, enhances the platform’s data reliability and reduces user risk by aggregating pricing from multiple high-quality sources. The KMNO token is used for staking, which gives a higher airdrop yield, and for voting in the project’s governance.

Raydium (RAY)

Raydium (RAY), a decentralized exchange and automated market maker (AMM) on Solana, has recently launched LaunchLab, a token launchpad designed to streamline the creation and distribution of new tokens, competing with the popular PumpFun. This initiative has spurred a 13% increase in the RAY token’s price and attracted over 30,000 daily active addresses to the platform.

LaunchLab’s features, such as customizable bonding curves and a no-code interface, make it accessible to a wide range of developers and projects. The platform’s fee structure, which allocates a portion of trading fees to RAY token buybacks, further incentivizes participation and supports token value.

Chainlink (LINK)

Chainlink (LINK) continues to solidify its position as a leading decentralized oracle network, facilitating the integration of real-world data into smart contracts. Recent partnerships, including collaborations with Abu Dhabi’s ADGM and Ripple, show its expanding role in bridging traditional finance with blockchain technology.

The LINK token is used to pay for services on the Chainlink oracle network, essentially powering the architecture. As efforts to tokenize real-world assets intensify, the demand for price oracles is expected to increase. In such an environment, Chainlink, as a leading oracle provider, stands to benefit the most.

Conclusion: Investing in Altcoins Could Yield Higher Returns in May

Historically, altcoins tend to deliver higher percentage returns than Bitcoin when momentum picks up, especially as capital rotates from major assets into smaller-cap tokens. In May, this dynamic could play out once again, as several altcoins are beginning to break away from Bitcoin dominance. With increasing liquidity, improving fundamentals, and bullish sentiment returning to the market, now may be the ideal time to consider well-positioned altcoins with strong use cases and early-stage opportunities.

Solaxy is one of the most compelling options in this environment. As the first Layer-2 built on Solana, it directly addresses the network’s biggest weaknesses, such as congestion and failed transactions, while seamlessly integrating Ethereum’s liquidity. This unique multi-chain capability makes Solaxy a rare bridge between two of the most active blockchain ecosystems.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Meme Coin to Buy Now: TOKEN6900 Soars to $1M in Viral Presale

23.07.2025 14:40 4 min. read -

3

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

4

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

5

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read

Best Crypto to Buy Now As UAE Bank Opens Crypto Trading to Retail Customers

For years, the Middle East has been steadily warming to digital assets, with retail interest already strong and active. But what was once seen as a parallel economy is now entering the very core of institutional banking. The change is no longer about passive support or distant partnerships. It is about integration. Institutions are not […]

Best Crypto Presale to Buy: $BEST ICO Nears $15 Million as Traders Bet Big

Bitcoin’s (BTC) resilience has been on full display this week, as the top cryptocurrency continues to trade less than 4% below its all-time high. Over the weekend, a Satoshi-era Bitcoin whale sold roughly 80,000 BTC (worth about $9.6 billion), yet the price of Bitcoin has remained within its broader uptrend. This stability under heavy selling […]

ETH Whale Wallets Hint at Altcoin Season – What Are the Best Meme Coins to Buy Now?

When ETH starts to rally with conviction and wallets swell with fresh inflows, it often foreshadows an altcoin breakout. That pattern appears to be forming again. Ethereum’s buying volume is rising faster than any other large-cap asset, yet the wider altcoin space has yet to catch up. This publication is sponsored. CryptoDnes does not endorse […]

With Cardano (ADA) Slipping Out of Top 20, Investors Prefer Unilabs (UNIL) & SUI For Staking ROI

As the Cardano price risks dropping out of the top 20 rankings, a major shift is shaking up the crypto landscape. Investors are rotating their capital toward promising alternatives like the SUI Blockchain and Unilabs Finance, a newcomer powered by artificial intelligence. This publication is sponsored. CryptoDnes does not endorse and is not responsible for […]

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Meme Coin to Buy Now: TOKEN6900 Soars to $1M in Viral Presale

23.07.2025 14:40 4 min. read -

3

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

4

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

5

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read