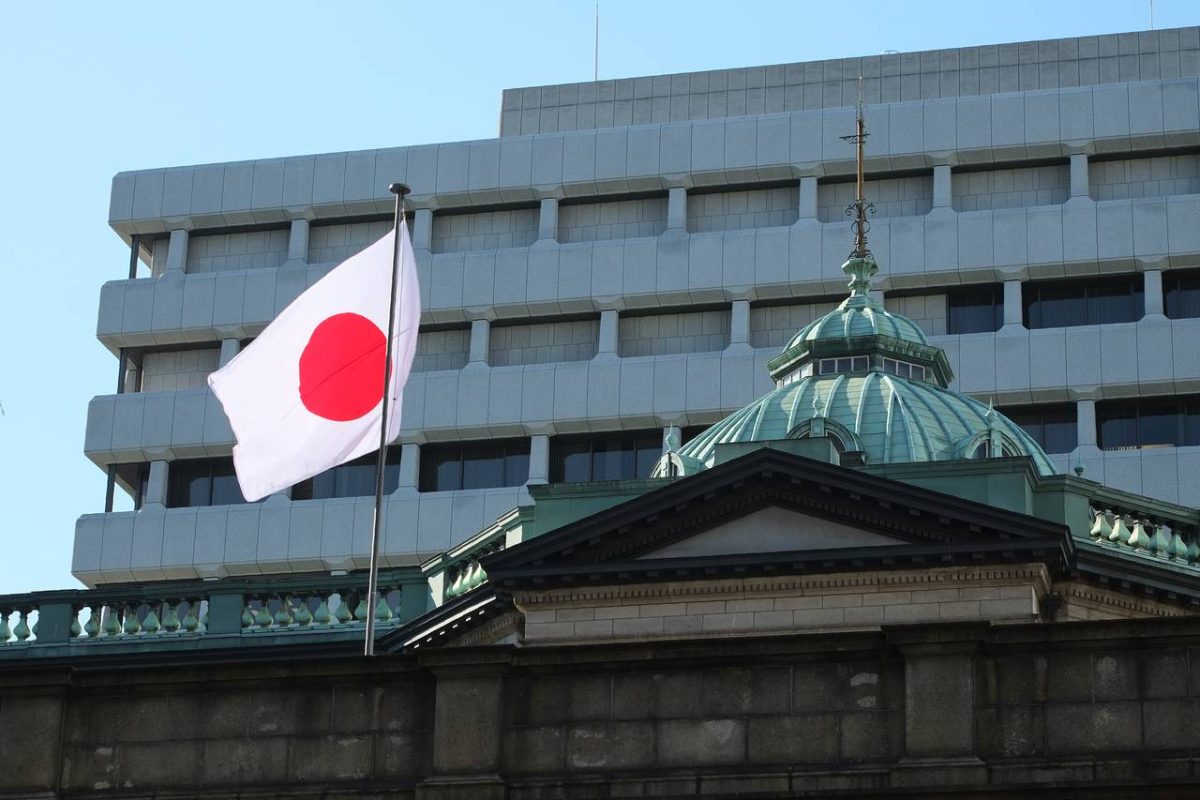

Bank of Japan Holds Interest Rates Amid Election Uncertainty

02.11.2024 13:00 1 min. read Alexander Stefanov

The Bank of Japan (BOJ) has chosen to hold its benchmark policy rate steady at 0.25% amid political uncertainties following Japan’s recent election.

BOJ Governor Kazuo Ueda confirmed the decision after the central bank’s October 30-31 policy meeting, stating that the bank remains focused on meeting its inflation target. The BOJ raised its rate to 0.25% earlier this year, moving out of a long period of negative interest rates.

In his remarks, Ueda discussed Japan’s current economic and political landscape, noting that the BOJ will analyze global and domestic factors before any future rate hikes.

Despite political shifts and recent losses by the ruling Liberal Democratic Party, Ueda assured that political changes won’t directly impact the bank’s inflation forecasts, though adjustments will be considered if needed.

Economists view the BOJ’s recent report as signaling a potential rate hike, with some experts forecasting an increase by year-end as the yen weakens.

Goldman Sachs Japan’s senior advisor, Akira Otani, predicted a rate rise by early next year, largely influenced by global economic trends. Meanwhile, Prime Minister Shigeru Ishiba, if re-elected, plans to propose a supplementary budget and may convene a new Diet session in November.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read