Are Crypto Investors Losing Interest in Hamster Kombat?

24.10.2024 18:00 1 min. read Kosta Gushterov

Hamster Kombat, the leading "tap-to-earn" game of 2024, is currently facing significant difficulties.

The game’s official Telegram channel has experienced a notable decline in its subscriber base, dropping from 60.7 million to 55 million in October, which translates to a loss of over 200,000 subscribers each day.

Despite this downturn, Hamster Kombat continues to hold a position as one of the most popular channels on Telegram.

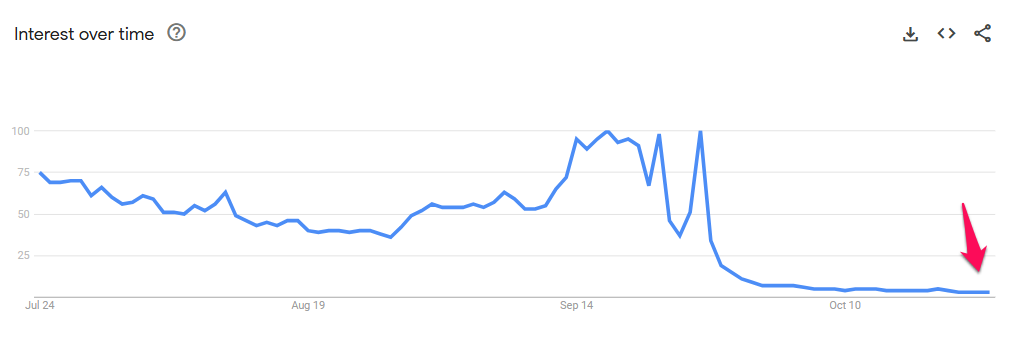

The game’s visibility has also suffered, as evidenced by a drastic drop in search interest on Google Trends. This metric fell sharply from a peak score of 100 in September to just 3 in October, reflecting the community’s disappointment with a recent airdrop campaign that failed to meet expectations.

In addition to dwindling interest, the price of HMSTR saw a more than 8% decline on October 23, reaching a new low of $0.003. The market capitalization of the token has dropped dramatically, plummeting from over $600 million to approximately $218 million.

Furthermore, the average trading volume has significantly decreased, falling from over $200 million in September to around $50 million in October. This decline highlights a growing lack of investor interest in the game, raising concerns about its future viability.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

Can Stellar bounce again? XLM returns to crucial retest zone

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

Altcoin Breakout: ResearchCoin, Electroneum, and REI Network Lead The Rally

A wave of bullish momentum is sweeping through smaller-cap altcoins, with ResearchCoin (RSC), Electroneum (ETN), and REI Network (REI) all recording substantial 24-hour gains.

ETF Speculation and Legal Clarity Renew Optimism for XRP and Solana

XRP is drawing fresh investor attention as optimism builds around its legal standing and potential exchange-traded products (ETPs).

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read