Analysts See Bitcoin Eyeing $200K in 2025 as Bull Cycle Unfolds

25.05.2025 18:00 1 min. read Alexander Stefanov

Bitcoin’s historic surge past $111,000 this week has reignited speculation over just how far the rally could go—some analysts are now eyeing $200,000 by the end of 2025.

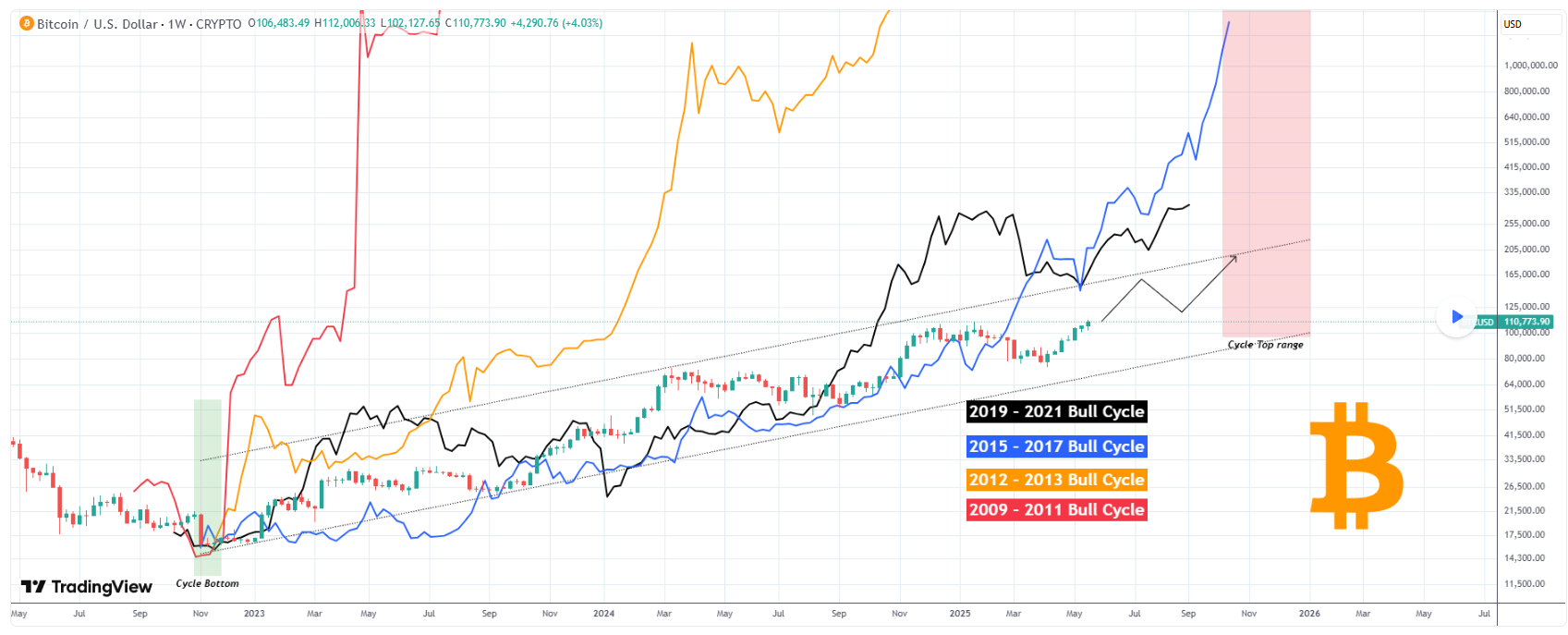

A recent projection from market analysis firm TradingShot points to a potential peak in late 2025, citing long-term chart patterns that have guided previous bull runs. Although the current cycle is considered the weakest in Bitcoin’s history, TradingShot argues it still aligns with an overarching growth trend shaped by the market’s gradual maturity.

Unlike the explosive gains of the early 2010s, Bitcoin’s trajectory has slowed—but not stalled. Each cycle, they note, shows a repeating pattern: a brief deviation followed by a reversion to trend. Their model suggests Bitcoin may once again accelerate later this year, potentially reaching between $150,000 and $200,000 by Q4 2025.

READ MORE:

How Bitcoin Hyper’s Four Technical Pillars Make BTC Practical for Everyday Use And Raised $200,000

This perspective isn’t unique. Seasoned trader Peter Brandt has also suggested a $150,000 target by August 2025, driven by the breakout above previous highs. Meanwhile, analyst Gert van Lagen pointed to Bitcoin’s consistent use of exponential patterns like the “cup and handle,” suggesting the final peak could be multiples above today’s prices.

While no forecast is guaranteed, the consensus is forming: Bitcoin’s momentum may just be getting started.

-

1

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

2

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

5

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

-

1

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

2

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

5

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read