Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

XRP Eyes Further Gains as Investor Activity Picks Up

April 28, 2025 14:00 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

XRP has caught the attention of investors lately, thanks to a strong price jump over the past seven days. Now trading near $2.28, the asset’s growth comes alongside a broader market rebound that’s reigniting optimism across the crypto space.

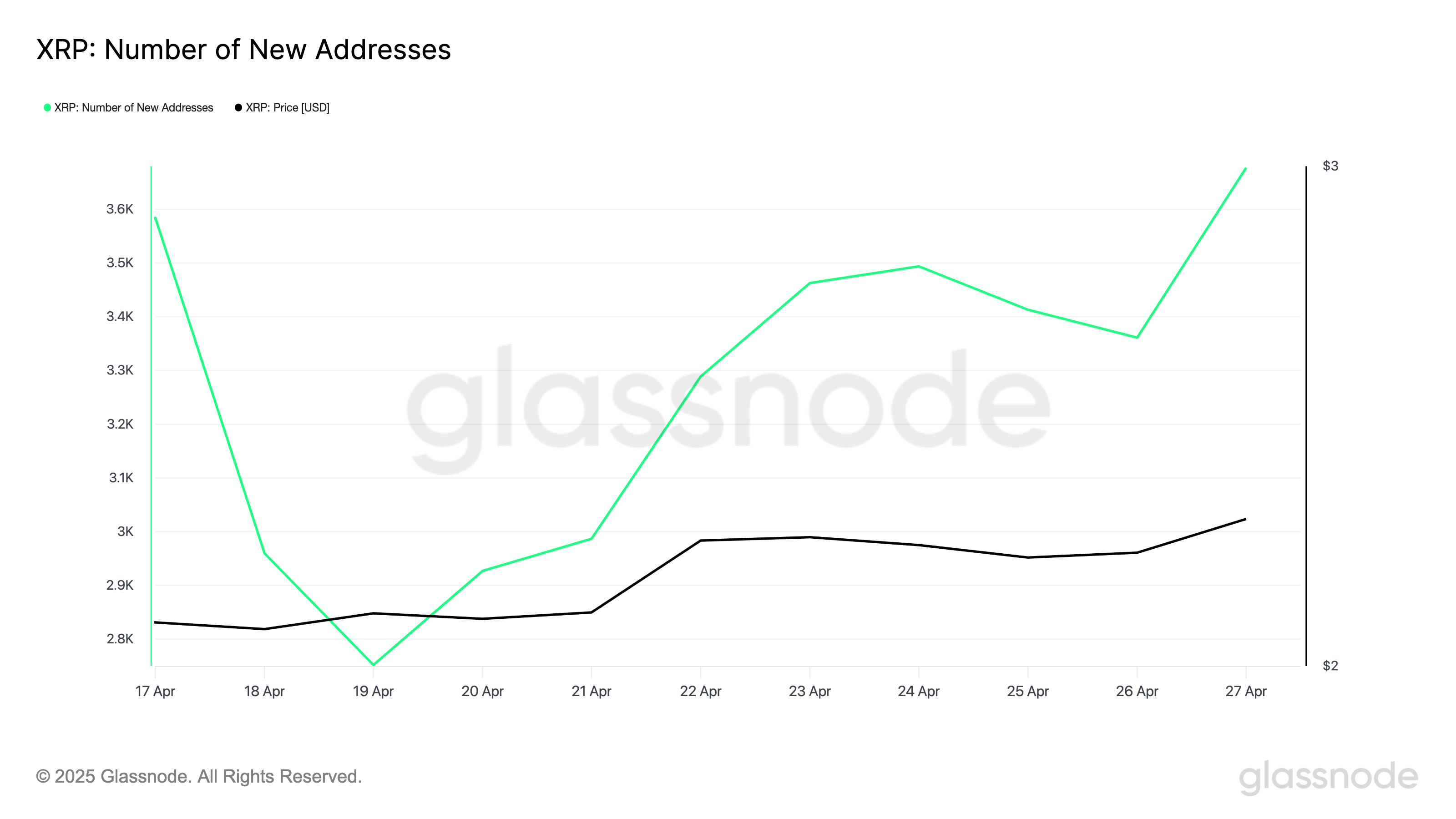

A major factor behind XRP’s recent strength appears to be a surge in new wallet creations. Data from Glassnode shows that the number of new XRP addresses reached 3,677 on April 28, marking the highest figure seen in two weeks. When new wallets spike like this, it often points to fresh investor interest and the injection of new money into the ecosystem — both essential ingredients for sustaining upward price movements.

Meanwhile, those who have held XRP for a significant period — more than five months — seem to be staying put. This is reflected in the drop of XRP’s Liveliness metric, which now stands at 0.81, its lowest point since early December. A decline in this metric typically suggests older coins aren’t moving, signaling that seasoned holders are choosing to sit tight rather than cashing out — a positive sign for market stability.

On the technical front, XRP’s momentum remains solid. The Relative Strength Index (RSI) has been climbing steadily and currently sits at 60.10. While it hasn’t crossed into “overbought” territory yet, the upward trend suggests buying pressure continues to outweigh selling. If XRP can maintain this momentum and push past resistance around $2.29, there’s a real possibility it could aim for the $2.50 mark next.

In short, growing demand from new entrants combined with the patience of veteran holders could set the stage for XRP to extend its rally in the near future.

XRP Stuck Between Key Levels as Market Awaits Breakout or Breakdown

XRP is currently navigating a pivotal moment, according to a new report from crypto analytics firm MakroVision. While the broader downward trajectory hasn’t reversed, the asset appears to be entering a phase of consolidation. Analysts at MakroVision highlight that XRP is struggling to decisively move beyond a key resistance zone between $2.19 and $2.30. This […]

Can XRP Overcome Resistance, or Is a Drop to $2 Next?

XRP, one of the top altcoins by market cap, held steady around $2.35 on March 27, despite mounting selling pressure. Traders have poured nearly $400 million into short positions over the past month, creating a barrier that has kept the price from breaking higher. With April approaching, the question is whether XRP can overcome this […]

Analysts Predict Massive XRP Surge – Could Triple Digits Be Next?

Analysts are making bold predictions about XRP’s future, with XRP Captain suggesting it could hit triple digits this cycle, though he provided no clear timeline or catalyst. Egrag Crypto expects XRP to reach double digits now and triple digits in the next cycle, while Dark Defender sees a potential surge to $333 if history repeats. […]

Is XRP on the Verge of a Massive Breakout?

XRP has been struggling to gain momentum, following the broader decline in the cryptocurrency market after the recent White House Crypto Summit. While price action remains volatile, analysts believe the token still holds significant long-term potential. Some experts suggest that XRP could replicate its historic bull run from 2017-2018, when it skyrocketed over 700%. If […]

-

1

XRP Makes Strong Comeback in Recent Rally – Is the Bullish Trajectory Sustainable?

15.07.2024 16:00 2 min. read -

2

XRP Price Analysis: Key Levels to Watch as Bullish Momentum Builds

16.01.2025 16:30 2 min. read -

3

XRP Targets $10 Amid Consolidation, Key Resistance Levels in Focus

28.01.2025 15:00 2 min. read -

4

XRP May Be Heading for a Major Price Surge – Here is Why

30.07.2024 13:37 1 min. read -

5

XRP Struggles Against Bitcoin as Developers Shift to Other Blockchains

09.09.2024 9:00 2 min. read