Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin Price Struggles with Resistance as Market Faces Volatility

August 16, 2024 13:30 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Over the past week, the price of Bitcoin has fluctuated within a narrow range of $57,815 to $61,815, encountering persistent resistance at the 50-day simple moving average (SMA) of $61,662.

At the time of writing, the price of Bitcoin (BTC) is around $58,500, reflecting a slight 0.7% spike over the past day. This marks a decline of 4% from its price seven days ago.

According to data provided by analytics company Glassnode, the recent volatility in the price of Bitcoin can be attributed in part to “weakness in spot demand.”

Glassnode assessed the current net balance of buying and selling in the spot Bitcoin market by analyzing the cumulative volume delta (CVD), which helps identify any directional trend in market activity.

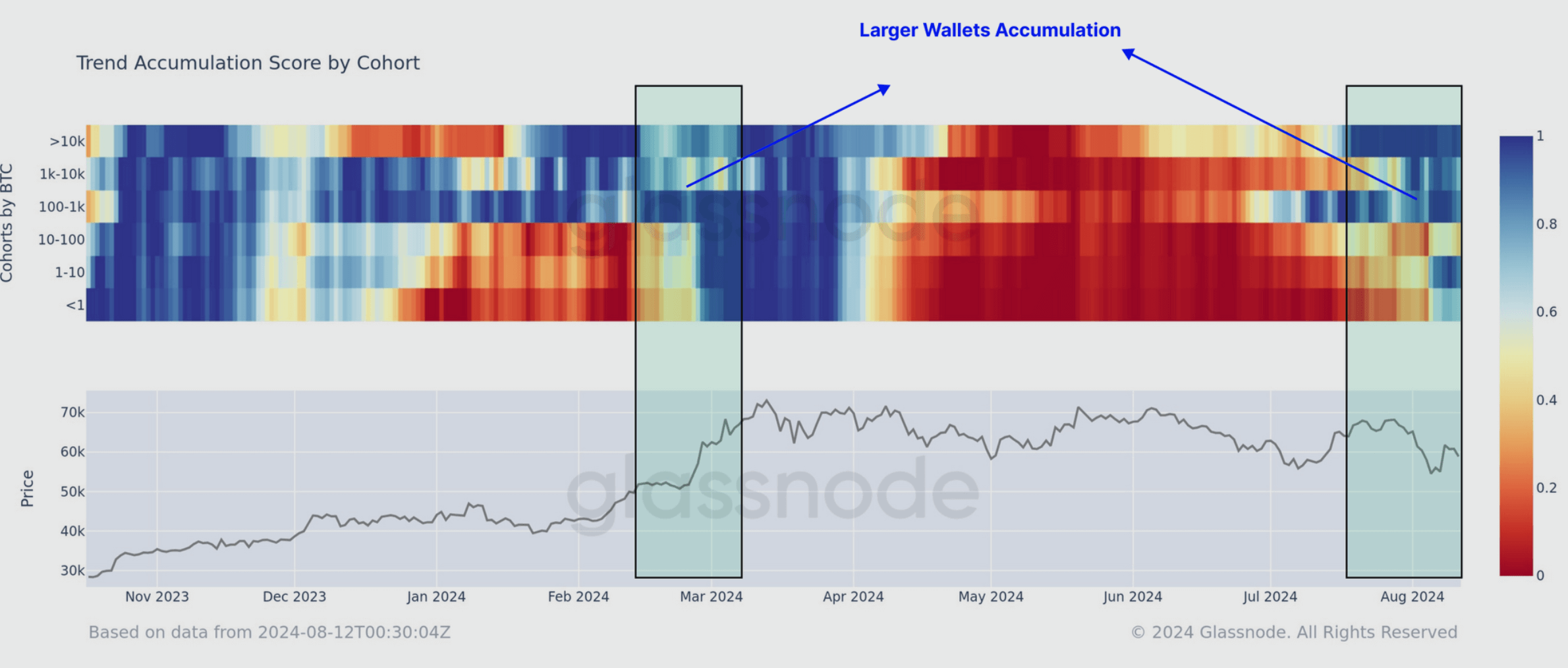

The company’s chain data shows that since Bitcoin reached an all-time high in March, the market has gone through a prolonged period of supply distribution, with portfolios of all sizes participating.

In recent weeks, however, there have been early signs of a reversal, particularly among the largest size portfolios, which are often associated with institutional investors such as ETFs. These large portfolios appear to be shifting back toward accumulation.

Glassnode experts suggest that spot market demand could resume if the adjusted CVD measure crosses the zero line and moves into positive territory. If that happens, Bitcoin could potentially break out of its current consolidation phase, to exceed the supply congestion zone of $70,000 to $72,000.

Bitcoin Price Predictions: Key Scenarios From Top Crypto Analysts

Bitcoin’s breakout past $118,000 has reignited bullish momentum, with multiple crypto analysts projecting even higher price targets in the months ahead. From chart pattern confirmations to long-term cycle models, several experts agree that the current market setup is entering a powerful phase of upward acceleration. CryptoCon: $184K is the golden number CryptoCon points to a […]

Is Bitcoin Headed for a Repeat of 2021? Analysts Sound the Alarm as Price Stalls

Bitcoin’s prolonged sideways movement near $105,000 has sparked comparisons to the 2021 market peak, with concerns growing that history may be repeating itself. Veteran trader Peter Brandt has drawn attention to the eerie similarities between current price action and the distribution phase that preceded Bitcoin’s dramatic collapse from $69,000 to $15,500 just a few years […]

Analyst Predicts Short-Term Dip Before Bitcoin Targets $160K

A well-followed crypto market analyst known for accurate Bitcoin forecasts suggests the top cryptocurrency may be gearing up for a temporary pullback before setting the stage for a major rally. According to the pseudonymous chartist Dave the Wave, Bitcoin could slide toward the $96,000 zone—just above a key Fibonacci support level—before resuming its long-term uptrend. […]

Analyst Warns Bitcoin May Stall at $90K Before Pushing Higher

A prominent crypto analyst known for accurately predicting the 2021 market downturn is urging caution as Bitcoin flirts with higher levels. Instead of expecting a straight shot to new highs, the trader suggests a sharp but temporary cooldown may come first. Posting under the alias Dave the Wave, the analyst told his followers on social […]

-

1

Bitcoin Price Predictions: Key Scenarios From Top Crypto Analysts

11.07.2025 16:20 2 min. read -

2

Bitcoin Poised for New Highs? Analyst Says $101K Is the Key

22.02.2025 16:00 1 min. read -

3

Bitcoin Set for Six-Figure Surge, But Expect a Pullback First

28.03.2025 11:00 2 min. read -

4

Bitcoin’s Bullish Pattern Might Be a Trap, Warns Veteran Trader

30.03.2025 22:00 1 min. read -

5

Bitcoin Poised for Breakout as Historic Pattern Points to $150K Target

13.04.2025 8:00 2 min. read