Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Cardano Sees Steady Growth as Big Holders Lock In for the Long Term

November 7, 2024 13:00 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

With Cardano whales holding off on selling, ADA gained 3.66% in the last day, supporting a slow but steady climb.

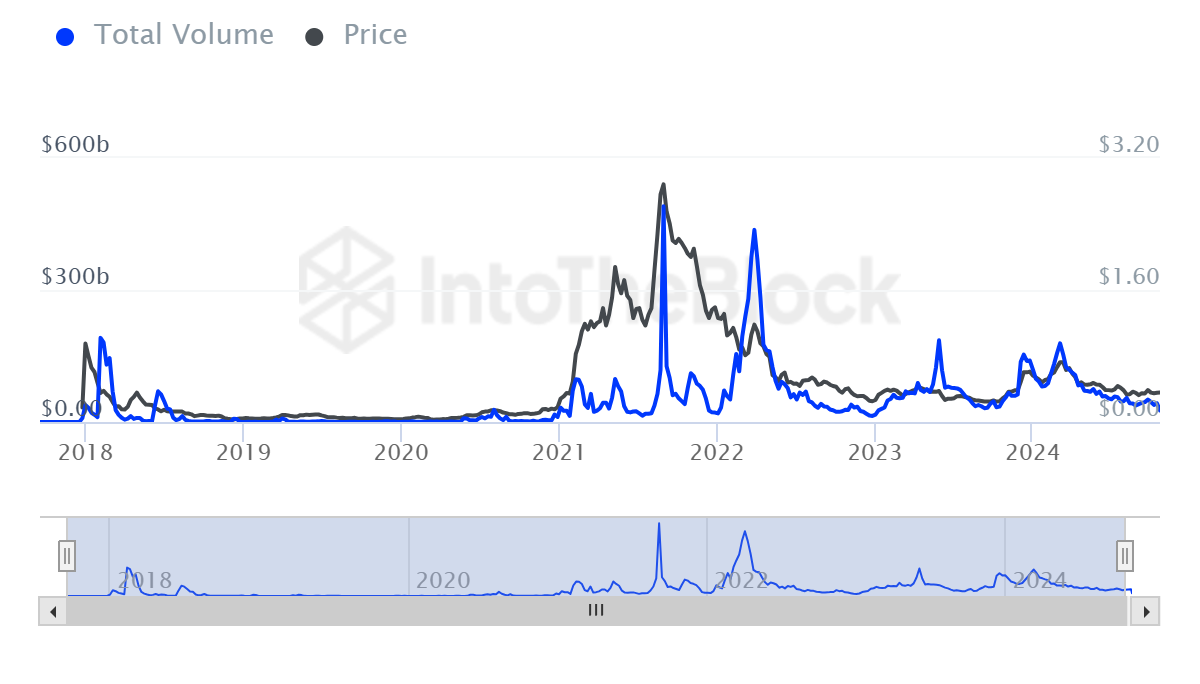

The latest data indicates a significant decrease in the “Large Holder Netflow” metric for ADA, which measures the net inflow and outflow of assets held by major investors. This metric fell by 1,181.52% over the past week, suggesting that these investors are moving ADA from exchanges to private wallets, likely indicating a shift toward holding long-term. Such a move could lead to a supply squeeze, which often has the potential to increase the coin’s value if demand persists.

The uptick in high volume transactions could also be a positive signal if buying activity continues.

This trend of accumulation might provide support for ADA’s price growth and potentially drive up trading volumes in the coming sessions.

Also, Open Interest (OI) for ADA has increased increased by 8% in the last 24 hours, according to Coinalyze data, indicating that more traders are opening long positions, possibly adding momentum to ADA’s current price trend.

On a broader scale, though, ADA’s Total Value Locked (TVL) has not shown significant movement, remaining neutral. An increase in TVL would likely strengthen ADA’s ongoing upward movement, signaling more robust investor interest in the platform’s ecosystem.

Cardano Faces Renewed Pressure as Key Metrics Point to Bearish Outlook

Cardano is navigating a rough patch as bearish market sentiment continues to weigh on its price. With recent trading activity failing to produce meaningful gains, short-term investors are showing signs of fatigue — and potentially preparing to cash out. Data from on-chain analytics suggests that holders who recently entered the market are now sitting on […]

Cardano’s Price Dip: An Opportunity for Investors Eyeing a Recovery

Cardano (ADA) has recently seen a notable decline in its price, dropping by 22% in the past few days. While this decrease might raise concerns for some, it may actually present an attractive opportunity for long-term investors. The current dip is being viewed as a chance for buyers to acquire ADA at lower prices, fueling […]

Cardano’s ADA Holds Strong as Investors Bet Big on a $2 Target

Cardano (ADA) continues to maintain its price around the $1.20 level, after a significant surge in the past 30 days. Despite giving up some of its earlier weekly gains, analysts believe the cryptocurrency is holding strong and preparing for a potential rally that could push its price towards $2. Key support levels play a vital […]

Cardano Shows Strong Momentum Amid Bullish Market Trends

Cardano (ADA) has been on a remarkable rally, climbing nearly 42% over the past week and capturing the attention of crypto enthusiasts. This strong uptrend is backed by technical indicators like the ADX, which signal sustained bullish momentum. However, short-term market signals hint at potential consolidation ahead if buying pressure falters. The Average Directional Index […]

-

1

Cardano’s Price Dip: An Opportunity for Investors Eyeing a Recovery

04.02.2025 19:00 2 min. read -

2

Cardano Shows Strength – is a $10 Surge Possible?

05.03.2024 20:05 2 min. read -

3

Cardano Faces Renewed Pressure as Key Metrics Point to Bearish Outlook

19.04.2025 8:00 2 min. read -

4

Cardano Sees Steady Growth as Big Holders Lock In for the Long Term

07.11.2024 13:00 2 min. read -

5

Cardano Sees Strong Price Momentum as Analysts Set Bullish Targets

21.11.2024 14:00 2 min. read