Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Cardano Faces Renewed Pressure as Key Metrics Point to Bearish Outlook

April 19, 2025 8:00 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Cardano is navigating a rough patch as bearish market sentiment continues to weigh on its price. With recent trading activity failing to produce meaningful gains, short-term investors are showing signs of fatigue — and potentially preparing to cash out.

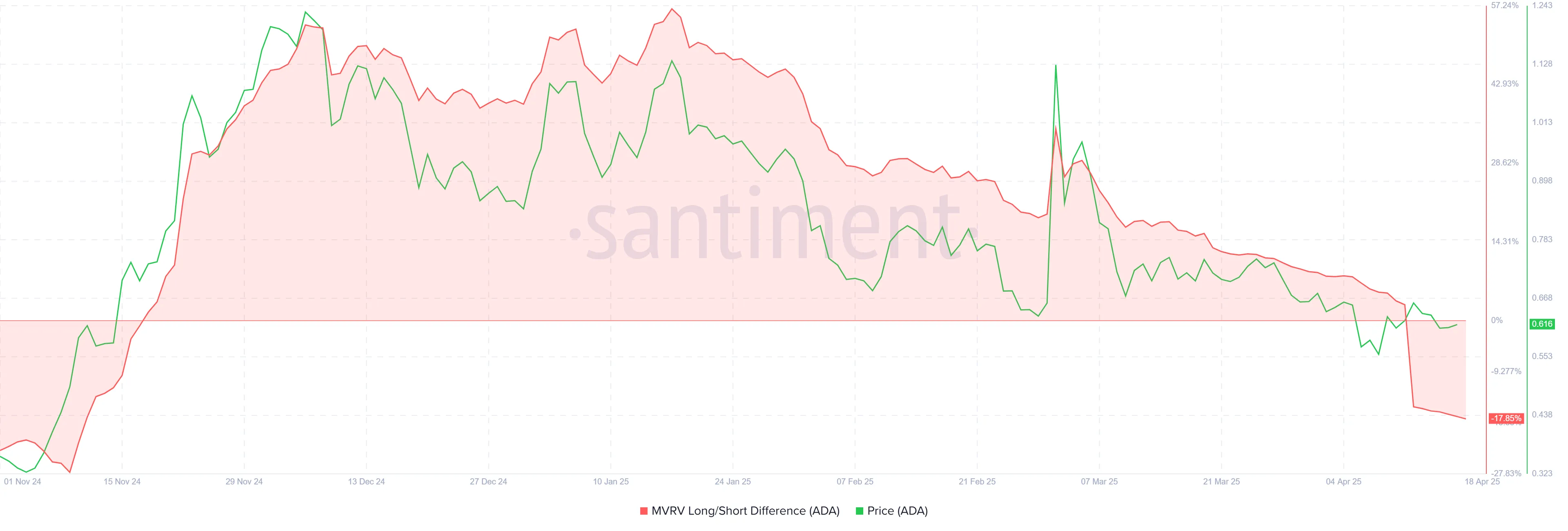

Data from on-chain analytics suggests that holders who recently entered the market are now sitting on the largest unrealized profits since late 2024. The Market Value to Realized Value (MVRV) Long/Short Difference has fallen to its lowest point in five months, dropping to -18%. Historically, when this metric enters negative territory, short-term holders are more likely to sell, adding to downward pressure on price.

The situation could spell trouble for ADA if selling accelerates, especially as confidence across the broader market remains shaky. One of the clearest indicators of this waning enthusiasm is the Chaikin Money Flow (CMF), which has remained below the neutral line since November. Persistent outflows and a lack of fresh capital entering the ecosystem reflect investor hesitation and growing disinterest in risk assets like ADA.

Cardano has also failed to recover key technical levels. Despite multiple attempts, the price remains pinned below the $0.63 resistance. Currently trading near $0.61, ADA has been unable to reverse a month-long downtrend. If the bearish sentiment persists, there’s a risk of retesting lower support around $0.57 — a level that, if breached, could deepen the losses and delay any potential recovery.

Still, a reversal isn’t entirely off the table. Should the overall crypto market regain momentum and confidence return, a breakout above $0.63 could flip that resistance into a new support level. In such a scenario, ADA might aim for a push toward $0.70 — a move that would mark a significant shift in trend.

For now, though, caution continues to define investor behavior, and Cardano’s outlook remains fragile as key indicators lean heavily toward the bears.

Cardano’s Price Dip: An Opportunity for Investors Eyeing a Recovery

Cardano (ADA) has recently seen a notable decline in its price, dropping by 22% in the past few days. While this decrease might raise concerns for some, it may actually present an attractive opportunity for long-term investors. The current dip is being viewed as a chance for buyers to acquire ADA at lower prices, fueling […]

Cardano’s ADA Holds Strong as Investors Bet Big on a $2 Target

Cardano (ADA) continues to maintain its price around the $1.20 level, after a significant surge in the past 30 days. Despite giving up some of its earlier weekly gains, analysts believe the cryptocurrency is holding strong and preparing for a potential rally that could push its price towards $2. Key support levels play a vital […]

Cardano Shows Strong Momentum Amid Bullish Market Trends

Cardano (ADA) has been on a remarkable rally, climbing nearly 42% over the past week and capturing the attention of crypto enthusiasts. This strong uptrend is backed by technical indicators like the ADX, which signal sustained bullish momentum. However, short-term market signals hint at potential consolidation ahead if buying pressure falters. The Average Directional Index […]

Cardano Sees Strong Price Momentum as Analysts Set Bullish Targets

The cryptocurrency’s daily trading volume has reached a seven-month high, topping $52 billion, while whale transactions have also spiked, reaching levels not seen in six months. In addition to this, the open interest (OI) in ADA futures has increased significantly, with OI hitting $735 million. This growing momentum has prompted analysts to reassess Cardano’s potential […]

-

1

Cardano’s Price Dip: An Opportunity for Investors Eyeing a Recovery

04.02.2025 19:00 2 min. read -

2

Cardano Faces Renewed Pressure as Key Metrics Point to Bearish Outlook

19.04.2025 8:00 2 min. read -

3

Cardano Shows Strength – is a $10 Surge Possible?

05.03.2024 20:05 2 min. read -

4

Cardano Sees Steady Growth as Big Holders Lock In for the Long Term

07.11.2024 13:00 2 min. read -

5

Cardano Sees Strong Price Momentum as Analysts Set Bullish Targets

21.11.2024 14:00 2 min. read