Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin Faces Further Price Drop Amid Government Move

July 30, 2024 14:30 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

After starting the week strongly, Bitcoin has recently seen a downturn. Currently priced at $66,500, Bitcoin has slipped by 4.5% in the past 24 hours.

This decline may be linked to the U.S. government’s recent transfer of $2 billion in Bitcoin seized from the Silk Road operation.

Veteran trader Roman Trading forecasts that Bitcoin might drop further to around $60,000.

$BTC 1D

Eyeing price targets of 64 & 60k respectively.

Showing bear divs with a possible DT reversal setup.

My bet is sentiment gets ultra bearish at these levels then we full send up once again.#bitcoin #cryptocurrency #cryptonews pic.twitter.com/YWPA6kPRoY

— Roman (@Roman_Trading) July 29, 2024

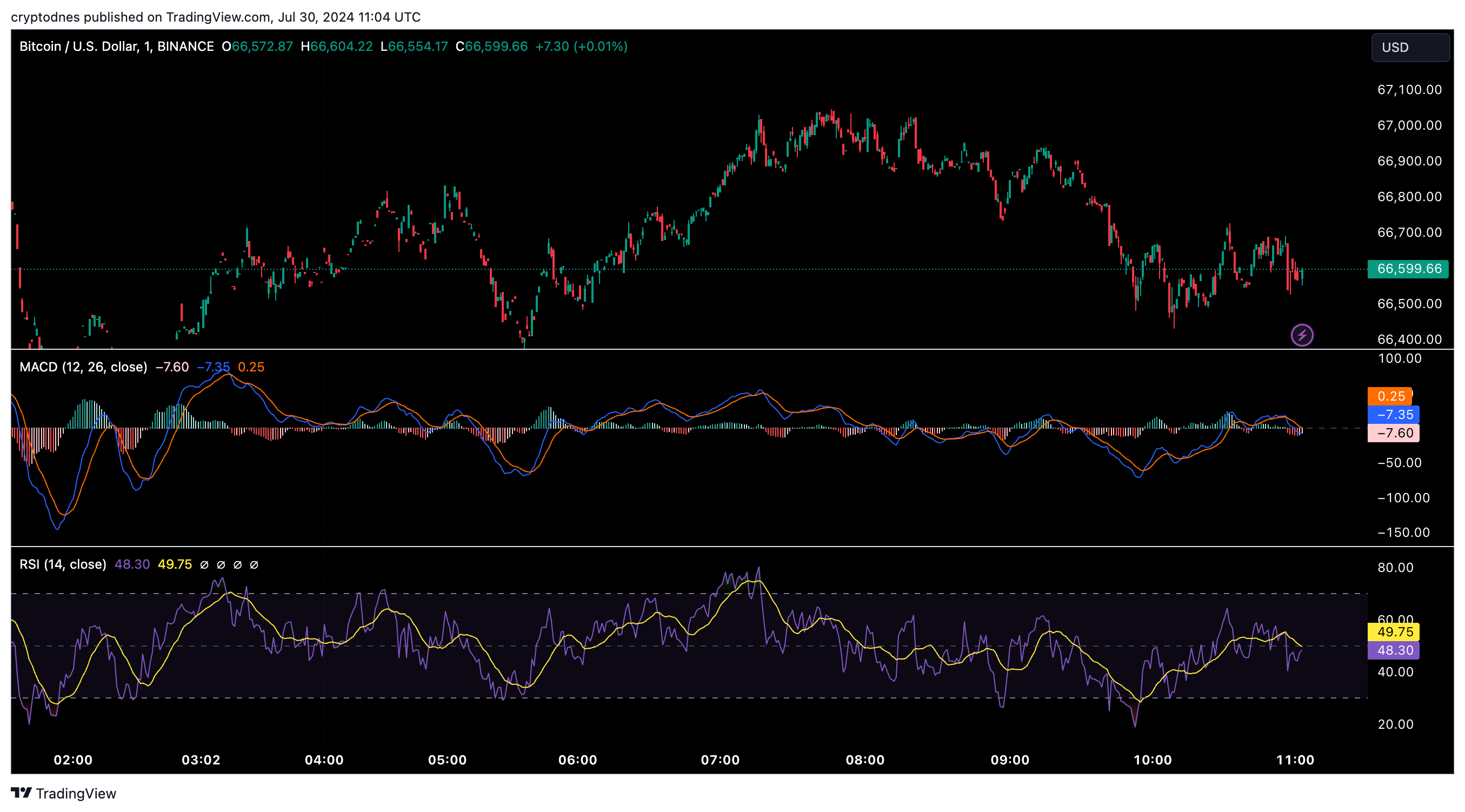

He points to bearish divergence on the 1-day chart, where despite price highs, momentum indicators like RSI and MACD are not aligning.

This pattern could signal a possible double-top reversal, suggesting Bitcoin might be on the verge of a correction.

The recent decline from $69,811 to around $66,500 adds weight to this bearish outlook. Roman Trading highlights that Bitcoin’s ability to hold the $66,000 resistance level is crucial. If it fails, attention will shift to potential support levels at $64,000 and $60,000.

READ MORE:

Why is Bitcoin (BTC) Back to $67,000?

Additionally, the U.S. government’s transfer of $2 billion in Bitcoin might have influenced the market. The transfer, involving 29,800 BTC moved to a new address and then dispersed further, followed Donald Trump’s recent announcement to acquire Bitcoin.

Despite the current negative sentiment, Roman Trading remains hopeful. He suggests that an overly pessimistic market could set the stage for a significant price rebound, as anxious traders might create favorable conditions for a future rally.

Is Bitcoin Headed for a Repeat of 2021? Analysts Sound the Alarm as Price Stalls

Bitcoin’s prolonged sideways movement near $105,000 has sparked comparisons to the 2021 market peak, with concerns growing that history may be repeating itself. Veteran trader Peter Brandt has drawn attention to the eerie similarities between current price action and the distribution phase that preceded Bitcoin’s dramatic collapse from $69,000 to $15,500 just a few years […]

Analyst Predicts Short-Term Dip Before Bitcoin Targets $160K

A well-followed crypto market analyst known for accurate Bitcoin forecasts suggests the top cryptocurrency may be gearing up for a temporary pullback before setting the stage for a major rally. According to the pseudonymous chartist Dave the Wave, Bitcoin could slide toward the $96,000 zone—just above a key Fibonacci support level—before resuming its long-term uptrend. […]

Analyst Warns Bitcoin May Stall at $90K Before Pushing Higher

A prominent crypto analyst known for accurately predicting the 2021 market downturn is urging caution as Bitcoin flirts with higher levels. Instead of expecting a straight shot to new highs, the trader suggests a sharp but temporary cooldown may come first. Posting under the alias Dave the Wave, the analyst told his followers on social […]

Here’s Why Bitcoin Could Break $100K Sooner Than You Think

Bitcoin’s recent performance has renewed investor optimism, with the asset climbing 13% over the past month. Although it hasn’t yet broken the $100,000 threshold, several key indicators suggest a return to previous highs could be on the horizon. One of the clearest signs of growing confidence is the continued drop in exchange-held Bitcoin. When fewer […]

-

1

Bitcoin Poised for New Highs? Analyst Says $101K Is the Key

22.02.2025 16:00 1 min. read -

2

Bitcoin Set for Six-Figure Surge, But Expect a Pullback First

28.03.2025 11:00 2 min. read -

3

Bitcoin’s Bullish Pattern Might Be a Trap, Warns Veteran Trader

30.03.2025 22:00 1 min. read -

4

Bitcoin Poised for Breakout as Historic Pattern Points to $150K Target

13.04.2025 8:00 2 min. read -

5

Bitcoin Faces Risk of Major Decline After Months Without New Highs

14.10.2024 9:00 2 min. read