Altcoins Face Uncertainty as Bitcoin Shows Signs of Strength

27.04.2025 10:00 2 min. read Alexander Stefanov

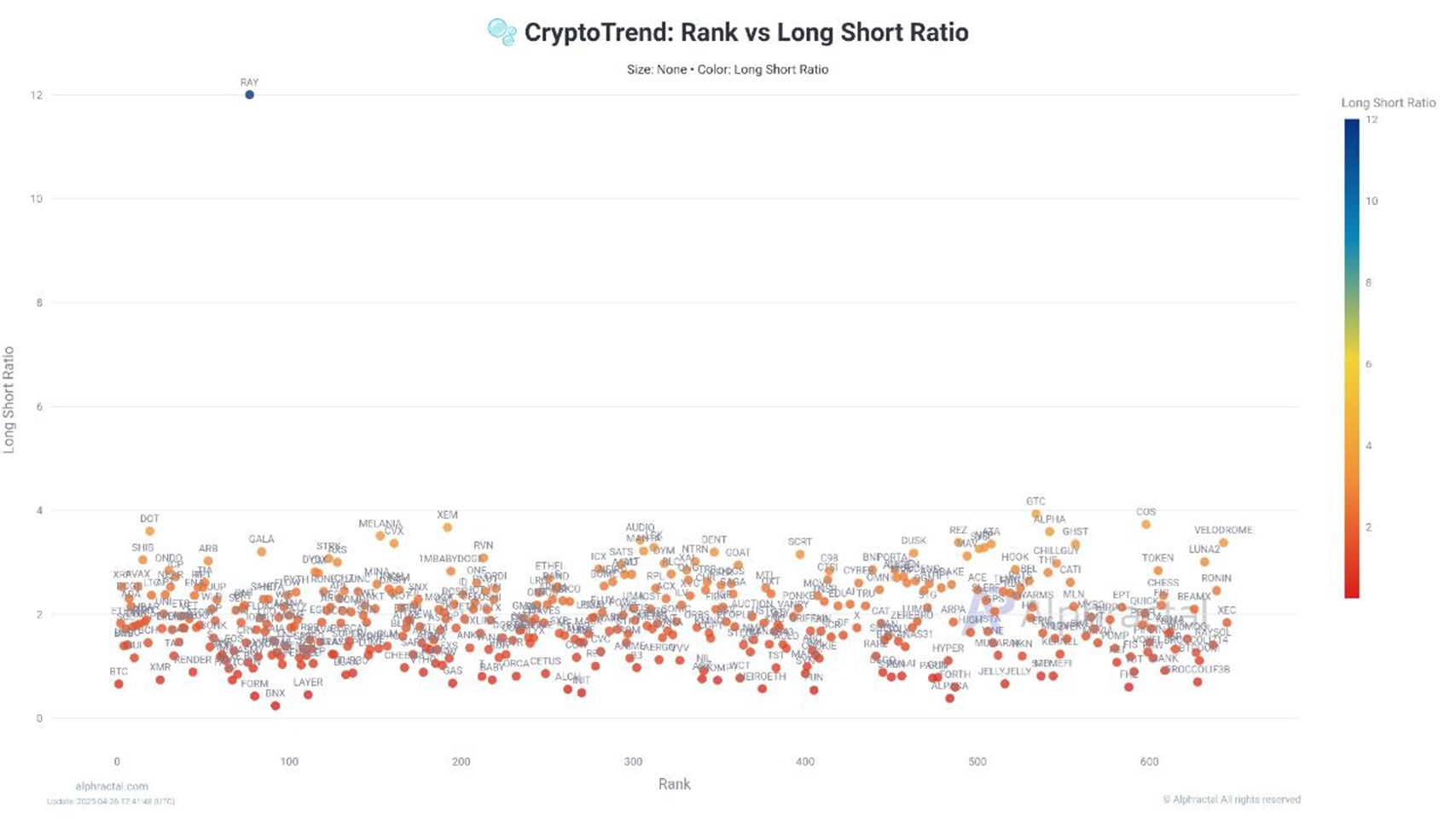

Crypto analytics firm Alphractal has released new insights into the altcoin market, highlighting RAY as the token with the highest long-to-short ratio among major altcoins.

Other coins showing a heavy tilt toward long positions include GTC, COS, DOT, ALPHA, MELANIA, AUDIO, and REZ.

The analysts warned that an unusually high long/short ratio doesn’t always favor price growth. In fact, it often weighs on performance, although in some cases it can trigger a reversal if a short squeeze plays out.

That said, Alphractal pointed out that for a genuine squeeze scenario to develop, a noticeable uptick in Open Interest would be needed — something they don’t currently see happening. As a result, they expect altcoin prices to mostly drift sideways in the near term.

Meanwhile, on the Bitcoin side, Alphractal’s CEO Joao Wedson flagged a bullish signal emerging on Binance. He pointed to the Bitcoin/Stablecoin Reserve Ratio moving within the $76,000 to $77,000 range — a pattern that historically preceded major Bitcoin rallies, notably after the 2020 COVID crash and again at the end of 2022.

Wedson explained that rising stablecoin reserves relative to Bitcoin holdings suggest that fresh capital is ready to move into the market, potentially setting the stage for another upward surge.

Despite the cautious tone on altcoins, Alphractal’s report hints that broader market conditions could soon shift if Bitcoin leads another rally. Analysts noted that strong Bitcoin momentum often pulls liquidity back into riskier assets, meaning any significant Bitcoin breakout could eventually breathe new life into altcoin markets as well.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read