Altcoin Volume on Binance Hits Highest Level Since February

22.07.2025 16:30 1 min. read Kosta Gushterov

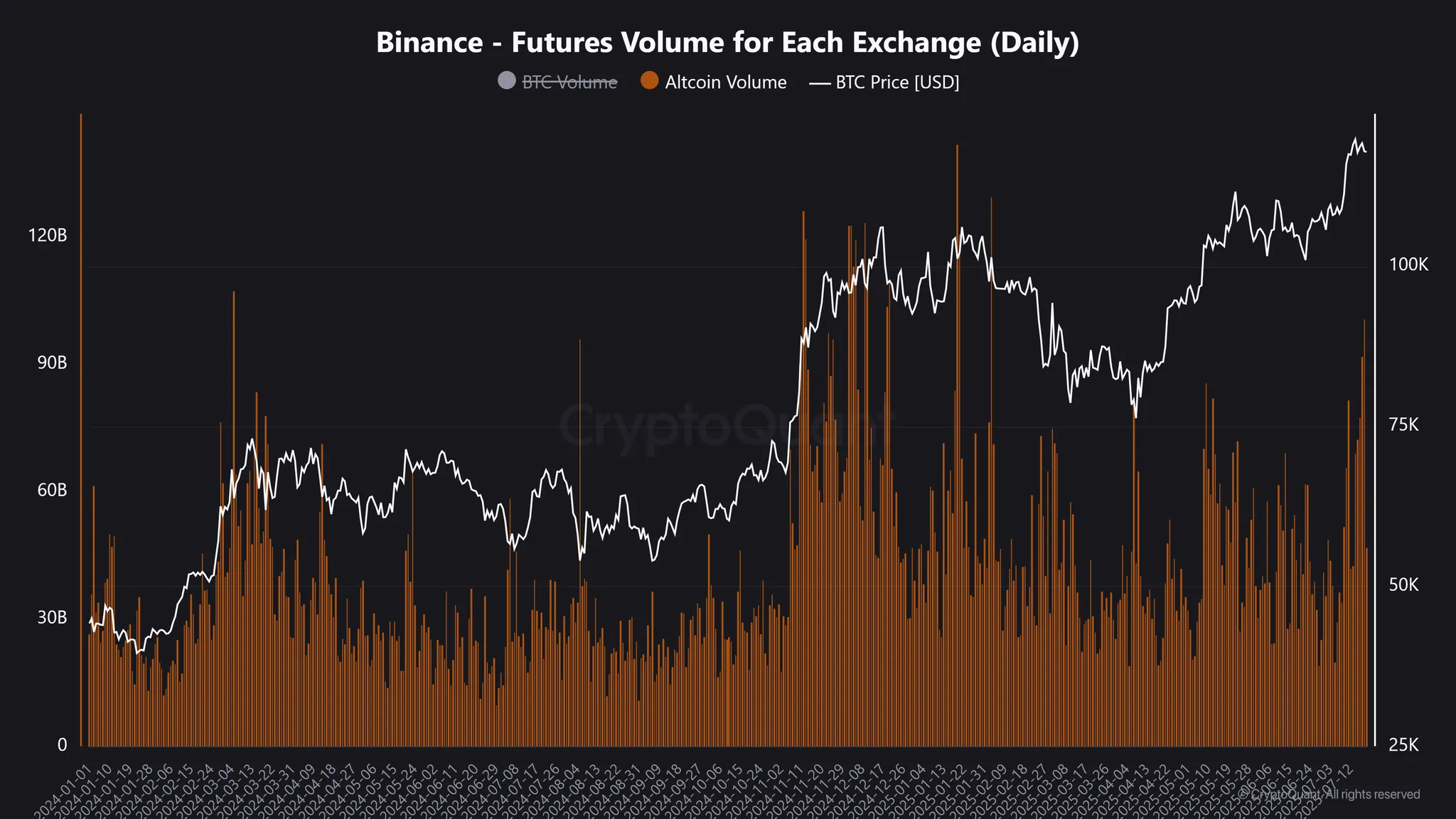

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

The spike follows Bitcoin’s recent all-time high breakout and suggests renewed interest in alternative assets.

Altcoins dominate futures activity

While Bitcoin’s futures volume has remained relatively stable, altcoins have seen a sharp uptick in trading. Altcoins now account for 71% of total volume on Binance Futures, meaning nearly three-quarters of all derivatives activity is currently focused on non-Bitcoin assets.

This shift highlights a growing risk appetite and increased trader interest in higher-beta opportunities. Historically, such volume rotation into altcoins has coincided with early stages of altcoin rallies, especially after Bitcoin breaks above major resistance levels.

Retail interest returns

The surge is also being interpreted as a sign of retail participation returning to the crypto markets. Binance remains the platform of choice for many traders, and such volume spikes typically occur in the wake of large BTC price moves, as traders begin rotating capital into altcoins seeking higher returns.

If this trend continues, analysts expect altcoin price volatility to rise—potentially setting the stage for a broader altseason if Bitcoin dominance weakens in the coming weeks.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Tron Signals Early Altseason Shift as Bitcoin Decouples

22.07.2025 15:30 2 min. read

Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

Tron Signals Early Altseason Shift as Bitcoin Decouples

Tron (TRX) is showing signs of breaking away from Bitcoin’s price action, potentially positioning itself as a leading indicator of an emerging altseason.

3 Cryptocurrencies Showing Strong Momentum Right Now

While Bitcoin consolidates, capital is rotating into select high-growth tokens showing strong upside momentum.

Solana Reclaims $200 as Short Squeeze, ETF hopes, and Institutional Flows Collide

Solana surged 5.6% to reclaim the $200 level for the first time since February, fueled by a confluence of bullish technical, fundamental, and institutional catalysts.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Tron Signals Early Altseason Shift as Bitcoin Decouples

22.07.2025 15:30 2 min. read