Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read Kosta Gushterov

Crypto markets have been under pressure for months, and many investors are asking the same question—where exactly are we in the altcoin market cycle?

According to renowned crypto analyst Michaël van de Poppe, the answer is clear: we’re in the depression phase.

In a recent post on X, van de Poppe explained that the key to understanding the current altcoin environment lies in comparing assets to Bitcoin ($BTC). “The primary charts to focus on are the $BTC valuations,” he wrote.

“They are all, due to macroeconomic factors, at the lows. We’re at the depression phase. After the depression phase is the bull phase.”

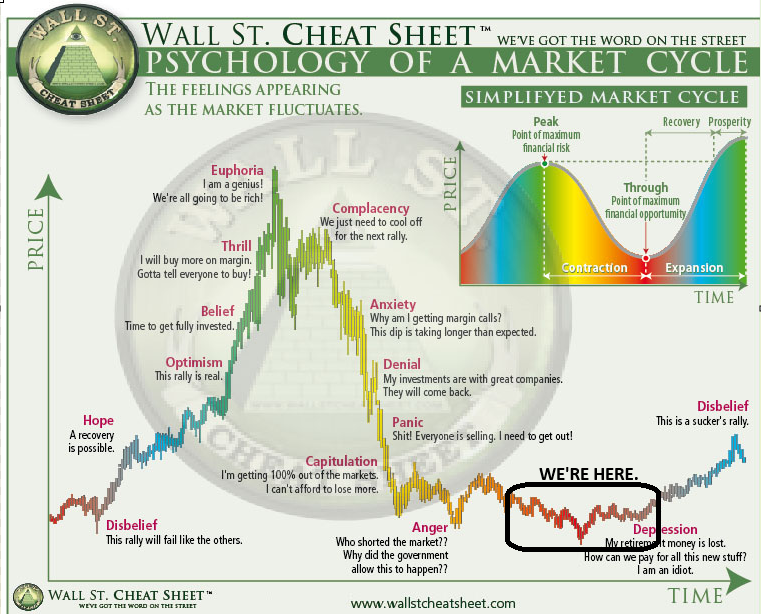

Van de Poppe referenced the widely known “Wall Street Cheat Sheet” to illustrate his point—a chart mapping the psychological stages investors experience throughout a full market cycle. The depression phase, positioned after panic and anger, is characterized by despair and emotional exhaustion. It’s when investors feel hopeless, saying things like “my retirement money is lost” or “how can we pay for all this new stuff?”

According to the chart, this phase often represents the deepest point in the cycle, but also the final stage before a new upward trend. Historically, markets that survive the depression phase enter the disbelief stage, where early signs of recovery are met with skepticism. That’s followed by a shift into optimism and then full-blown euphoria during the next bull cycle.

Van de Poppe’s analysis suggests that, while sentiment remains bleak, this could be a pivotal moment. With valuations at historical lows and many altcoins forgotten by retail investors, the conditions may be forming for a major recovery—one that rewards those who remain patient and forward-looking.

If history repeats, the depression phase may be the last stop before the altcoin market turns bullish once again.

-

1

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read