Altcoin Market at Key Resistance as Capital Rotation Begins

21.07.2025 16:30 2 min. read Kosta Gushterov

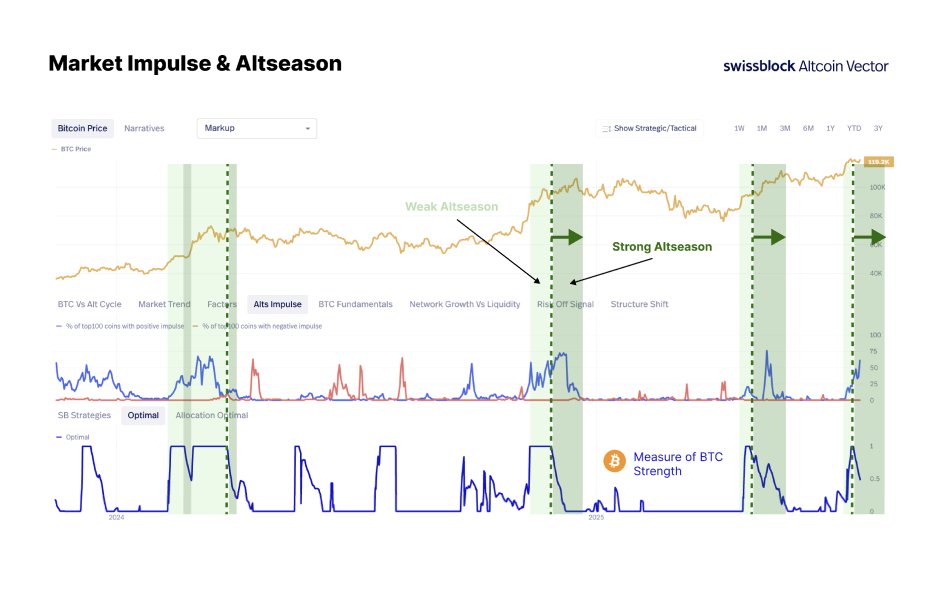

According to Swissblock, the altcoin market has reached a critical inflection point, with 75% of altcoins now sitting at resistance levels.

This phase typically determines whether a true “altseason” unfolds or fails. While Bitcoin’s momentum has started to fade, capital is gradually rotating into altcoins—a sign that market conditions may be shifting in favor of higher-beta assets.

Weak vs strong altseasons: what’s the difference?

Swissblock distinguishes between two types of altseasons: weak and strong. Weak altseasons occur when Bitcoin remains dominant, allowing only short, fragmented bursts of altcoin rallies with limited capital rotation. These are characterized by “light green zones” on Swissblock’s Altcoin Vector, where altcoin price gains tend to be isolated and unsustainable.

In contrast, strong altseasons take shape when Bitcoin’s relative strength declines, BTC dominance drops, and capital flows meaningfully into a broad set of altcoins. These “dark green areas” indicate a more systemic shift in market behavior—where altcoins outperform as a group and liquidity flows out of Bitcoin in a risk-on environment.

Decision point: Bitcoin stalls, altcoin rotation starts

The market now stands at what Swissblock calls a decision point. Bitcoin is showing signs of slowing momentum near all-time highs, and early capital rotation toward altcoins has already begun. Historical data from Swissblock’s chart shows that similar setups in 2021 and 2023 led to strong altseasons—marked by sustained outperformance across a wide array of altcoins.

However, to confirm a full-fledged altseason, the market still needs to see broad breakouts across altcoin charts and a decisive drop in Bitcoin dominance. Until then, the market remains on the edge—poised either for a breakout into a strong altseason or a fade into another short-lived rotation phase.

-

1

Top 10 Trending Cryptocurrencies, According to CoinGecko

18.07.2025 18:34 2 min. read -

2

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

3

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

4

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

5

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

The Ether Machine Targets Nasdaq Debut With $1.6B in Capital and 400K ETH

A newly formed Ethereum-focused company, The Ether Machine, is set to become the largest publicly traded vehicle dedicated solely to Ethereum following a definitive merger announcement on Monday.

Previous Crypto Week Sets New Record: $4.39 Billion in Fund Inflows

Global crypto investment products saw a historic $4.39 billion in inflows last week, setting a new all-time weekly record and driving total assets under management (AuM) to $220 billion.

Major Token Unlocks This Week: SOL, TRUMP, AVAIL Lead the Pack

A wave of large token unlocks is set to hit the crypto market between July 21 and July 28, with significant implications for both price action and investor sentiment.

-

1

Top 10 Trending Cryptocurrencies, According to CoinGecko

18.07.2025 18:34 2 min. read -

2

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

3

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

4

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

5

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read