AI Becomes Gen Z’s Secret Weapon for Crypto Trading

25.07.2025 11:00 2 min. read Kosta Gushterov

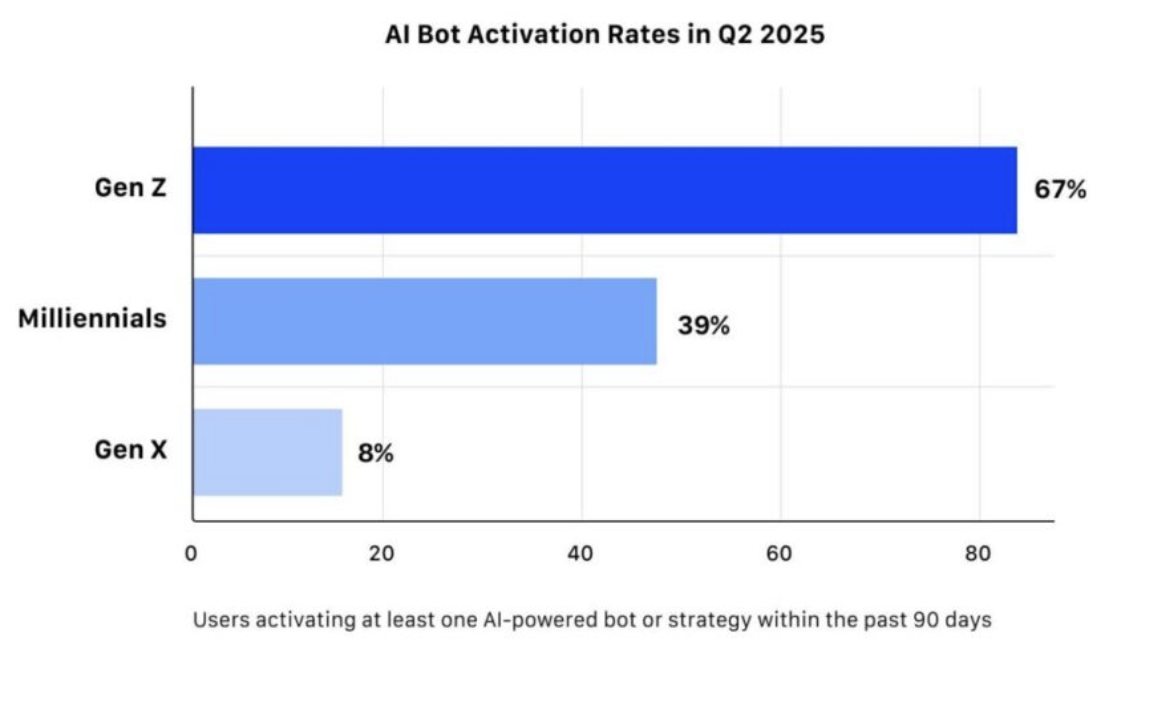

A new report from MEXC reveals a striking generational shift in crypto trading behavior: Gen Z traders are rapidly embracing AI tools as core components of their strategy.

Based on platform-wide data from over 780,000 Gen Z accounts, the report shows that 67% of users aged 18 to 27 have activated at least one AI-powered bot or strategy in the past 90 days.

Automation over emotion

Unlike older generations, Gen Z doesn’t view AI as a novelty—they treat it as a necessary edge in fast-moving markets. These traders use AI to manage trades, set conditional strategies, and reduce emotional reactions. The data shows that Gen Z users are twice as likely as those over 30 to engage with AI tools, with usage peaking during times of market volatility or major news events.

MEXC reports that these users spend an average of 11.4 days per month interacting with AI systems. In contrast, Millennials and Gen X show far less engagement. During price spikes, 73% of Gen Z users activate bots, but intentionally turn them off during sideways or low-volume markets—highlighting strategic awareness rather than blind trust in automation.

Trading psychology is evolving

Gen Z’s relationship with AI reflects broader digital-age behaviors. Rather than making every decision manually, these traders configure AI tools as “co-pilots” to execute trades during high-stress conditions. According to MEXC, Gen Z users who relied on bots during volatile sessions experienced 47% fewer panic-sell events compared to manual traders.

This “emotional buffer” is more than just convenience—it’s a form of psychological resilience. Many users reported seeing AI as a tool for structured delegation, letting them remain emotionally detached from the stress of losses or quick decisions. A recent Resume.org study echoes this, showing that many Gen Z users view AI (like ChatGPT) as more approachable than human managers.

A new framework for risk

AI usage isn’t just about speed—it’s becoming Gen Z’s default risk management layer. The report shows that these users are 1.9x less likely to act impulsively during market shocks and 2.4x more likely to apply structured stop-loss and take-profit settings.

By treating AI as a responsive system rather than a fixed script, Gen Z traders are shaping a new era of semi-automated, psychologically attuned investing—faster, more flexible, and emotionally intelligent.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

3 key Reasons Behind Today’s Crypto Market Drop

The crypto market shed 1.02% in the past 24 hours, led by a sharp Bitcoin drop and fading altcoin interest.

FTX Sets Next Data for Creditor Distribution

FTX Trading Ltd. and the FTX Recovery Trust have announced August 15, 2025 as the official record date for their next round of distributions.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read