Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

29.07.2025 19:00 2 min. read Kosta Gushterov

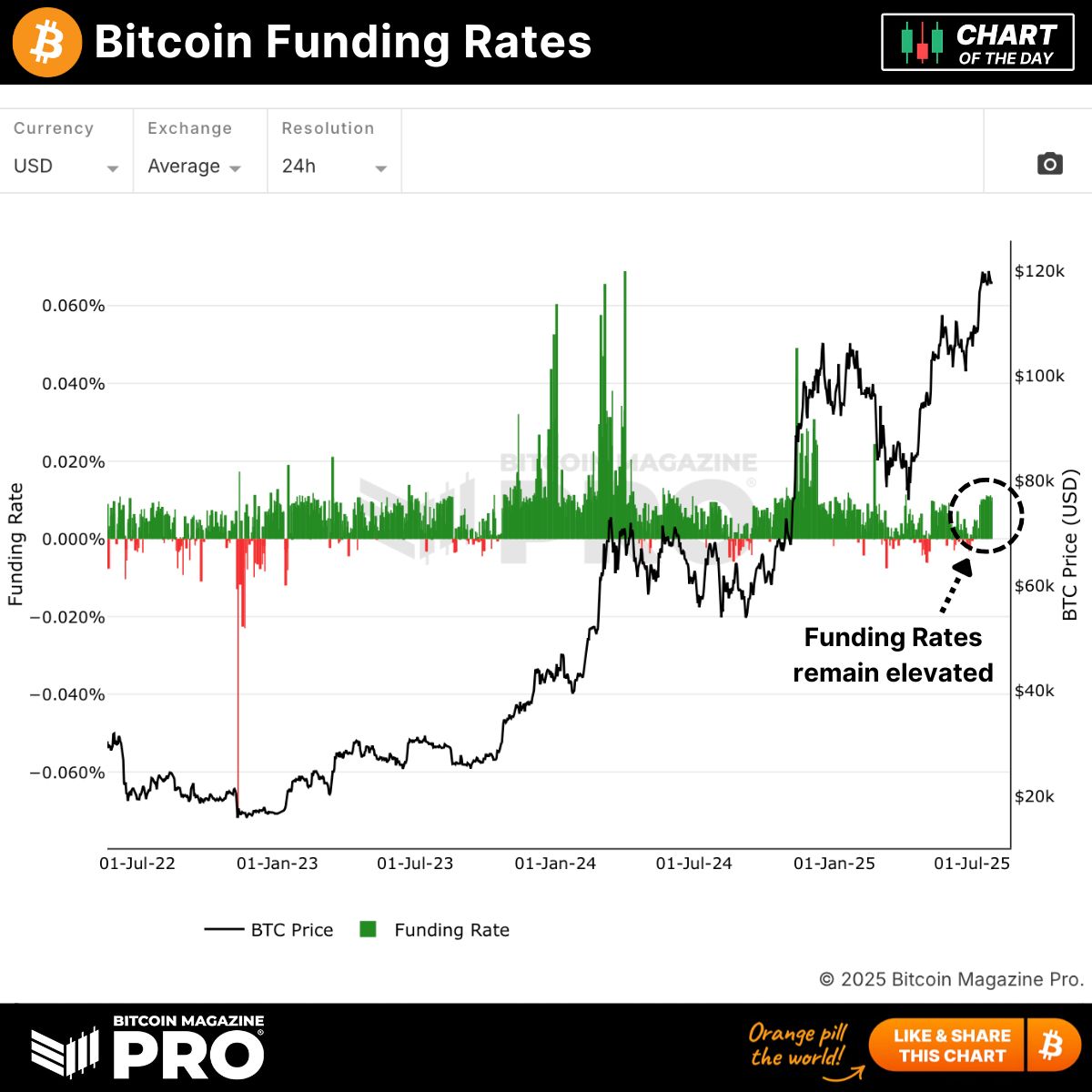

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

This typically reflects leveraged traders betting heavily on upside—but such optimism can be a double-edged sword.

The latest data from Bitcoin Magazine Pro shows that funding rates—fees paid by traders holding long positions in perpetual futures—have stayed well above neutral throughout July. Historically, sustained high funding often precedes sharp corrections, as over-leveraged long positions become vulnerable to liquidations if prices dip unexpectedly.

Yet in this case, the market has absorbed the leverage buildup without major downside. That has many wondering: are bulls truly in control, or is the market setting up for a punishing flush?

Since early 2024, Bitcoin’s price has surged dramatically from under $40K to over $120K, driven by ETF inflows, institutional buying, and macro tailwinds. But since topping out in Q2 2025, BTC has entered a consolidation phase—trading between $90K and $120K—with few clear breakout catalysts on the horizon.

Still, the elevated funding rates suggest speculative demand remains strong. Long-biased traders are clearly expecting a renewed push toward new highs, betting that any short-term volatility will be shallow. The question is whether the broader market agrees—or whether a wave of liquidations could be triggered if support levels break.

This funding chart may also signal growing divergence between retail optimism and institutional caution. Derivatives markets tend to heat up during moments of complacency, and funding rate spikes often precede large directional moves—either upward blowouts or downward squeezes.

Traders now face a familiar fork in the road: elevated funding rates can mean bullish momentum is brewing—or that leverage is outpacing real demand. In past cycles, both scenarios have played out, sometimes in quick succession.

With Bitcoin still trading near all-time highs, the stakes are significant. A successful breakout could send BTC into price discovery above $130K, while a breakdown might test the $80K–$90K zone. Either way, funding rates will likely remain a key indicator to watch in the days ahead.

-

1

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

13.07.2025 10:00 1 min. read -

4

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

5

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

15.07.2025 21:00 2 min. read

Here is How Much Bitcoin Should Cost to Surpass Amazon, Apple, and Gold

As Bitcoin continues its steady ascent in 2025, comparisons with the world’s largest assets are once again gaining traction.

Bitcoin Stalls Below $120K as Markets Signal Late-Cycle Fatigue, Says QCP Capital

Bitcoin is treading water near the $120,000 resistance, with persistent bids around $116,000 offering a firm base—but failing to ignite fresh upside momentum.

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Billionaire Ray Dalio Revealed What his Portfolio Says About the Future of mMoney

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has suggested that a balanced investment portfolio should include up to 15% allocation to gold or Bitcoin, though he remains personally more inclined toward the traditional asset.

-

1

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

2

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read -

3

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

13.07.2025 10:00 1 min. read -

4

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

5

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

15.07.2025 21:00 2 min. read