Stablecoins are Overtaking Visa: Here is The Latest Data

29.07.2025 18:18 2 min. read Kosta Gushterov

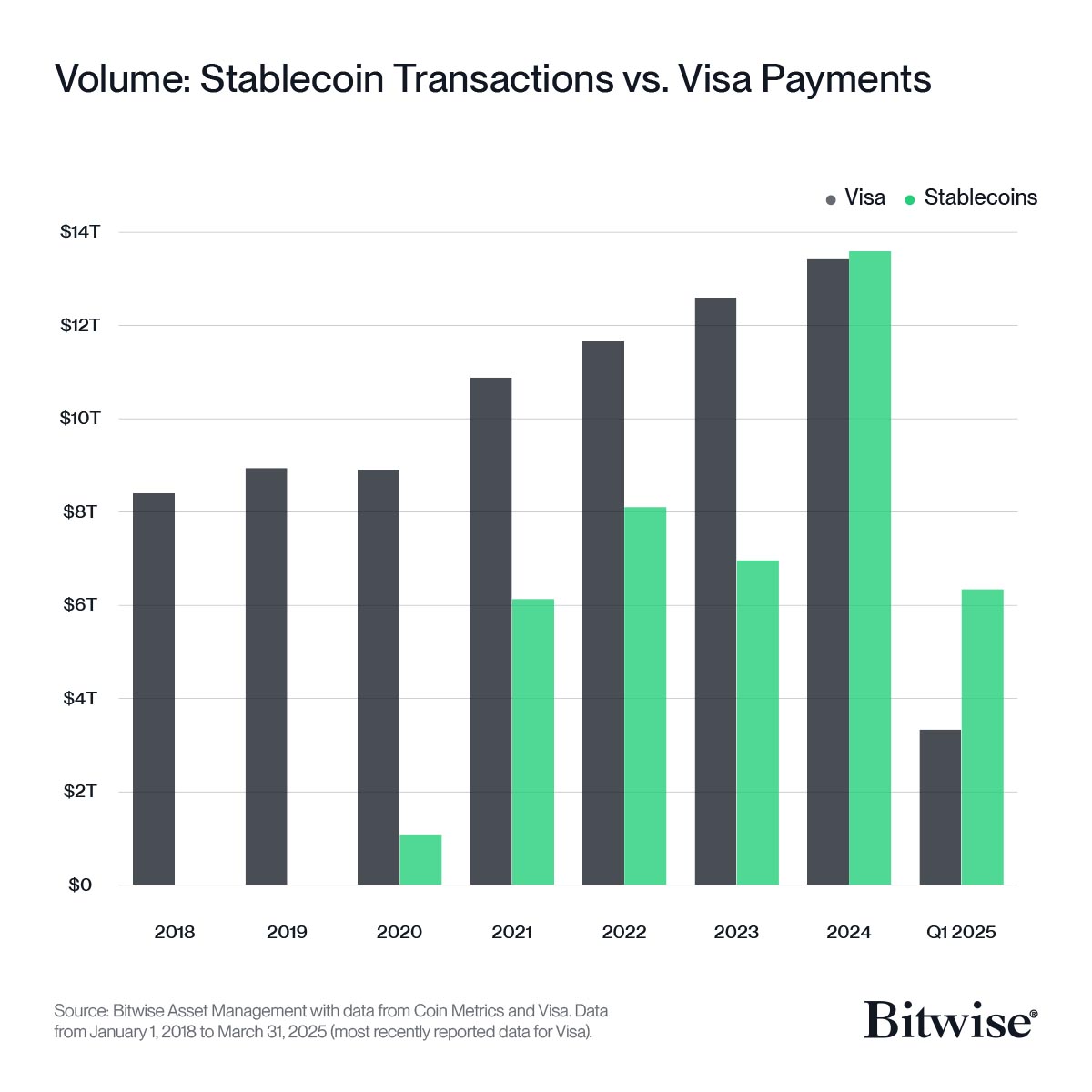

A new chart from Bitwise Asset Management has sent shockwaves through the financial world, showing that stablecoin transaction volumes are now rivaling—and in some cases surpassing—Visa’s global payments.

The chart, which compares annual volume data from 2018 to Q1 2025, paints a clear picture: digital dollars are gaining serious traction.

From 2018 through 2021, Visa maintained a solid lead over stablecoins in terms of payment volume, with annual totals consistently hovering around $9T–$11T. Stablecoins, on the other hand, didn’t even register meaningfully until 2020. But by 2021, they had crossed $6T, and by 2022, they had soared past $8T—eclipsing MasterCard and creeping up behind Visa.

Then came the tipping point. In 2023 and 2024, stablecoin volumes surged past Visa’s, reaching the $13–14 trillion range. Visa’s growth, while steady, appeared linear and flat by comparison. In Q1 2025 alone, stablecoins processed more volume than Visa—a staggering signal of adoption, considering that’s just one quarter.

This rapid rise is powered by the increasing integration of blockchain-based payments into everyday use cases—cross-border transactions, remittances, DeFi applications, and even on-chain payroll. Stablecoins, pegged to fiat currencies like the U.S. dollar, offer the stability of traditional money with the speed and programmability of crypto rails.

Bitwise’s caption couldn’t be more direct: “If traditional payment companies aren’t getting nervous, they should be.” The implication is clear—legacy payment networks are being disrupted at a structural level.

Visa, for its part, has not ignored the trend. It has launched pilot programs for stablecoin-based settlements on Ethereum and other networks. But with stablecoins being used for real-time settlement, programmable finance, and lower-fee international transactions, Visa’s dominance is being actively eroded.

The big question heading into the rest of 2025: Will regulators accelerate frameworks to support stablecoin adoption—or will they act to preserve legacy financial infrastructure? Either way, the numbers show the future of payments is no longer purely plastic. It’s programmable, blockchain-based, and already moving trillions.

-

1

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

2

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

3

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read -

4

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read -

5

Czech National Bank Enters Crypto Sector with $18M Coinbase Investment

14.07.2025 9:00 1 min. read

Visa Settles $200M in Stablecoin Transactions, Eyes Long-term Potential

Visa reported over $200 million in stablecoin settlements during Q2 2025, a milestone in its growing commitment to digital asset infrastructure.

Bank of Korea Launches New Division to Oversee Crypto and Stablecoin Developments

The Bank of Korea (BOK) has taken a significant step toward deepening its involvement in the digital asset ecosystem by establishing a dedicated virtual asset division, according to a report from local media outlet News1.

JPMorgan: Coinbase Could Gain $60B From USDC-Circle Ecosystem

A new report from JPMorgan is shedding light on the staggering upside potential of Coinbase’s partnership with Circle and its deep exposure to the USDC stablecoin.

5 Major US Events and How They Can Shape Crypto Market in The Next Days

The week ahead is shaping up to be one of the most pivotal for global markets in months. With five major U.S. economic events scheduled between July 30 and August 1, volatility is almost guaranteed—and the crypto market is bracing for impact.

-

1

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

2

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

3

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read -

4

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

18.07.2025 9:00 1 min. read -

5

Czech National Bank Enters Crypto Sector with $18M Coinbase Investment

14.07.2025 9:00 1 min. read