Whale Activity Spikes as Smart Money Eyes Reversal Zones

29.07.2025 16:00 1 min. read Kosta Gushterov

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Large transactions—defined as movements over $100,000—have been climbing for several mid-cap assets that are typically overlooked by retail traders.

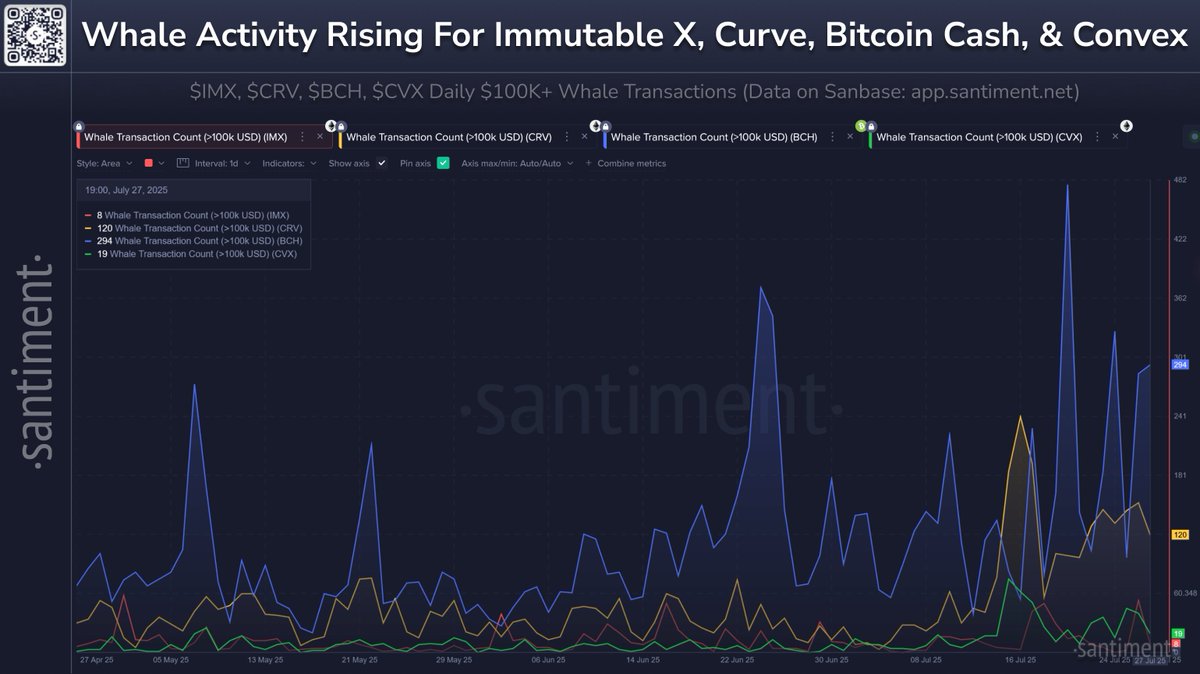

According to Santiment’s on-chain data, Immutable X (IMX) recently experienced its second-highest whale transaction day in the past three months. Meanwhile, Curve (CRV) saw its fourth-highest, while both Bitcoin Cash (BCH) and Convex Finance (CVX) recorded their fifth-highest days in terms of whale transaction count during the same timeframe.

Santiment shared a comparative chart showing transaction spikes across all four tokens. The rise in large transactions may suggest increased accumulation, distribution, or positioning by major holders—often seen as early indicators of trend reversals or incoming volatility. When whales move in clusters, it can reflect either opportunistic buying at local lows or the beginning of more active speculation in preparation for broader market moves.

For investors and analysts monitoring altcoin rotations, this data may serve as an early warning system. Santiment encourages users to track real-time whale activity on their interactive dashboard to help identify potential price inflection points.

As markets remain cautious, spikes in whale movement on mid-cap assets like IMX, CRV, BCH, and CVX could foreshadow a shift in sentiment and capital allocation strategies among larger players.

-

1

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

2

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read -

3

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

4

6 Altcoins Gaining Attention After Market Rally, Says Analyst

15.07.2025 12:05 2 min. read -

5

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

14.07.2025 10:57 2 min. read

Bonk Price Prediction: BONK Nears Key Area of Support – Is It Ready for a Big Bounce?

Bonk (BONK) has gone down by 7.6% in the past 24 hours and currently stands at $0.00002800. Although the token has been on a downtrend for a few days, it is approaching a key area of support that could favor a bullish Bonk price prediction. Trading volumes have gone down by 18% during this period, […]

Santiment Highlights 6 Most Discussed Altcoins Amid Crypto Volatility

As Bitcoin and the broader altcoin market continue to swing unpredictably, blockchain analytics firm Santiment has identified six altcoins that have sparked intense interest across social media platforms.

Ethereum Turns 10: Celebrating the Genesis Block That Changed Crypto Forever

On this day ten years ago—July 30, 2015—a revolutionary chapter in blockchain history began.

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

-

1

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

2

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

12.07.2025 16:20 2 min. read -

3

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

4

6 Altcoins Gaining Attention After Market Rally, Says Analyst

15.07.2025 12:05 2 min. read -

5

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

14.07.2025 10:57 2 min. read