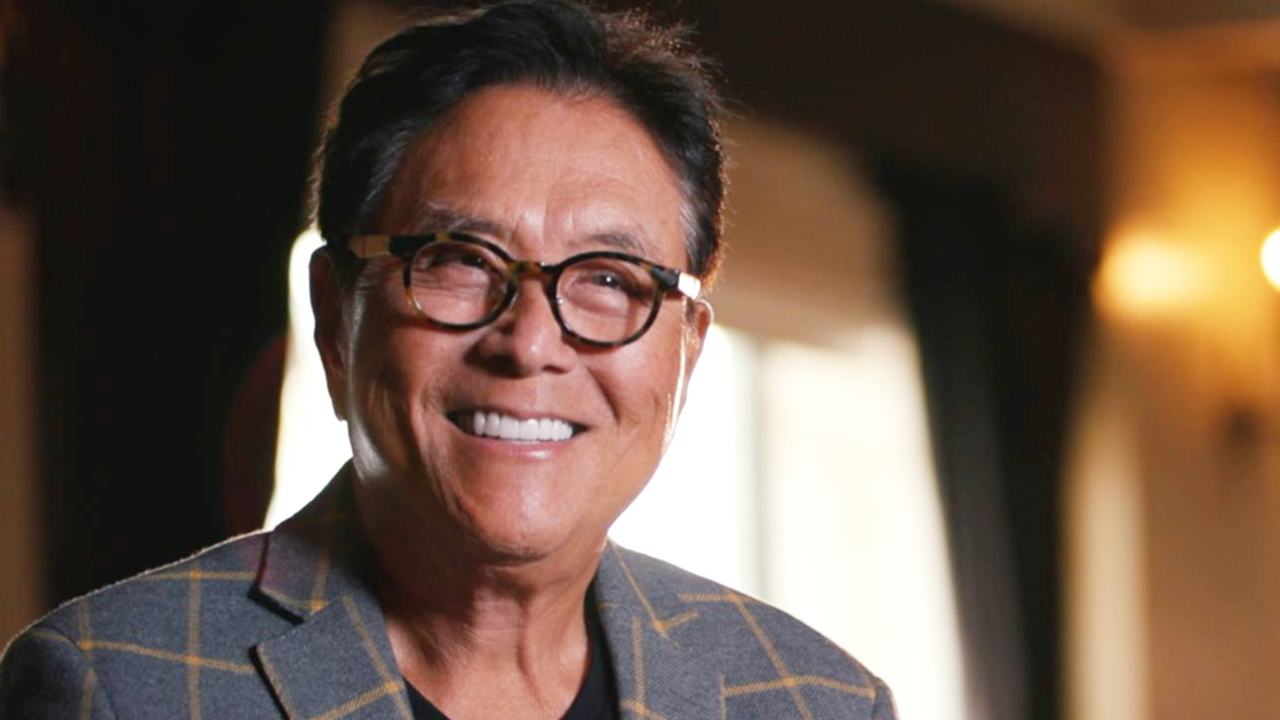

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

28.07.2025 10:00 2 min. read Kosta Gushterov

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

In a recent social media post, he questioned the safety of traditional retirement portfolios packed with stocks and bonds, hinting at an imminent collapse resembling the 1929 Great Depression.

Kiyosaki pointed to legendary investors Warren Buffett and Jim Rogers, noting that both have significantly reduced their exposure to equities and bonds. According to him, their shift toward cash and silver isn’t accidental—it’s a signal that something deeper may be wrong.

Debt Concerns Fuel Flight to Hard Assets

Kiyosaki believes the root of the problem lies in the ballooning U.S. debt. He described America as the largest debtor nation in world history and warned that the current monetary system—propped up by continuous money printing—is unsustainable.

“The U.S. can only print money to pay its bills for so long,” he cautioned.

In light of these risks, Kiyosaki reaffirmed his trust in alternative stores of value. He’s holding firm with gold, silver, and Bitcoin as safe-haven assets. Unlike fiat currencies, he argues, these options offer long-term protection against inflation and systemic collapse.

Crisis or Correction? The Choice Is Yours

While some view Kiyosaki’s outlook as overly pessimistic, others see it as a necessary reminder to diversify beyond conventional assets. His message was clear: investors must do their own research and prepare for what he sees as a looming financial reset.

He ended with a sober note—advising caution, not panic. “Please take care,” Kiyosaki wrote, “and do your own research.”

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read